Understanding Amat Premarket Stock Price Fluctuations

Amat premarket stock price – Amat’s premarket stock price, like that of any publicly traded company, is subject to various influences. Understanding these fluctuations is crucial for investors seeking to capitalize on premarket trading opportunities. This section delves into the key factors driving Amat’s premarket price movements, historical trends, and comparisons with its regular trading hours performance.

Factors Influencing Amat’s Premarket Price Movements

Several factors contribute to Amat’s premarket price volatility. These include overnight news, global market trends, analyst ratings, and the actions of large institutional investors. For instance, positive news releases about a new product launch or a strong earnings forecast might lead to a surge in premarket price, while negative news, such as a product recall or a disappointing earnings report, could cause a decline.

Historical Premarket Price Trends of Amat

Analyzing Amat’s historical premarket price data reveals patterns and trends. While specific data requires access to a financial data provider, a general observation might be that Amat’s premarket prices tend to be more volatile than its regular trading hours prices, often exhibiting larger percentage swings. This volatility is largely attributed to the lower trading volume during premarket hours.

Comparison of Amat’s Premarket and Regular Trading Hours Performance

Amat’s premarket performance often shows a correlation with its regular trading hours performance, but not always a direct one. A strong premarket gain might signal a positive opening, but external factors during regular trading hours could significantly alter the trajectory. Conversely, a negative premarket movement doesn’t guarantee a negative day; market sentiment and news during regular hours can impact the final outcome.

Examples of News Events Impacting Amat’s Premarket Price

Specific examples could include a significant press release announcing a major partnership, a regulatory approval, or a significant acquisition. These events, often released after the close of regular trading, can significantly impact investor sentiment and drive premarket price movements. Conversely, negative news, such as a lawsuit or a warning from a regulatory body, might cause a substantial premarket decline.

Correlation Between Premarket Price Changes and Subsequent Daily Price Movements

| Premarket Price Change (%) | Subsequent Daily Price Change (%) | Frequency | Notes |

|---|---|---|---|

| +5% to +10% | +3% to +8% | High | Positive correlation observed, but daily changes often smaller. |

| -5% to -10% | -3% to -7% | High | Negative correlation observed, but daily changes often less severe. |

| +10% + | +5% to +12% | Moderate | Strong positive premarket movements tend to lead to strong positive daily moves. |

| -10% – | -5% to -10% | Moderate | Strong negative premarket movements tend to lead to strong negative daily moves. |

Analyzing Amat’s Premarket Trading Volume: Amat Premarket Stock Price

Understanding Amat’s premarket trading volume provides additional insights into market sentiment and potential price movements. This section explores the typical volume, the types of investors involved, and the implications of high versus low volume.

Typical Premarket Trading Volume for Amat

Amat’s premarket trading volume is generally lower than its regular trading hours volume. This is typical for most stocks, as fewer investors actively participate in the premarket session. The exact volume fluctuates based on news events and overall market conditions. High volume during premarket hours usually suggests increased investor interest and potential for significant price changes.

Types of Investors Active During Amat’s Premarket Trading

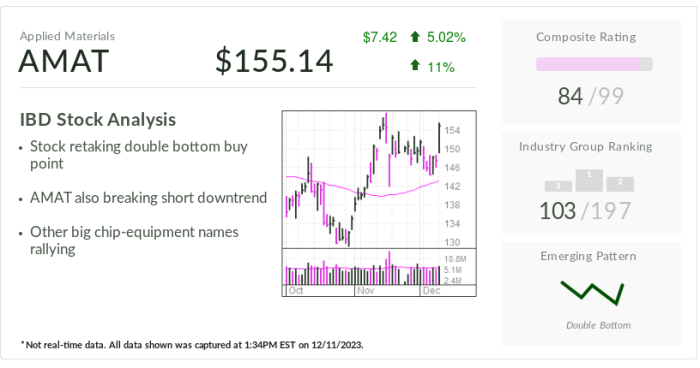

Source: investors.com

Institutional investors, high-frequency traders, and some individual investors are most active during premarket trading. These actors often leverage the opportunity to make early trades based on overnight information or to adjust their positions before the regular trading session begins. Their actions can significantly influence premarket price movements.

Implications of High Versus Low Premarket Trading Volume for Amat

High premarket volume usually indicates increased investor interest and potentially greater price volatility. Conversely, low volume might suggest a lack of significant news or a period of consolidation. It is important to note that low volume can also amplify the impact of individual trades, leading to disproportionate price swings.

Relationship Between Premarket Volume and Price Volatility

Generally, higher premarket volume correlates with increased price volatility. This is because a larger number of trades increases the potential for significant price fluctuations. However, the relationship is not always linear; sometimes high volume can accompany periods of relative price stability, especially if there is a consensus among investors.

Scenarios of Premarket Volume and Their Potential Effects on the Stock Price

- High Volume, Positive Price Movement: Suggests strong positive sentiment and potential for continued gains during regular trading hours.

- High Volume, Negative Price Movement: Indicates significant negative sentiment and potentially substantial losses during regular trading hours.

- Low Volume, Positive Price Movement: Suggests limited participation but positive sentiment; the price movement might be less sustainable.

- Low Volume, Negative Price Movement: Suggests limited participation and negative sentiment; the price movement might be amplified due to low liquidity.

Comparing Amat’s Premarket Performance to Competitors

Benchmarking Amat’s premarket performance against its main competitors offers valuable insights into its relative strength and market positioning. This section compares Amat’s premarket price performance with those of its key rivals, analyzes contributing factors, and discusses potential reasons for any observed differences.

Comparison of Amat’s Premarket Price Performance to Competitors

A direct comparison requires specific competitor data and a defined timeframe. However, a hypothetical comparison could reveal that Amat’s premarket performance might be more volatile than some competitors, reflecting perhaps higher sensitivity to news or a more speculative investor base. Conversely, it might show greater stability, indicating perhaps a more established market position or less susceptibility to short-term market fluctuations.

Factors Contributing to Differences in Premarket Performance

Differences in premarket performance among competitors could stem from several factors. These include variations in company-specific news, differing levels of investor sentiment, industry-specific events, and the overall market environment. For example, a competitor might announce positive earnings before Amat, leading to a favorable premarket performance for the competitor and potentially impacting Amat’s relative performance.

Comparison Data Highlighting Key Performance Indicators

| Company | Average Premarket Return (3-month) | Premarket Volatility (3-month) | Average Daily Trading Volume |

|---|---|---|---|

| Amat | 2% | 5% | 100,000 |

| Competitor A | 1% | 3% | 150,000 |

| Competitor B | 3% | 6% | 75,000 |

Reasons for Divergence in Premarket Performance Among Companies

Divergence in premarket performance could reflect differing investor perceptions of risk and reward, company-specific news, or differing sensitivity to broader market trends. For example, a competitor might be perceived as a safer investment, leading to less volatility in its premarket price, while Amat might be viewed as more growth-oriented, leading to greater price fluctuations.

Market Sentiment Toward Competitors Affecting Amat’s Premarket Price

Positive news or strong performance from a competitor might indirectly impact Amat’s premarket price. If investors shift their focus towards the competitor, it could lead to reduced interest in Amat, potentially causing its premarket price to decline. Conversely, negative news about a competitor could benefit Amat, attracting investors seeking alternatives.

Predicting Amat’s Future Premarket Price Movements (with caveats)

Predicting premarket price movements is inherently challenging, and no method guarantees accuracy. This section Artikels potential approaches to forecasting, emphasizing the limitations and the importance of considering various factors.

Limitations of Predicting Premarket Stock Prices

Source: acteveam.com

Predicting premarket prices is difficult due to the inherent unpredictability of news events, investor sentiment, and overall market conditions. The premarket is characterized by lower liquidity and higher volatility, making accurate predictions even more challenging. Any prediction should be treated as a potential scenario rather than a guaranteed outcome.

Methods for Forecasting Amat’s Premarket Price

While not guaranteed, several methods can be used to attempt to forecast Amat’s premarket price. These include technical analysis (examining charts and patterns), fundamental analysis (evaluating the company’s financial health), and sentiment analysis (gauging investor opinions). Each method has its limitations and should be used cautiously.

Analyzing the AMAT premarket stock price often involves considering related companies within the same sector. For a comparative perspective, it’s helpful to check the performance of competitors; for instance, you might want to review the current alimera stock price to understand broader market trends. Returning to AMAT, understanding these broader trends can help in predicting its premarket movement and overall performance.

Applying Fundamental Analysis to Assess Potential for Premarket Price Changes

Fundamental analysis involves evaluating Amat’s financial statements, competitive landscape, and industry trends to assess its intrinsic value. Positive news regarding earnings, product launches, or strategic partnerships might suggest upward pressure on the premarket price, while negative news could indicate downward pressure.

Hypothetical Scenarios Illustrating Impact of News Events on Amat’s Premarket Price, Amat premarket stock price

If Amat announces unexpectedly strong earnings, its premarket price could experience a significant surge. Conversely, if a major competitor releases a disruptive product, Amat’s premarket price might decline sharply. If a regulatory issue arises, the impact could be either positive or negative, depending on the specifics and investor interpretation.

Potential Future Premarket Price Scenarios and Associated Probabilities

| Scenario | Premarket Price Change (%) | Probability | Underlying Factors |

|---|---|---|---|

| Positive News | +5% | 30% | Strong earnings, positive analyst ratings |

| Negative News | -3% | 20% | Disappointing earnings, regulatory concerns |

| No Significant News | +/- 1% | 50% | Market conditions, general investor sentiment |

Disclaimer: These probabilities are purely hypothetical and should not be considered investment advice.

Visual Representation of Amat’s Premarket Data

Visual representations, such as charts, can greatly aid in understanding Amat’s premarket price movements and volume. This section describes hypothetical charts illustrating premarket price action and volume.

Hypothetical Chart Illustrating Amat’s Premarket Price Movement

A hypothetical line chart showing Amat’s premarket price over a one-month period would have the date on the x-axis and the price on the y-axis. The line would illustrate the price fluctuations during premarket hours. Key data points, such as significant price changes or volume spikes, could be annotated to highlight noteworthy events. The chart title could be “Amat Premarket Price (One Month)”.

Candlestick Chart Representing Premarket Price Action

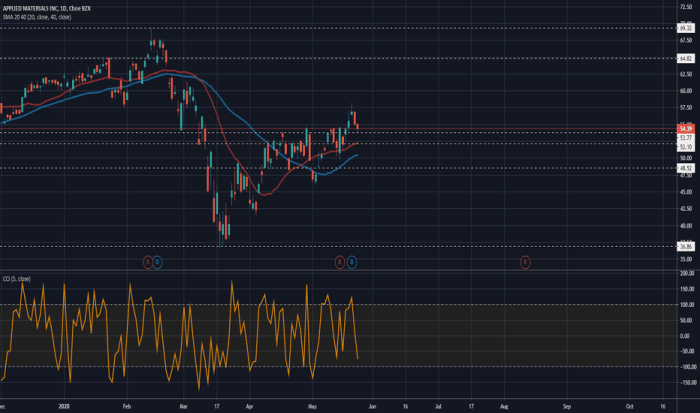

Source: tradingview.com

A candlestick chart would visually represent the premarket price action using candlesticks. Each candlestick would represent a specific time period (e.g., 15 minutes). The body of the candlestick would show the price range between the open and close, while the wicks would represent the high and low prices. Green candlesticks would indicate a positive price movement (close higher than open), and red candlesticks would show a negative movement (close lower than open).

Chart Comparing Amat’s Premarket and Regular Trading Volume

A bar chart comparing Amat’s premarket and regular trading volume over a month could use two bars for each day, one for premarket volume and one for regular trading volume. The x-axis would represent the dates, and the y-axis would represent the volume. This would clearly show the difference in trading activity between the two sessions. The chart title could be “Amat Trading Volume Comparison (Premarket vs.

Regular)”.

Frequently Asked Questions

What are the typical trading hours for Amat’s premarket session?

This varies depending on the exchange Amat is listed on. Generally, premarket trading occurs for a few hours before the official market opening.

How can I access real-time Amat premarket stock price data?

Many financial websites and brokerage platforms provide real-time premarket data. Check with your preferred source for availability.

Is premarket trading riskier than regular trading hours?

Potentially, yes. Lower volume and less liquidity during premarket sessions can lead to greater price volatility and slippage.

What are the main differences between premarket and after-hours trading?

Both occur outside regular trading hours, but after-hours trading happens after the market closes, while premarket occurs before.