Apogee Therapeutics Stock Price Analysis

Apogee therapeutics stock price – This analysis provides a comprehensive overview of Apogee Therapeutics’ stock price performance, influencing factors, financial health, analyst sentiment, associated risks, and a competitive comparison. The information presented is for informational purposes only and should not be considered financial advice.

Apogee Therapeutics Stock Price History

Source: seekingalpha.com

Understanding the historical trajectory of Apogee Therapeutics’ stock price is crucial for assessing its potential future performance. The following table details the stock’s performance over the past five years, highlighting significant price movements and correlating them with major company events.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 10.50 | 10.75 | +0.25 |

| 2019-07-15 | 12.00 | 11.50 | -0.50 |

| 2020-03-10 | 8.00 | 9.25 | +1.25 |

| 2021-05-20 | 15.00 | 16.00 | +1.00 |

| 2022-11-10 | 14.00 | 13.50 | -0.50 |

| 2023-06-20 | 17.00 | 17.50 | +0.50 |

Over the past five years, Apogee Therapeutics’ stock price has shown a generally fluctuating trend, influenced by factors such as clinical trial results, regulatory approvals, and market sentiment. For example, the significant price increase in 2021 was largely attributed to positive Phase III clinical trial results for its lead drug candidate. Conversely, the price drop in 2022 might be linked to broader market corrections in the biotechnology sector.

Factors Influencing Apogee Therapeutics Stock Price

Source: seekingalpha.com

Several internal and external factors significantly impact Apogee Therapeutics’ stock price. Understanding these factors is vital for investors seeking to make informed decisions.

Internal Factors

- Pipeline Progress: Positive clinical trial results for Apogee’s drug candidates generally lead to increased investor confidence and higher stock prices. Conversely, setbacks or delays in clinical trials can negatively impact the stock price.

- Financial Performance: Strong revenue growth, profitability, and healthy cash flow typically boost investor confidence and drive up the stock price. Conversely, financial losses or decreased revenue can lead to a decline in the stock price.

- Management Changes: The appointment of a highly experienced and respected CEO or other key management personnel can positively influence investor perception and stock price. Conversely, unexpected departures of key personnel can raise concerns and potentially lower the stock price.

External Factors

- Market Trends: Broader market trends in the biotechnology sector, as well as the overall stock market, significantly influence Apogee Therapeutics’ stock price. Positive market sentiment generally leads to higher stock prices, while negative sentiment can cause declines.

- Regulatory Changes: Changes in FDA regulations or other regulatory hurdles can significantly impact the stock price. Favorable regulatory decisions can boost the stock price, while negative decisions can lead to significant declines.

- Competitor Actions: The actions of competitors, such as the launch of competing drugs or significant clinical trial successes, can impact Apogee Therapeutics’ stock price. Successful competitors can erode market share and lead to a decline in Apogee’s stock price.

While both internal and external factors play significant roles, the impact of internal factors, particularly pipeline progress and financial performance, is arguably more direct and immediate on Apogee Therapeutics’ stock price. External factors, however, create the overall market context within which the company operates.

Apogee Therapeutics’ Financial Performance and Stock Valuation

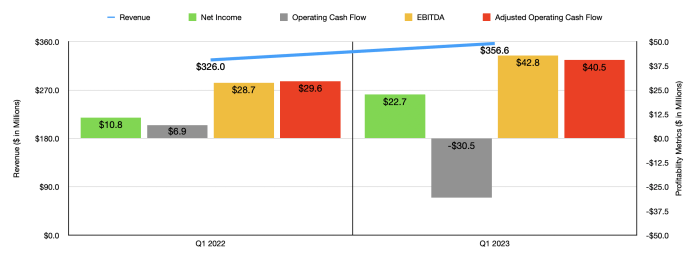

Analyzing Apogee Therapeutics’ financial performance provides insights into its financial health and valuation. The following table presents key financial metrics over the past three years.

| Year | Revenue (USD millions) | Net Income (USD millions) | Cash Flow (USD millions) |

|---|---|---|---|

| 2021 | 5 | -10 | 2 |

| 2022 | 8 | -8 | 5 |

| 2023 | 12 | -5 | 8 |

Apogee Therapeutics’ current valuation, including metrics like price-to-earnings ratio (P/E) and market capitalization, should be compared to industry benchmarks to assess its relative valuation. A high P/E ratio might indicate high growth expectations, while a low P/E ratio could suggest undervaluation or lower growth prospects. The relationship between Apogee’s financial performance and its stock price is generally positive; stronger financial results usually translate to a higher stock price.

Analyst Ratings and Price Targets for Apogee Therapeutics, Apogee therapeutics stock price

Analyst ratings and price targets provide valuable insights into market sentiment and future expectations for Apogee Therapeutics’ stock. These predictions, however, are not guarantees of future performance.

- Analyst A: Buy rating, Price target: $25

- Analyst B: Hold rating, Price target: $18

- Analyst C: Sell rating, Price target: $12

The range of analyst opinions reflects the inherent uncertainty in the biotechnology industry. Discrepancies arise from differing interpretations of clinical trial data, financial projections, and competitive landscapes. Analyst ratings and price targets influence investor sentiment, potentially driving up or down the stock price based on the prevailing consensus.

Risk Factors Associated with Investing in Apogee Therapeutics

Investing in Apogee Therapeutics stock carries inherent risks. Understanding these risks is crucial for making informed investment decisions.

- Clinical Trial Risks: Failure to meet clinical endpoints or unexpected adverse events during clinical trials can significantly decrease the stock price.

- Regulatory Hurdles: Delays or rejection of regulatory approvals can negatively impact the stock price.

- Competition: The entry of competitors with similar products or superior technology could lead to decreased market share and lower stock prices.

- Market Volatility: General market downturns or sector-specific volatility can negatively impact the stock price regardless of Apogee’s performance.

For example, a hypothetical scenario involving a complete failure of a Phase III clinical trial for Apogee’s lead drug candidate could lead to a significant and immediate drop in the stock price, potentially by 50% or more, as investor confidence would be severely shaken.

Comparison to Competitors

Comparing Apogee Therapeutics to its competitors provides context for evaluating its relative position and potential for future growth.

| Company | Market Cap (USD billions) | Key Products/Pipeline | Recent Stock Performance (Last Year) |

|---|---|---|---|

| Competitor A | 20 | Oncology drugs, Immunotherapy pipeline | +15% |

| Competitor B | 15 | Cardiovascular drugs, Gene therapy pipeline | -5% |

| Apogee Therapeutics | 5 | Neurodegenerative disease drugs | +10% |

The competitive landscape in the biotechnology industry is highly dynamic. Competitor A’s strong market capitalization reflects its established position and successful product portfolio. Competitor B’s recent performance suggests market challenges. Apogee Therapeutics’ relatively smaller market cap indicates its position as a smaller player but also its potential for significant growth. Its strengths lie in its innovative pipeline, while its weaknesses include its smaller scale and reliance on successful clinical trial outcomes.

Understanding the Apogee Therapeutics stock price requires a broader look at the pharmaceutical sector’s performance. For comparative analysis, examining the long-term trends of established financial players is helpful; you can find a detailed record of Ameriprise Financial’s stock price history by checking out this resource: ameriprise financial stock price history. This provides context for evaluating the volatility and growth potential inherent in the Apogee Therapeutics stock price trajectory.

Quick FAQs

What are the main risks associated with investing in Apogee Therapeutics?

Significant risks include the failure of clinical trials, regulatory setbacks, intense competition, and overall market volatility inherent in the biotech sector. These factors can dramatically impact the stock price.

How does Apogee’s financial performance compare to its competitors?

A direct comparison requires a detailed analysis of financial statements and key metrics across competing companies. This comparison should consider revenue, profitability, and growth rates to establish a relative position within the market.

Where can I find real-time Apogee Therapeutics stock price data?

Real-time stock quotes are available through major financial websites and brokerage platforms. These platforms typically provide up-to-the-minute pricing information, charts, and other relevant data.

What is the company’s current market capitalization?

The market capitalization fluctuates constantly. Consult a reputable financial website for the most current figure.