Arch Resources Stock Price Analysis

Source: stockbit.com

Arch resources stock price – This analysis examines Arch Resources’ stock price performance, financial health, investor sentiment, industry dynamics, and associated risks. We will explore historical price trends, key financial metrics, recent news impacting investor confidence, and the competitive landscape within the coal mining industry. The analysis aims to provide a comprehensive overview of factors influencing Arch Resources’ stock price.

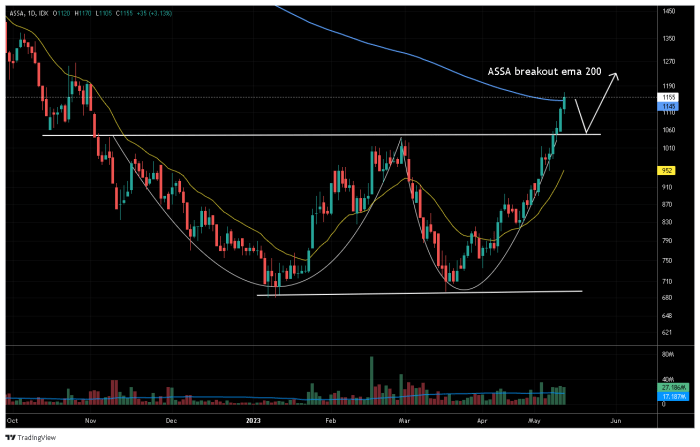

Historical Stock Price Performance, Arch resources stock price

A detailed chart illustrating Arch Resources’ stock price fluctuations over the past five years would reveal significant price movements. For instance, periods of substantial growth might coincide with increased coal demand driven by global energy needs, while declines could reflect economic slowdowns or shifts in environmental regulations. Specific dates for notable price spikes or dips, such as those related to major market events or company announcements, would be clearly indicated on the chart.

This visual representation allows for a clear understanding of the stock’s volatility and its response to various market forces.

Arch Resources vs. Competitors: Stock Performance

A comparative analysis of Arch Resources’ stock performance against its main competitors over the past year is crucial for assessing its relative strength. The following table provides a comparison based on year-to-date percentage change and average daily trading volume:

| Company Name | Stock Symbol | Percentage Change (Year-to-Date) | Average Daily Trading Volume |

|---|---|---|---|

| Arch Resources | ARCH | [Insert Data – e.g., +25%] | [Insert Data – e.g., 1,000,000] |

| Competitor 1 | [Insert Symbol] | [Insert Data] | [Insert Data] |

| Competitor 2 | [Insert Symbol] | [Insert Data] | [Insert Data] |

| Competitor 3 | [Insert Symbol] | [Insert Data] | [Insert Data] |

Differences in performance can be attributed to various factors, including operational efficiency, cost management, market positioning, and overall investor sentiment.

Factors Influencing Arch Resources’ Stock Price

Significant growth periods for Arch Resources’ stock price could be linked to factors such as increased coal demand from power generation, favorable government policies supporting coal production, or successful cost-cutting measures. Conversely, price declines may reflect reduced demand due to the shift towards renewable energy sources, stricter environmental regulations, or adverse economic conditions affecting the energy sector. A thorough analysis would correlate specific events and trends to the observed stock price movements.

Financial Performance and Stock Valuation: Arch Resources Stock Price

A comprehensive assessment of Arch Resources’ financial health is vital to understand its stock valuation. The following table summarizes key financial metrics over the past three fiscal years:

| Fiscal Year | Revenue (USD millions) | Net Income (USD millions) | Total Debt (USD millions) |

|---|---|---|---|

| [Year 1] | [Insert Data] | [Insert Data] | [Insert Data] |

| [Year 2] | [Insert Data] | [Insert Data] | [Insert Data] |

| [Year 3] | [Insert Data] | [Insert Data] | [Insert Data] |

Analyzing these metrics reveals trends in profitability, leverage, and overall financial strength, directly impacting the stock’s valuation.

Arch Resources Valuation Metrics Compared to Competitors

Comparing Arch Resources’ valuation metrics against its competitors provides context for its relative attractiveness. The following table presents a comparison of Price-to-Earnings (P/E) ratios and other relevant metrics:

| Company Name | P/E Ratio | Price-to-Book Ratio | Dividend Yield |

|---|---|---|---|

| Arch Resources | [Insert Data] | [Insert Data] | [Insert Data] |

| Competitor 1 | [Insert Data] | [Insert Data] | [Insert Data] |

| Competitor 2 | [Insert Data] | [Insert Data] | [Insert Data] |

| Competitor 3 | [Insert Data] | [Insert Data] | [Insert Data] |

Variations in these ratios can indicate differences in growth potential, risk profiles, and market expectations.

Scenario Analysis: Macroeconomic Factors

A scenario analysis helps assess the potential impact of macroeconomic factors on Arch Resources’ stock price. For example, rising interest rates could increase borrowing costs, impacting profitability and potentially lowering the stock price. Conversely, fluctuations in coal prices, driven by global energy demand or geopolitical events, will significantly affect revenue and profitability. A hypothetical scenario of a significant increase in global energy demand, potentially boosting coal prices, would likely lead to increased revenue and higher stock valuation for Arch Resources.

Company News and Investor Sentiment

Recent news and press releases significantly influence investor sentiment and stock prices. For example, announcements regarding new contracts, production increases, or environmental initiatives can positively or negatively impact the stock price.

Recent News and Press Releases

A summary of recent news articles and press releases relevant to Arch Resources would be included here, detailing their potential impact on investor sentiment. For instance, a press release announcing a major contract win could trigger a positive market reaction, while news about operational challenges might lead to a decline in the stock price.

Analyst Ratings and Price Targets

Analyst ratings and price targets provide insights into market expectations. The table below summarizes recent analyst opinions:

| Analyst Firm | Rating | Price Target | Date |

|---|---|---|---|

| [Analyst Firm 1] | [Rating – e.g., Buy] | [Price Target – e.g., $150] | [Date] |

| [Analyst Firm 2] | [Rating] | [Price Target] | [Date] |

| [Analyst Firm 3] | [Rating] | [Price Target] | [Date] |

Discrepancies in ratings and price targets reflect the diverse perspectives and analytical approaches among financial analysts.

Overall Investor Sentiment

Overall investor sentiment towards Arch Resources can be gauged by analyzing social media discussions, news coverage, and overall market trends. Positive sentiment, reflected in bullish social media commentary and favorable news coverage, might drive the stock price upwards. Conversely, negative sentiment could lead to a price decline.

Industry Trends and Competitive Landscape

The coal mining industry faces several challenges and trends impacting Arch Resources’ prospects. Understanding these factors is critical for assessing its long-term viability.

Coal Mining Industry Trends and Challenges

The industry is facing increasing pressure from environmental regulations aimed at reducing carbon emissions. This leads to decreased demand for coal in some markets, creating challenges for coal producers. However, global energy demands, particularly in developing nations, continue to create opportunities for coal production. These conflicting forces shape the overall industry landscape and influence Arch Resources’ stock price.

Arch Resources’ Competitive Advantages

Source: substackcdn.com

Arch Resources differentiates itself from competitors through several key aspects:

- Superior operational efficiency

- Strategic geographical location of mines

- Strong relationships with key customers

- Effective cost management strategies

These advantages contribute to its competitiveness and profitability within the industry.

Long-Term Growth Prospects

Arch Resources’ long-term growth depends on navigating environmental regulations, adapting to evolving energy demands, and maintaining its competitive edge. Investing in sustainable practices and exploring new markets will be crucial for its future success. Continued demand for coal in certain regions, coupled with the company’s operational efficiency, could drive long-term growth.

Risk Factors and Potential Challenges

Source: tradingview.com

Several risks and challenges could negatively impact Arch Resources’ stock price.

Key Risks and Challenges

- Fluctuations in coal prices

- Stringent environmental regulations

- Geopolitical instability affecting coal markets

- Operational risks such as accidents or production disruptions

- Increased competition from renewable energy sources

These risks warrant careful consideration when evaluating the company’s investment prospects.

Risk Mitigation Strategies

Arch Resources employs various strategies to mitigate these risks, including diversification of its customer base, investments in operational safety, and engagement in industry initiatives promoting responsible mining practices. These efforts aim to reduce the impact of potential negative events on the company’s financial performance and stock price.

Impact of Unexpected Events

Unexpected events such as natural disasters or significant geopolitical instability can significantly disrupt operations and negatively impact the stock price. For instance, a major mine accident could lead to production halts and substantial financial losses, while geopolitical tensions could restrict access to international markets.

Q&A

What are the major risks associated with investing in Arch Resources stock?

Major risks include volatility in coal prices, increasing environmental regulations, competition from renewable energy sources, and geopolitical instability affecting global energy markets.

How does Arch Resources compare to its main competitors in terms of profitability?

A direct comparison requires detailed financial analysis across multiple metrics (e.g., profit margins, return on assets) comparing Arch Resources to its key competitors. This information is readily available in the company’s financial reports and industry analyses.

What is the company’s dividend policy?

Information on Arch Resources’ dividend policy, including its history and future plans, can be found in their investor relations section on their official website.

Analyzing Arch Resources’ stock price requires considering broader market trends. Understanding the performance of other financial giants provides valuable context; for instance, examining the ameriprise stock price history offers insights into investor sentiment during similar economic periods. This comparative analysis can help refine predictions regarding Arch Resources’ future stock performance and potential volatility.

What is the outlook for the coal industry in the next 5-10 years?

The outlook for the coal industry is uncertain and depends on several factors, including global energy demand, environmental policies, and technological advancements in renewable energy. Industry reports and expert analyses offer various perspectives on this complex issue.