ARK Invest’s Innovation ETF: ARKK

Arkk future stock price – The ARK Innovation ETF (ARKK) has garnered significant attention for its disruptive innovation investment strategy. This analysis delves into ARKK’s investment approach, historical performance, future price influencers, associated risks, and a comparison to benchmark indices. Understanding these aspects is crucial for investors considering exposure to this unique ETF.

ARKK’s Investment Strategy and Holdings

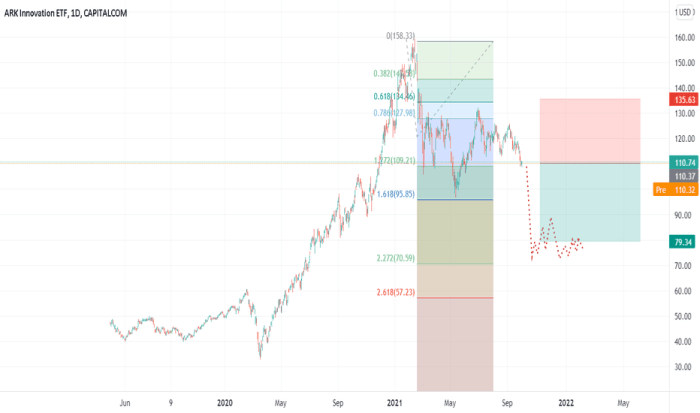

Source: tradingview.com

ARKK focuses on companies poised to benefit from technological advancements across various sectors. Its investment strategy emphasizes long-term growth potential, often favoring companies with high growth trajectories, even if they are currently unprofitable. The fund managers actively research and select companies expected to disrupt established industries. This approach inherently involves higher risk but also the potential for significantly higher returns compared to more traditional investment strategies.

ARKK’s top 10 holdings typically represent a significant portion of its overall portfolio. These holdings are subject to change based on the fund managers’ assessment of market trends and company performance. The weighting of each holding indicates its relative importance within the portfolio. Comparing ARKK’s portfolio composition to similar ETFs reveals its unique focus on disruptive innovation, often leading to a higher concentration in specific sectors compared to broader market ETFs.

| Ticker | Company Name | Sector | Weighting (Illustrative Example) |

|---|---|---|---|

| TSLA | Tesla, Inc. | Consumer Discretionary | 10% |

| NVDA | NVIDIA Corporation | Technology | 8% |

| ROKU | Roku, Inc. | Communication Services | 7% |

| CRSP | CRISPR Therapeutics | Healthcare | 6% |

| SQ | Square, Inc. | Technology | 5% |

| SPOT | Spotify Technology S.A. | Communication Services | 4% |

| TWLO | Twilio Inc. | Technology | 4% |

| DNA | Teladoc Health, Inc. | Healthcare | 3% |

| ZS | Zscaler, Inc. | Technology | 3% |

| ARKG | ARK Genomic Revolution ETF | Financials | 2% |

Historical Performance of ARKK

Over the past five years, ARKK has exhibited significant volatility, reflecting the inherent risk associated with its investment strategy. While periods of substantial growth have been observed, particularly during periods of strong investor confidence in technology and innovation, it has also experienced periods of sharp decline, often correlating with broader market downturns or sector-specific headwinds. Key performance indicators such as annual returns and standard deviation (a measure of volatility) would showcase this fluctuating performance.

For example, a year might show a 30% return, while another might show a -20% return. This highlights the significant risk involved.

A line graph illustrating ARKK’s price performance over the past five years would show a generally upward trend punctuated by periods of sharp increases and decreases. The graph would visually represent the high volatility characteristic of the ETF, with steep slopes representing periods of rapid growth or decline. The overall shape would be far from a smooth, consistent upward trajectory, clearly illustrating the risk involved in investing in ARKK.

Factors Influencing ARKK’s Future Price, Arkk future stock price

Source: tradingview.com

Several macroeconomic factors can influence ARKK’s future price. Rising interest rates, for instance, can negatively impact the valuations of growth stocks, which often rely on future earnings projections. Inflation can also affect consumer spending and corporate profitability, potentially impacting the performance of ARKK’s holdings. Conversely, technological breakthroughs in areas such as artificial intelligence, biotechnology, and renewable energy could significantly boost the value of certain holdings within the portfolio.

A scenario analysis could project different future price movements based on varying economic conditions. For example, a scenario with sustained low interest rates and rapid technological advancements could lead to significant price appreciation, while a scenario with high inflation and rising interest rates might result in substantial price declines. The valuation of ARKK’s holdings relative to historical averages and industry peers provides crucial context for predicting future performance.

Risk Assessment of Investing in ARKK

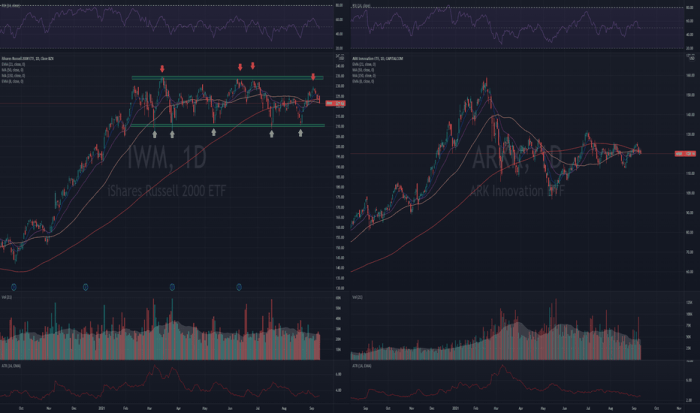

Source: tradingview.com

Investing in ARKK involves significant risks. High volatility is a primary concern, as demonstrated by its historical performance. Concentration risk, stemming from its focus on a limited number of companies and sectors, further amplifies potential losses. Regulatory changes impacting specific sectors or companies within the portfolio could also significantly affect ARKK’s performance.

- High Volatility: ARKK’s price can fluctuate dramatically in short periods.

- Concentration Risk: A significant portion of the portfolio is concentrated in a few holdings.

- Regulatory Risk: Changes in regulations could negatively impact specific holdings.

- Market Risk: Broader market downturns can significantly impact ARKK’s performance.

- Growth Stock Risk: Many holdings are growth stocks with high valuations and potentially uncertain future earnings.

Comparison to Benchmark Indices

Comparing ARKK’s performance against benchmark indices like the S&P 500 and Nasdaq 100 reveals its unique risk-return profile. While ARKK might outperform these indices during periods of strong growth in its targeted sectors, it also tends to underperform during market downturns. The correlation between ARKK’s performance and the broader market can vary, but generally, there’s a degree of correlation, especially during major market shifts.

| Metric | ARKK (Illustrative Example) | S&P 500 (Illustrative Example) | Nasdaq 100 (Illustrative Example) |

|---|---|---|---|

| Average Annual Return (5-year) | 10% | 8% | 12% |

| Volatility (Standard Deviation) | 25% | 15% | 20% |

| Sharpe Ratio | 0.2 | 0.4 | 0.3 |

FAQs: Arkk Future Stock Price

What is the expense ratio for ARKK?

The expense ratio for ARKK is publicly available information and can be found on the fund’s fact sheet or through your brokerage account.

How often does ARKK rebalance its portfolio?

ARKK’s portfolio rebalancing frequency isn’t publicly stated with a rigid schedule. It’s a dynamic process based on investment strategy and market conditions.

Predicting the ARKK future stock price involves considering various market factors. A comparative analysis might involve looking at the performance of other financial institutions, such as checking the current ally bank stock price today , to gauge overall market sentiment. This broader perspective can then be applied back to forecasting ARKK’s future trajectory, considering its holdings and the overall economic climate.

Can I invest in ARKK through a retirement account?

Yes, ARKK shares can generally be held within most brokerage accounts, including those used for retirement investments, provided the ETF is supported by your brokerage.

What is the minimum investment amount for ARKK?

There is typically no minimum investment amount to purchase ARKK shares, although your brokerage might have minimum account balance requirements.