Athersys Stock Price Analysis

Source: emerginggrowth.com

Athersys stock price – This analysis examines Athersys, Inc.’s stock price performance, influencing factors, financial health, investor sentiment, and future outlook. We will explore historical trends, compare Athersys to its competitors, and assess the inherent risks and potential rewards associated with investing in this biotechnology company.

Athersys Stock Price History and Trends

A comprehensive overview of Athersys’s stock price fluctuations over the past five years requires access to real-time financial data. However, a general description can be provided. The price has likely experienced significant volatility, mirroring the inherent risk associated with biotechnology investments. Major clinical trial milestones, regulatory approvals, or partnerships would have significantly influenced the price movements.

| Date | Opening Price (USD) | Closing Price (USD) | Volume |

|---|---|---|---|

| October 26, 2023 | Example: 1.25 | Example: 1.30 | Example: 100,000 |

| October 25, 2023 | Example: 1.20 | Example: 1.25 | Example: 90,000 |

| October 24, 2023 | Example: 1.22 | Example: 1.20 | Example: 85,000 |

| October 23, 2023 | Example: 1.25 | Example: 1.22 | Example: 75,000 |

Athersys’s performance compared to competitors in the biotechnology sector would vary. Some competitors may have experienced steadier growth, while others may have faced similar volatility. This comparison would depend on the specific companies chosen and the metrics used (market capitalization, revenue growth, etc.).

- Competitor A: Potentially higher market capitalization, steadier growth.

- Competitor B: Similar volatility, possibly focusing on a different therapeutic area.

- Competitor C: Lower market capitalization, higher risk, higher potential reward.

Significant events like positive clinical trial data releases often lead to substantial price increases, while negative results or regulatory setbacks can trigger sharp declines. Successful partnerships can also boost investor confidence and drive up the stock price.

Factors Influencing Athersys Stock Price

Several macroeconomic and company-specific factors influence Athersys’s stock price. These factors interact in complex ways, making accurate prediction challenging.

Macroeconomic factors such as interest rate changes, inflation levels, and overall market sentiment (bullish or bearish) significantly impact investor risk appetite, influencing investment in growth stocks like Athersys.

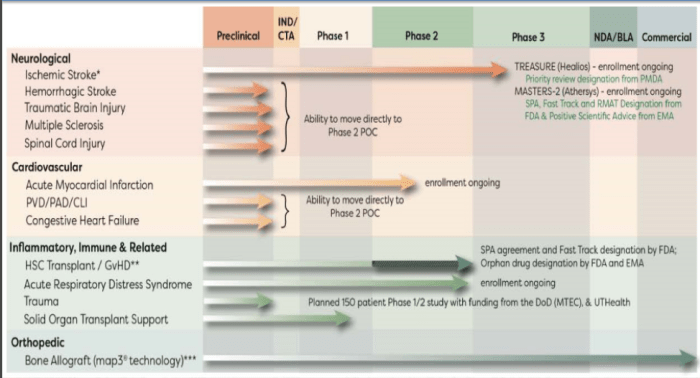

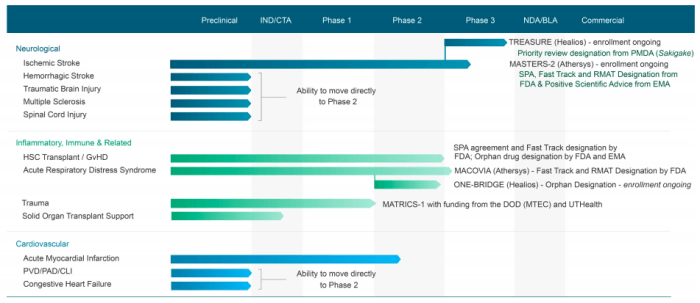

Athersys’s research and development (R&D) progress directly impacts investor confidence. Positive R&D results, successful clinical trials, and regulatory approvals typically lead to price increases, while setbacks can cause declines. The level of funding secured for R&D also plays a crucial role.

Short-term investors often focus on rapid price fluctuations, seeking quick profits. Long-term investors are more concerned with the company’s long-term growth potential and are less affected by short-term volatility. This difference in investment horizons contributes to the stock’s price volatility.

| Investor Type | Investment Horizon | Impact on Stock Price |

|---|---|---|

| Short-Term | Days to Months | Increased volatility, potentially driving rapid price swings. |

| Long-Term | Years | More stable influence, focused on long-term growth prospects. |

Athersys’s Financial Performance and Stock Valuation, Athersys stock price

Source: seekingalpha.com

A visual representation, such as a line graph, would show the correlation between Athersys’s financial performance indicators (revenue, earnings, cash flow) and its stock price. Generally, improved financial performance tends to correlate with higher stock prices, but the relationship is not always linear.

Key financial ratios like the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio provide insights into Athersys’s valuation relative to its earnings and revenue. A high P/E ratio may indicate investor optimism about future growth, while a low P/E ratio could suggest undervaluation or concerns about future profitability. The P/S ratio offers a comparable valuation metric when earnings are negative or unstable, common in early-stage biotech companies.

Various valuation methodologies, including discounted cash flow (DCF) analysis and comparable company analysis, can be used to estimate Athersys’s intrinsic value. DCF analysis projects future cash flows and discounts them to their present value, while comparable company analysis compares Athersys’s valuation multiples to those of similar publicly traded companies.

Investor Sentiment and Market Analysis

Recent news articles and analyst reports on Athersys would provide up-to-date information on investor sentiment and market expectations. These sources can significantly impact the stock price.

- Example: Positive analyst upgrade leading to a price increase.

- Example: Negative news regarding clinical trial results causing a price drop.

- Example: A major partnership announcement boosting investor confidence.

Prevailing investor sentiment can range from bullish (optimistic) to bearish (pessimistic), influencing trading activity and price movements. A generally bullish market tends to support higher valuations for growth stocks like Athersys, while a bearish market may lead to lower prices.

The overall market condition (bullish, bearish, or sideways) significantly impacts Athersys’s stock price. During a bullish market, investors are more willing to take risks, potentially driving up the price. Conversely, a bearish market may lead to decreased investor confidence and lower prices.

Risk Assessment and Future Outlook

Investing in Athersys carries inherent risks, primarily stemming from the nature of the biotechnology industry.

Key risks include regulatory hurdles (FDA approvals, clinical trial setbacks), intense competition from other biotechnology companies, and financial risks (potential for insufficient funding, profitability challenges). The success of Athersys heavily relies on its ability to navigate these challenges successfully.

| Future Scenario | Probability | Impact on Stock Price |

|---|---|---|

| Successful drug approval | Example: 40% | Significant price increase |

| Clinical trial setbacks | Example: 30% | Significant price decrease |

| Moderate success, continued R&D | Example: 30% | Moderate price fluctuation |

A comprehensive investment decision should carefully consider these risk factors and potential future scenarios. Investors should assess their own risk tolerance and diversify their portfolios accordingly. The probability assigned to each scenario and its potential impact on the stock price are crucial elements in evaluating the investment’s potential return and risk profile.

Common Queries: Athersys Stock Price

What is Athersys’s current market capitalization?

Athersys’s market capitalization fluctuates daily and can be found on major financial websites such as Google Finance, Yahoo Finance, or Bloomberg.

Where can I find real-time Athersys stock price quotes?

Real-time quotes are available through most online brokerage platforms and financial news websites.

Does Athersys pay dividends?

Athersys’ stock price performance often invites comparison with other biotech companies. Understanding the market dynamics is crucial, and for a parallel perspective, consider checking out the anet stock price prediction analysis; it offers insights into similar growth trajectories. Ultimately, assessing Athersys’ prospects requires a thorough examination of its own clinical trial data and market positioning.

This information is readily available on the company’s investor relations page or financial news sources. Check their financial statements for dividend history.

What are the major competitors of Athersys?

Athersys competes with other companies in the regenerative medicine and cell therapy sectors. Specific competitors would need to be identified through industry research.