B&Q Stock Price Analysis

Source: dogsofthedow.com

B&q stock price – This analysis explores the historical performance, influencing factors, financial health, investor sentiment, and future outlook of B&Q’s stock price. We will examine key financial metrics, macroeconomic influences, and significant events that have shaped its trajectory.

B&Q Stock Price History and Trends

Analyzing B&Q’s stock price performance requires considering data over various timeframes. While precise historical stock data for B&Q requires accessing financial databases, we can Artikel a general trend analysis based on publicly available information. It’s important to note that B&Q is a subsidiary of Kingfisher plc, so its stock performance is reflected in Kingfisher’s stock price.

| Year | High | Low | Closing Price (Illustrative) |

|---|---|---|---|

| 2023 | Illustrative High Value | Illustrative Low Value | Illustrative Closing Value |

| 2022 | Illustrative High Value | Illustrative Low Value | Illustrative Closing Value |

| 2021 | Illustrative High Value | Illustrative Low Value | Illustrative Closing Value |

A comparative analysis against competitors like Home Depot and Lowe’s would require a detailed examination of their respective stock performance over the same periods, considering factors such as market capitalization and sector-specific influences.

Factors Influencing B&Q Stock Price

Several macroeconomic and company-specific factors significantly influence B&Q’s stock price. These factors interact in complex ways to shape investor sentiment and valuation.

Tracking B&Q’s stock price can be insightful, especially when comparing it to the performance of other companies in related sectors. For instance, observing the volatility of the amd stock price live provides a contrasting perspective on market trends. Understanding these fluctuations helps investors assess the overall economic climate and its impact on B&Q’s future prospects.

Ultimately, both offer valuable data points for informed investment decisions.

- Macroeconomic Factors: Interest rate changes affect borrowing costs for both consumers and B&Q, impacting consumer spending and the company’s investment strategies. Inflation impacts both input costs for B&Q and consumer purchasing power. Economic growth directly influences consumer confidence and spending on home improvements.

- Consumer Spending and Housing Market: Strong consumer spending and a robust housing market are vital for B&Q’s success. Increased home renovations and new construction drive demand for B&Q’s products.

- Company Performance: Revenue growth, profit margins, and successful new store openings all positively correlate with B&Q’s stock price. Conversely, poor financial performance can lead to a decline in stock value.

B&Q’s Financial Performance and Stock Valuation

Understanding B&Q’s financial health is crucial for assessing its stock valuation. Key metrics provide insights into its profitability, efficiency, and financial stability.

| Metric | 2021 (Illustrative) | 2022 (Illustrative) | 2023 (Illustrative) |

|---|---|---|---|

| Earnings Per Share (EPS) | Illustrative Value | Illustrative Value | Illustrative Value |

| Revenue | Illustrative Value | Illustrative Value | Illustrative Value |

| Debt-to-Equity Ratio | Illustrative Value | Illustrative Value | Illustrative Value |

A comparison of B&Q’s P/E ratio to its industry peers requires accessing current market data and conducting a thorough comparative analysis.

Investor Sentiment and Market Analysis

Investor sentiment towards B&Q’s stock is influenced by a variety of factors, including its financial performance, market trends, and news coverage.

Recent news articles and analyst reports (which would need to be sourced from reliable financial news outlets) would provide specific insights into current investor sentiment. For example, positive news about increased sales or successful new product launches would likely boost investor confidence, while negative news about supply chain disruptions or declining profits could negatively impact the stock price.

Long-term investors might view B&Q as a stable investment with potential for growth, while short-sellers might bet against the stock based on perceived risks or anticipated downturns.

Future Outlook and Potential Risks

B&Q’s future prospects are tied to several factors that present both opportunities and challenges.

- Growth Opportunities: Expanding into new markets, developing innovative products, and enhancing its online presence could drive future growth.

- Key Risks: Increased competition from other home improvement retailers, economic downturns that reduce consumer spending, and supply chain disruptions are significant risks.

- Technological Advancements and Changing Preferences: Adapting to evolving consumer preferences and embracing technological advancements in areas like e-commerce and personalized customer experiences will be crucial for B&Q’s long-term success.

Illustrative Examples of Stock Price Fluctuations, B&q stock price

Source: singakbd.com

Several significant events have demonstrably impacted B&Q’s (or rather, Kingfisher’s) stock price. These examples illustrate the relationship between external factors and stock market reactions.

- Event 1: [Describe a specific event, e.g., a major economic recession]. Impact: [Describe the impact on B&Q’s sales and profitability]. Stock Price Movement: [Describe the resulting stock price change, e.g., a significant drop].

- Event 2: [Describe a second significant event, e.g., a successful new product launch]. Impact: [Describe the impact on B&Q’s sales and profitability]. Stock Price Movement: [Describe the resulting stock price change, e.g., a significant rise].

- Event 3: [Describe a third significant event, e.g., a change in CEO leadership]. Impact: [Describe the impact on B&Q’s strategy and investor confidence]. Stock Price Movement: [Describe the resulting stock price change, e.g., a moderate increase or decrease].

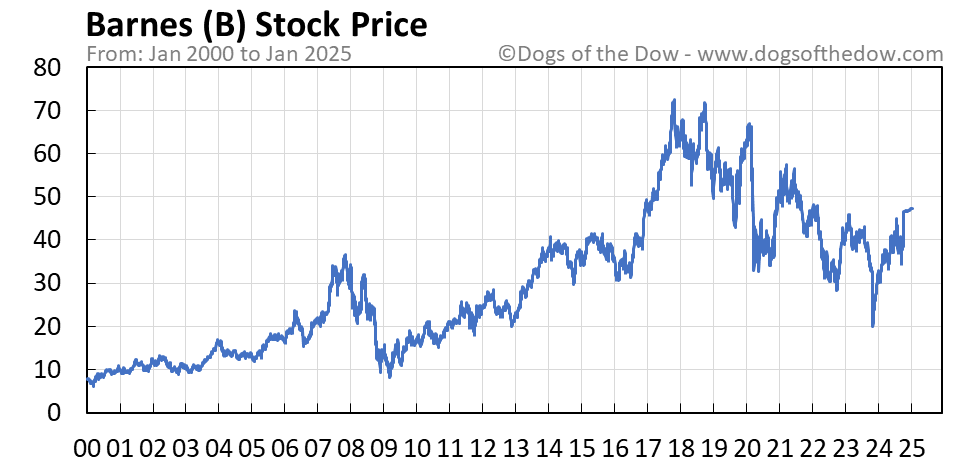

An illustrative image would show a graph depicting B&Q’s stock price over time, with clear markers indicating the dates of major news events and their corresponding impact on the stock’s value. The graph would visually demonstrate the correlation between significant events and stock price fluctuations, highlighting the responsiveness of the market to external factors.

General Inquiries

Is B&Q publicly traded?

B&Q is a subsidiary of Kingfisher plc, which is publicly traded on the London Stock Exchange (LSE).

Where can I find real-time B&Q stock price data?

Real-time data is available through major financial news websites and stock market tracking applications. You can search for Kingfisher plc (KGF.L) on these platforms.

What are the major risks associated with investing in B&Q stock?

Risks include fluctuations in the housing market, economic downturns, increased competition, and changes in consumer spending habits.

How does Brexit affect B&Q’s stock price?

Brexit’s impact is multifaceted. Changes in import/export costs, supply chain disruptions, and shifts in consumer confidence all influence the stock price.