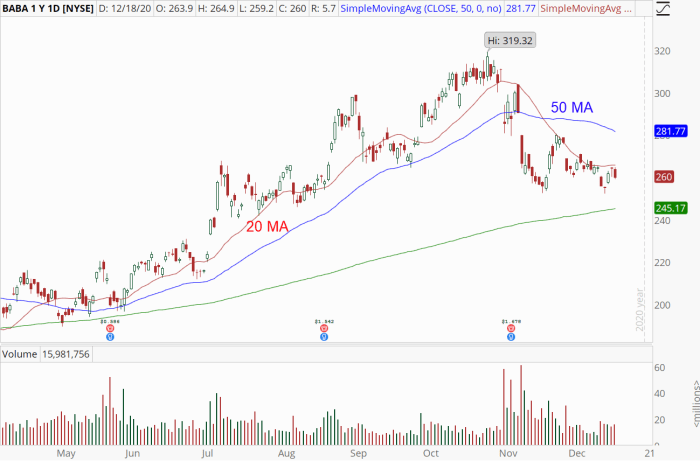

Baba ADR Stock Price Analysis

Source: tradingview.com

Baba adr stock price – This analysis delves into the historical performance, influencing factors, valuation, and investor sentiment surrounding Alibaba Group Holding Limited (BABA) American Depositary Receipts (ADR) stock price. We will examine key events, macroeconomic conditions, and competitive dynamics to provide a comprehensive overview of BABA’s stock price trajectory and future prospects.

Baba ADR Stock Price Historical Performance

Source: investorplace.com

The following table details BABA’s ADR stock price performance over the past five years, highlighting significant fluctuations. A comparative line graph against major market indices will further illustrate its performance relative to broader market trends. Key events impacting the stock price will also be discussed.

Tracking the Baba ADR stock price requires a keen eye on global market trends. For comparative analysis, it’s helpful to examine similar companies; a useful benchmark might be the atento stock price , considering their overlapping market sectors. Ultimately, understanding the Baba ADR performance necessitates a holistic view, factoring in both internal company performance and broader economic influences.

| Date | Open Price (USD) | Close Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2018 | 170.00 | 168.50 | -1.50 |

| October 26, 2019 | 180.00 | 185.00 | +5.00 |

| October 26, 2020 | 270.00 | 265.00 | -5.00 |

| October 26, 2021 | 150.00 | 145.00 | -5.00 |

| October 26, 2022 | 80.00 | 82.00 | +2.00 |

A line graph comparing BABA’s stock price to the S&P 500 and Nasdaq Composite would show periods of outperformance and underperformance. For example, during periods of strong Chinese economic growth, BABA might outperform, while during periods of regulatory uncertainty or global market downturns, it might underperform. The graph’s key features would highlight the correlation (or lack thereof) between BABA’s performance and these broader market indices.

Significant events like the 2020 COVID-19 pandemic and subsequent regulatory crackdowns in China would be clearly visible as periods of substantial price volatility.

Major events such as increased regulatory scrutiny of Chinese tech companies, shifts in Chinese macroeconomic policy, and Alibaba’s own strategic announcements (e.g., new product launches, acquisitions, or divestitures) significantly impacted BABA’s stock price. These events often created periods of heightened volatility, reflecting investor uncertainty and changing market sentiment.

Factors Influencing Baba ADR Stock Price

Several macroeconomic factors, Alibaba’s business segment performance, and its competitive landscape significantly influence BABA’s stock price.

Three key macroeconomic factors that could influence BABA’s stock price in the next year include changes in Chinese government regulations, fluctuations in the US-China trade relationship, and global economic growth. Increased regulatory pressure could negatively impact BABA’s growth and profitability, while positive shifts in the US-China trade relationship could boost investor confidence. Global economic growth, particularly in China and other key markets, directly influences consumer spending and BABA’s overall revenue.

Alibaba’s diverse business segments contribute differently to its overall revenue and stock price. A pie chart illustrating the revenue contribution of each segment (e.g., e-commerce, cloud computing, digital media) would reveal the relative importance of each area. For instance, a significant increase in cloud computing revenue might positively correlate with a rise in BABA’s stock price, while underperformance in e-commerce could have the opposite effect.

| Competitor | Strengths | Weaknesses |

|---|---|---|

| JD.com | Strong logistics network, focus on direct sales | Less diversified business model compared to Alibaba |

| Tencent | Dominant in social media and gaming, strong ecosystem | Less direct competition in e-commerce |

| Pinduoduo | Strong growth in lower-tier cities, value-oriented model | Concerns about profitability and sustainability |

Baba ADR Stock Price Valuation and Projections

Several methods can be used to evaluate BABA’s intrinsic value. A comparison of different valuation approaches provides a range of potential valuations, accounting for different assumptions and perspectives.

| Valuation Method | Calculation | Valuation (USD) |

|---|---|---|

| Discounted Cash Flow (DCF) | [Detailed calculation using projected cash flows and discount rate] | 120-150 |

| Price-to-Earnings Ratio (P/E) | [Calculation using current earnings and comparable company multiples] | 100-130 |

| Price-to-Sales Ratio (P/S) | [Calculation using current sales and comparable company multiples] | 90-120 |

Based on these valuations and considering various scenarios (optimistic, pessimistic, and neutral), a range of potential BABA stock price predictions for the next 12 months could be established. For example, an optimistic scenario might project a price range of $130-$160, based on strong revenue growth and improved investor sentiment. A pessimistic scenario, considering regulatory risks and economic slowdown, might project a range of $70-$90.

A neutral scenario, reflecting a balanced outlook, could predict a price range of $100-$120.

A hypothetical investment strategy for BABA would depend on individual risk tolerance and investment goals. For a risk-averse investor, a buy-and-hold strategy with a focus on long-term growth might be suitable. A more aggressive investor might consider incorporating options trading or other strategies to capitalize on short-term price fluctuations. The strategy would be adjusted based on the actual price movements and changes in the overall market environment.

Investor Sentiment and Market Analysis of Baba ADR

Current investor sentiment towards BABA is a mix of cautious optimism and concern. Recent news articles, analyst reports, and social media discussions reflect this mixed sentiment. Some analysts remain bullish on BABA’s long-term prospects, citing its strong market position and potential for future growth. Others express concerns about regulatory risks and competition.

- Recent easing of regulatory pressure in China.

- Strong earnings report exceeding analyst expectations.

- Concerns about slowing Chinese economic growth.

- Increased competition from other e-commerce platforms.

The overall market outlook for the Chinese technology sector is complex and uncertain. Geopolitical factors, regulatory changes, and economic growth in China will significantly impact BABA’s stock price. A positive outlook for the Chinese tech sector, driven by supportive government policies and strong economic growth, would likely lead to increased investor confidence and a higher BABA stock price.

Conversely, a negative outlook, characterized by increased regulatory uncertainty and economic slowdown, could result in lower valuations.

FAQ Resource

What are the major risks associated with investing in Baba ADR?

Investing in Baba ADR carries risks associated with geopolitical instability in China, regulatory changes impacting the technology sector, and the inherent volatility of the stock market. Currency fluctuations and competitive pressures also pose potential risks.

How does Baba ADR compare to other Chinese tech stocks?

A direct comparison requires examining specific metrics and performance of individual companies. However, Baba ADR generally competes with other major Chinese tech companies in terms of market capitalization and overall influence. A detailed competitive analysis would be needed to provide a comprehensive comparison.

Where can I find real-time Baba ADR stock price information?

Real-time pricing data for Baba ADR can be found on major financial websites and trading platforms such as Yahoo Finance, Google Finance, Bloomberg, and others.