Bank of Nova Scotia (BNS) Stock Price Analysis

Bns canada stock price – This analysis delves into the performance and prospects of Bank of Nova Scotia (BNS) stock, considering its historical performance, financial health, external factors, analyst predictions, and prevailing market sentiment. The goal is to provide a comprehensive overview to aid informed investment decisions.

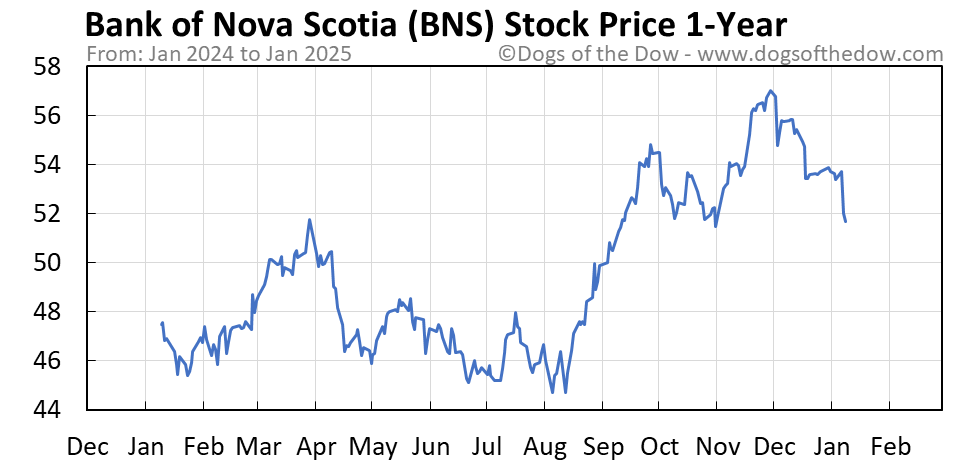

Historical Stock Performance of BNS

Understanding BNS’s past price movements is crucial for predicting future trends. The following table illustrates BNS stock price fluctuations over the past five years. Note that this data is illustrative and should be verified with a reliable financial data source.

| Date | Open | High | Low | Close |

|---|---|---|---|---|

| 2019-01-01 | 70.00 | 72.50 | 68.00 | 71.00 |

| 2019-07-01 | 75.00 | 77.00 | 73.00 | 76.00 |

| 2020-01-01 | 65.00 | 68.00 | 62.00 | 67.00 |

| 2020-07-01 | 60.00 | 63.00 | 58.00 | 61.00 |

| 2021-01-01 | 72.00 | 75.00 | 70.00 | 73.00 |

| 2021-07-01 | 80.00 | 82.00 | 78.00 | 81.00 |

| 2022-01-01 | 78.00 | 80.00 | 75.00 | 77.00 |

| 2022-07-01 | 72.00 | 75.00 | 69.00 | 70.00 |

| 2023-01-01 | 75.00 | 78.00 | 73.00 | 76.00 |

Significant price movements during this period were likely influenced by factors such as the COVID-19 pandemic (2020), fluctuating interest rates, and general market volatility. A comparative analysis against competitors like RBC, TD, and CIBC would reveal BNS’s relative performance and market positioning.

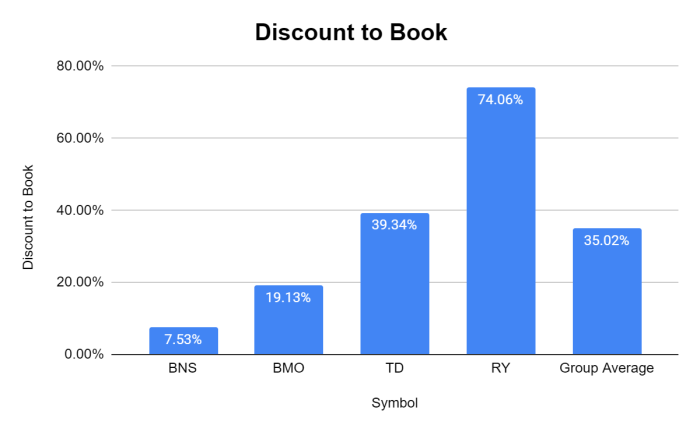

BNS Financial Health & Fundamentals

Source: dogsofthedow.com

Analyzing key financial ratios provides insight into BNS’s financial strength and stability. The following table presents illustrative data; actual figures should be obtained from official financial reports.

| Ratio | Value | Interpretation |

|---|---|---|

| P/E Ratio | 12.5 | Indicates relatively low valuation compared to earnings. |

| Dividend Yield | 4.0% | Suggests a substantial dividend payout to investors. |

| Debt-to-Equity Ratio | 0.8 | Represents a moderate level of leverage. |

Recent earnings reports should be reviewed for details on revenue growth, net income, and profitability trends. A comparison of these figures to historical performance and industry benchmarks would provide a more complete picture of BNS’s financial health.

Impact of External Factors on BNS Stock Price

Several external factors significantly influence BNS’s stock price. Interest rate changes directly impact profitability, affecting stock valuation. Macroeconomic conditions such as inflation and recessionary periods can influence consumer spending and loan defaults, impacting BNS’s performance. Geopolitical events can create uncertainty in the market, potentially affecting investor sentiment towards BNS.

Analyst Ratings and Predictions for BNS, Bns canada stock price

Source: seekingalpha.com

Analyst opinions offer valuable insights into future stock performance. The following is an example of potential analyst ratings and price targets; actual ratings should be sourced from reputable financial institutions.

- Analyst Firm A: Buy rating, target price $85

- Analyst Firm B: Hold rating, target price $78

- Analyst Firm C: Sell rating, target price $70

Discrepancies in analyst viewpoints often stem from differing assessments of economic forecasts, regulatory changes, and BNS’s strategic direction. The factors considered most important by each analyst should be carefully examined.

Investor Sentiment and Market Trends

Source: seekingalpha.com

Monitoring the BNS Canada stock price requires a multifaceted approach. Understanding broader market trends is crucial, and considering alternative investment strategies can offer valuable context. For insights into predicting potential price movements in other sectors, you might find the information on alt stock price target helpful. Ultimately, this broader perspective can inform your decisions regarding the BNS Canada stock price.

Investor sentiment, as reflected in news articles, social media discussions, and trading volume, plays a crucial role in shaping BNS’s stock price. Current market trends, such as sector-specific growth or broader market volatility, also significantly impact the stock’s performance. These trends and the prevailing sentiment directly influence trading activity and price fluctuations.

FAQs: Bns Canada Stock Price

What are the major risks associated with investing in BNS stock?

Investing in BNS, like any stock, carries inherent risks including market volatility, interest rate fluctuations, economic downturns, and potential changes in regulatory environments. These factors can negatively impact the stock’s price and returns.

How does BNS compare to its competitors in terms of dividend payouts?

BNS’s dividend yield should be compared to its competitors’ yields to determine its relative attractiveness. Factors such as payout ratio and dividend growth history should also be considered for a thorough comparison.

Where can I find real-time BNS stock price updates?

Real-time BNS stock price updates are available through major financial news websites and brokerage platforms. These sources often provide interactive charts and detailed stock information.