ALBT Stock Price Analysis

Source: tradingview.com

Albt stock price – This analysis examines the historical performance, influencing factors, predictive models, valuation, and investor behavior related to ALBT stock. We will explore various aspects to provide a comprehensive overview of the stock’s dynamics and potential future trajectories.

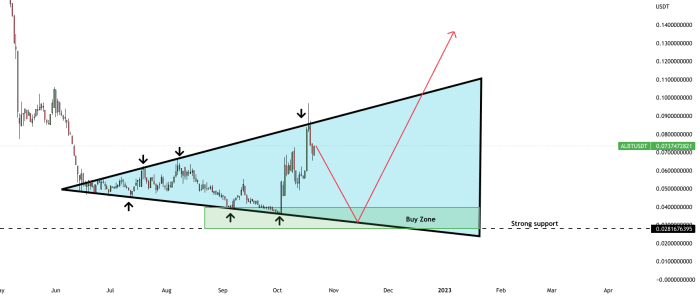

ALBT Stock Price Historical Performance

A line graph illustrating ALBT stock price fluctuations over the past year would show significant price volatility. The graph should clearly label the highest and lowest points, along with key dates marking significant price changes. For example, a sharp drop might be correlated with a negative news event, while a surge might follow a positive announcement.

The highest point in the past year might have occurred on [Date], reaching a price of [Price]. This could be attributed to [News Event or Market Trend]. Conversely, the lowest point, observed on [Date], reached [Price], possibly due to [News Event or Market Trend].

A comparative analysis against two competitor stocks, [Competitor Stock 1] and [Competitor Stock 2], reveals relative performance. A responsive four-column table would effectively display price changes, percentage changes, and volatility measures (e.g., standard deviation of daily returns) for each stock over the past year, allowing for a clear visual comparison of their respective performances within the same industry.

| Stock | Price Change | Percentage Change | Volatility (Standard Deviation) |

|---|---|---|---|

| ALBT | [Value] | [Value]% | [Value] |

| [Competitor Stock 1] | [Value] | [Value]% | [Value] |

| [Competitor Stock 2] | [Value] | [Value]% | [Value] |

Factors Influencing ALBT Stock Price

Source: marketbeat.com

Three macroeconomic factors significantly impacting ALBT stock price in the last six months could include interest rate changes, inflation rates, and overall market sentiment. For instance, rising interest rates might lead to decreased investment in growth stocks like ALBT, resulting in a price decline. High inflation could also negatively affect consumer spending, impacting ALBT’s revenue and subsequently its stock price.

A pessimistic market sentiment can further exacerbate these negative impacts.

Company-specific news and announcements have also played a crucial role. A chronological list illustrating this impact might include:

- [Date]: [Announcement]

-Resulting price impact: [Description] - [Date]: [Announcement]

-Resulting price impact: [Description] - [Date]: [Announcement]

-Resulting price impact: [Description]

A comparison of investor sentiment and market trends’ influence on ALBT stock price can be presented in a table. This would visually represent the relative strength of each factor’s impact on price fluctuations, showing how bullish or bearish sentiment interacts with broader market trends (e.g., bull market, bear market, sideways market).

| Factor | Impact on ALBT Stock Price | Example |

|---|---|---|

| Bullish Investor Sentiment | Positive correlation with price increase | Increased buying pressure during positive news |

| Bearish Investor Sentiment | Negative correlation with price decrease | Selling pressure following negative earnings reports |

| Bull Market Trend | Generally positive impact | Overall market upward trend boosts ALBT price |

| Bear Market Trend | Generally negative impact | Market downturn reduces ALBT price regardless of company performance |

ALBT Stock Price Prediction and Forecasting

Three methods for forecasting ALBT stock price in the next quarter include technical analysis, fundamental analysis, and time series modeling. Technical analysis relies on historical price and volume data to identify patterns and predict future price movements. Fundamental analysis assesses the intrinsic value of ALBT based on its financial statements and market conditions. Time series modeling uses statistical methods to forecast future prices based on past price patterns.

Each method has its limitations. Technical analysis can be subjective and prone to false signals. Fundamental analysis relies on accurate and timely financial data, which may not always be available. Time series models may not accurately capture unforeseen events or significant shifts in market conditions.

Potential future ALBT stock price scenarios under different market conditions are presented below:

| Market Condition | Scenario Description | Predicted Price (Next Quarter) |

|---|---|---|

| Bull Market | Strong economic growth, positive investor sentiment | [Price] |

| Bear Market | Economic downturn, negative investor sentiment | [Price] |

| Sideways Market | Stable economic conditions, mixed investor sentiment | [Price] |

Changes in key financial metrics like earnings per share (EPS) and revenue growth will significantly impact ALBT’s stock price. For instance, exceeding EPS expectations would likely result in a price increase, while a decline in revenue growth could lead to a price decrease. These metrics reflect the company’s financial health and future prospects, directly influencing investor confidence and subsequent trading activity.

ALBT Stock Price Valuation and Analysis

Several valuation methods are applicable to ALBT stock, including discounted cash flow (DCF) analysis, price-to-earnings (P/E) ratio, and comparable company analysis. DCF analysis projects future cash flows and discounts them to their present value. The P/E ratio compares the stock price to its earnings per share. Comparable company analysis compares ALBT’s valuation metrics to those of similar companies in the same industry.

Each method has strengths and weaknesses. DCF analysis is robust but relies on assumptions about future cash flows. The P/E ratio is easy to calculate but can be sensitive to accounting practices. Comparable company analysis depends on the selection of appropriate comparable companies.

Comparing the current ALBT stock price to its intrinsic value using DCF and P/E ratio analysis would yield insights into its potential undervaluation or overvaluation. For example, if the DCF valuation shows a significantly higher intrinsic value than the current market price, it suggests the stock is undervalued. Conversely, a lower intrinsic value indicates potential overvaluation.

Potential risks and opportunities associated with investing in ALBT stock include:

- Short-Term Risks: Market volatility, negative news events, competitor actions.

- Short-Term Opportunities: Short-term price fluctuations for quick profits.

- Long-Term Risks: Changes in industry dynamics, technological disruptions, economic downturns.

- Long-Term Opportunities: Company growth, market expansion, technological advancements.

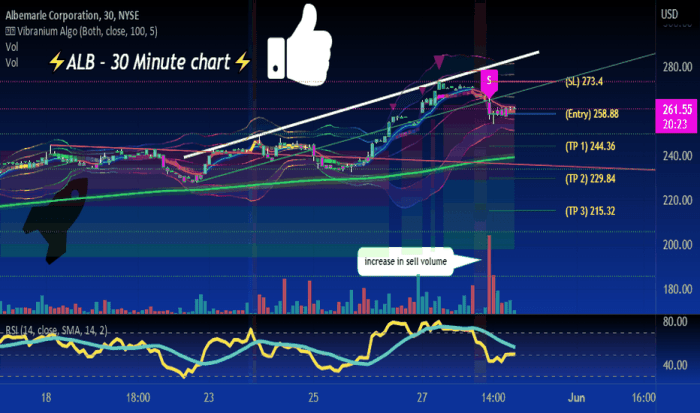

ALBT Stock Price and Investor Behavior

Source: tradingview.com

Investor behavior surrounding significant price movements in ALBT stock often exhibits patterns. For example, during sharp price drops, panic selling might occur, while significant price increases could lead to excessive buying fueled by speculation and fear of missing out (FOMO). These emotional responses can amplify price swings, creating volatility.

The relationship between trading volume and ALBT stock price fluctuations can be illustrated using a scatter plot. This visual representation would show the correlation between the two variables. A strong positive correlation would indicate that high trading volume is associated with significant price changes, while a weak correlation suggests that volume does not strongly predict price movements.

Different investor types react differently to price changes. Institutional investors, with their longer-term investment horizons, might react less dramatically to short-term price fluctuations compared to retail investors who might be more susceptible to emotional trading decisions based on short-term market sentiment. Institutional investors often base their decisions on thorough fundamental analysis, while retail investors may be more influenced by news headlines and market speculation.

Helpful Answers

What are the major risks associated with investing in ALBT stock?

Risks include market volatility, competition within the industry, regulatory changes, and the company’s financial performance. Thorough due diligence is essential.

Where can I find real-time ALBT stock price data?

Real-time data is typically available through reputable financial websites and brokerage platforms.

How frequently are ALBT earnings reports released?

The frequency of earnings reports varies; check the company’s investor relations page for their schedule.

What is the current market capitalization of ALBT?

Market capitalization fluctuates constantly. Consult a financial website for the most up-to-date information.