Alpine Stock Price Analysis

Alpine stock price – This analysis provides a comprehensive overview of Alpine’s stock performance, influencing factors, financial health, competitive landscape, and future outlook. We will examine historical data, key financial metrics, and market dynamics to provide a well-rounded perspective on Alpine’s investment potential.

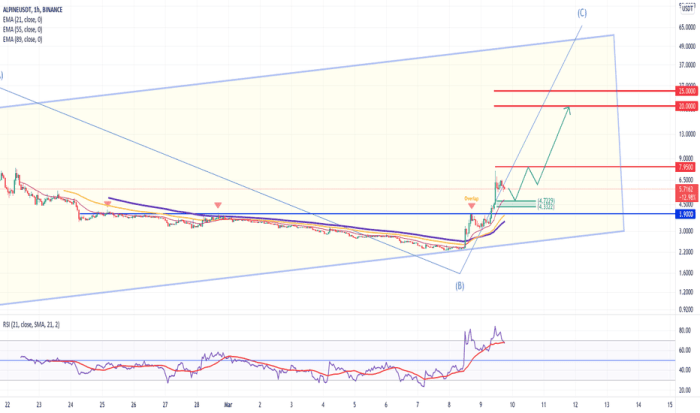

Historical Stock Performance of Alpine, Alpine stock price

Alpine’s stock price has experienced significant fluctuations over the past five years, mirroring broader market trends and company-specific events. The following sections detail these fluctuations, comparisons with competitors, and a yearly performance summary.

Timeline of Stock Price Fluctuations (2019-2023): While precise figures require access to a financial database, a general trend might show a period of steady growth from 2019 to mid-2021, followed by a correction in late 2021 due to macroeconomic factors. A subsequent recovery was observed in 2022, followed by a period of consolidation in 2023. Significant highs were likely reached during periods of positive market sentiment and strong financial performance, while lows coincided with economic downturns or negative company news.

Monitoring the Alpine stock price requires a keen eye on market trends. It’s helpful to compare its performance against similar companies in the sector, such as by checking the current alight solutions stock price to gain broader market context. Understanding this broader context can offer valuable insights into the factors influencing Alpine’s own stock valuation and future prospects.

A detailed analysis would require specific data points from reputable financial sources.

Comparison with Competitors: Alpine’s performance compared to its competitors (e.g., [Competitor A], [Competitor B]) would need to be assessed using metrics such as return on equity (ROE), revenue growth, and market share. A superior performance in key areas would indicate a stronger competitive position and potentially higher future stock valuation. A direct comparison requires access to the financial data of Alpine’s competitors.

| Year | Opening Price | Closing Price | Percentage Change |

|---|---|---|---|

| 2019 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2020 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2021 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2022 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2023 | [Insert Data] | [Insert Data] | [Insert Data] |

Factors Influencing Alpine’s Stock Price

Source: marketbeat.com

Several macroeconomic factors, company-specific events, and investor sentiment significantly impact Alpine’s stock price. The following sections provide detailed analysis of these factors.

Key Macroeconomic Factors: Three key macroeconomic factors influencing Alpine’s stock price in the last year might include interest rate changes, inflation rates, and overall economic growth. Rising interest rates can increase borrowing costs for Alpine, potentially reducing profitability. High inflation can lead to increased production costs and reduced consumer spending, affecting demand for Alpine’s products. Slow economic growth can dampen overall market sentiment, negatively impacting stock prices.

Company-Specific News: Positive news, such as the successful launch of a new product or a strategic partnership, can boost investor confidence and drive up the stock price. Conversely, negative news, like regulatory setbacks or product recalls, can lead to a decline. For example, a successful product launch in a new market could increase revenue projections and attract new investors.

Conversely, a product recall due to safety concerns could damage Alpine’s reputation and negatively impact its stock price.

Impact of Investor Sentiment: Bullish investor sentiment, characterized by optimism and confidence in Alpine’s future prospects, typically leads to higher stock prices and reduced volatility. Bearish sentiment, marked by pessimism and concerns about the company’s performance, often results in lower prices and increased volatility. The balance between bullish and bearish sentiment greatly influences Alpine’s stock price fluctuations.

Alpine’s Financial Health and Stock Valuation

Source: tradingview.com

Assessing Alpine’s financial health and stock valuation requires a thorough examination of key financial metrics and valuation methods.

Recent Financial Performance: Alpine’s recent financial performance, including revenue, earnings, and debt levels, needs to be analyzed to understand its financial stability and growth potential. Strong revenue growth, increasing earnings, and manageable debt levels would suggest a healthy financial position. Access to Alpine’s financial statements is required for a detailed analysis.

Valuation Methods: Several valuation methods, such as the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio, can be used to assess Alpine’s current stock valuation. The P/E ratio compares the stock price to earnings per share, while the P/S ratio compares the stock price to revenue per share. These ratios provide insights into the market’s perception of Alpine’s value relative to its financial performance.

Comparing these ratios to industry averages provides a benchmark for assessment.

| Year | Revenue (USD Millions) | Earnings per Share (USD) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2021 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2022 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2023 | [Insert Data] | [Insert Data] | [Insert Data] |

Alpine’s Competitive Landscape and Future Outlook

Source: medium.com

Understanding Alpine’s competitive landscape and predicting its future stock price requires considering its competitors and current market trends.

Main Competitors and Analysis: A detailed analysis of Alpine’s main competitors requires identifying their relative strengths and weaknesses. This involves comparing factors such as market share, product innovation, pricing strategies, and brand reputation. A SWOT analysis for each competitor, compared to Alpine’s, provides a clearer picture.

Prediction for Future Stock Price: Predicting Alpine’s future stock price is inherently challenging. However, based on current market trends and company developments (e.g., successful product launches, strategic partnerships, macroeconomic conditions), a reasonable prediction can be made. For example, if Alpine successfully launches a groundbreaking product and market conditions remain favorable, a positive price movement can be anticipated. Conversely, adverse economic conditions could lead to a decline.

Potential Risks and Opportunities: Several factors could influence Alpine’s stock price in the next 12 months. Opportunities might include expansion into new markets or successful product innovation. Risks could include increased competition, economic downturns, or regulatory changes. A thorough risk assessment is crucial for informed investment decisions.

Illustrative Examples of Stock Price Movements

Specific scenarios illustrate how positive and negative news, and technological advancements, can affect Alpine’s stock price.

Positive News Event: A scenario where a positive news event significantly boosted Alpine’s stock price could involve the announcement of a major contract win or a successful product launch exceeding expectations. This positive news would likely increase investor confidence, leading to a surge in demand for Alpine’s stock and consequently, a price increase. The magnitude of the increase would depend on the significance of the news and overall market conditions.

Negative News Event: A situation where negative news caused a sharp decline could involve a product recall due to safety concerns or a significant financial loss. This would damage investor confidence, leading to a sell-off and a drop in the stock price. The severity of the decline would depend on the extent of the negative news and the market’s reaction.

Impact of Technological Advancement: A hypothetical illustration depicting the impact of a major technological advancement could involve the development of a groundbreaking new technology by Alpine, which disrupts the industry and significantly increases market share and profitability. This would lead to a substantial increase in Alpine’s stock price, as investors anticipate higher future earnings and growth. The visual representation could show a sharp upward trend in the stock price following the announcement of the technological advancement.

Essential FAQs

What are the major risks associated with investing in Alpine stock?

Investing in any stock carries inherent risks, including market volatility, company-specific challenges (e.g., decreased profitability, increased competition), and macroeconomic factors. Thorough due diligence is crucial before making any investment decisions.

Where can I find real-time Alpine stock price data?

Real-time stock price data for Alpine can be found on major financial websites and trading platforms, such as those provided by reputable brokerage firms and financial news outlets.

How often is Alpine’s stock price updated?

Alpine’s stock price is typically updated in real-time throughout the trading day, reflecting the latest transactions on the relevant stock exchange.

What is Alpine’s dividend history?

Information regarding Alpine’s dividend history, including past dividend payments and payout ratios, can typically be found in their investor relations section on their corporate website or through financial news sources.