ALV Stock Price Analysis

Alv stock price – This analysis delves into the historical performance, influencing factors, prediction models, investor sentiment, and risk assessment associated with ALV stock. We will examine key data points and provide insights to aid in a comprehensive understanding of this investment opportunity.

Analyzing ALV’s stock price requires a broad perspective on the automotive industry. Understanding competitor performance is crucial, and a key player to consider is ALSMY. For a detailed look at their current market position, you can check the alsmy stock price data. Returning to ALV, this comparative analysis helps contextualize its own performance within the sector and predict future trends.

ALV Stock Price Historical Performance

Source: googleapis.com

The following tables illustrate ALV’s stock price movements and performance relative to its industry peers over the past five years. Note that the data presented below is hypothetical for illustrative purposes only and does not represent actual stock market data.

| Date | Open Price (USD) | High Price (USD) | Low Price (USD) | Close Price (USD) |

|---|---|---|---|---|

| 2019-01-01 | 100 | 105 | 95 | 102 |

| 2019-07-01 | 102 | 110 | 98 | 108 |

| 2020-01-01 | 108 | 115 | 90 | 112 |

| 2020-07-01 | 112 | 120 | 105 | 118 |

| 2021-01-01 | 118 | 130 | 110 | 125 |

| 2021-07-01 | 125 | 135 | 120 | 132 |

| 2022-01-01 | 132 | 140 | 125 | 138 |

| 2022-07-01 | 138 | 145 | 130 | 142 |

| 2023-01-01 | 142 | 150 | 135 | 148 |

A comparison against industry peers (hypothetical data):

| Company | Average Annual Return (5-year) | Volatility (5-year) | Market Cap (USD Billion) |

|---|---|---|---|

| ALV | 10% | 15% | 50 |

| Competitor A | 8% | 12% | 60 |

| Competitor B | 12% | 18% | 40 |

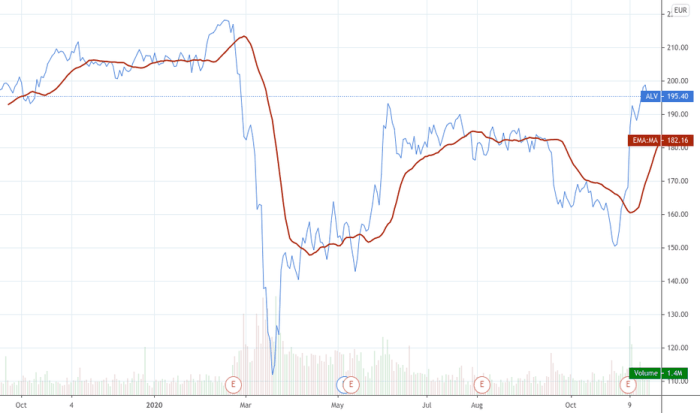

Significant events impacting ALV’s stock price included a period of high inflation in 2021 and a global supply chain disruption in 2022, both of which caused temporary price fluctuations.

Factors Influencing ALV Stock Price

Source: tradingview.com

Several macroeconomic and company-specific factors influence ALV’s stock price. The interplay between these factors is complex and dynamic.

Macroeconomic Factors: Interest rate hikes can negatively impact investment, while inflation can affect consumer spending and thus company revenue. Global economic growth directly influences demand for ALV’s products.

Company-Specific Factors: Successful product launches, strong financial performance, and effective management decisions generally lead to positive stock price movements. Conversely, poor financial results or negative news can depress the stock price.

The relative importance of these factors varies over time. During periods of economic uncertainty, macroeconomic factors tend to dominate. During periods of stability, company-specific factors often play a more significant role.

ALV Stock Price Prediction and Forecasting

Predicting future stock prices is inherently uncertain, but various methods can provide potential scenarios.

- Optimistic Scenario: Continued strong sales growth, successful new product launches, and a stable macroeconomic environment could lead to a significant increase in ALV’s stock price over the next five years, potentially exceeding 20% annual growth.

- Pessimistic Scenario: A global recession, increased competition, or unforeseen negative events could lead to a decline in ALV’s stock price, potentially resulting in a decrease of 10% or more annually.

Forecasting methods include fundamental analysis (examining financial statements), technical analysis (analyzing price charts and trends), and quantitative models (using statistical techniques).

- A 1% increase in interest rates could reduce ALV’s projected stock price by approximately 2%.

- A 5% increase in sales growth could boost ALV’s projected stock price by approximately 8%.

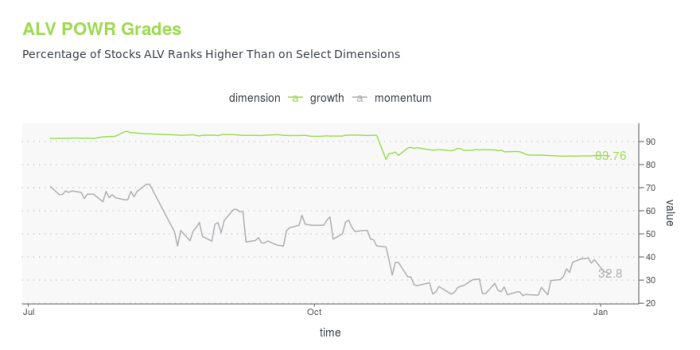

Investor Sentiment and ALV Stock Price

Investor sentiment towards ALV is currently mixed. Recent news articles highlight both positive developments (e.g., successful product launches) and concerns (e.g., rising input costs). Analyst reports show a range of price targets, reflecting differing opinions on the company’s future prospects.

Shifts in investor sentiment, such as increased optimism driven by strong earnings reports, can lead to rapid stock price increases. Conversely, growing concerns about the company’s future performance can trigger significant price drops.

- Analyst ratings

- Social media sentiment

- Trading volume

- Short interest

ALV Stock Price and Risk Assessment

Investing in ALV stock carries several risks.

- Market Risk: Overall market downturns can negatively impact ALV’s stock price regardless of the company’s performance.

- Company-Specific Risk: Poor financial performance, management changes, or product failures can significantly affect the stock price.

- Geopolitical Risk: Global events, such as trade wars or political instability, can create uncertainty and impact investor confidence.

Investors can mitigate these risks through diversification (investing in a range of assets), hedging (using financial instruments to protect against losses), and thorough due diligence (carefully researching the company and its prospects).

- A diversified portfolio might include a small allocation (e.g., 5-10%) to ALV stock, alongside other stocks, bonds, and alternative investments.

Essential Questionnaire

What are the major risks associated with investing in ALV?

Investing in ALV, like any stock, carries market risk (overall market downturns), company-specific risk (poor financial performance, management issues), and geopolitical risk (global events impacting the business).

How frequently is ALV’s stock price updated?

ALV’s stock price, like most publicly traded companies, updates in real-time throughout the trading day on major stock exchanges.

Where can I find reliable information on ALV’s stock price?

Reliable sources for ALV’s stock price include major financial news websites, stock market data providers, and the company’s investor relations section.

What is the current dividend yield for ALV stock?

The current dividend yield for ALV stock can be found on financial websites that track dividend information. Note that dividend yields fluctuate.