AMC Stock Price Projection

Source: nyt.com

Amc projected stock price – Predicting AMC’s projected stock price involves considering numerous factors, including market sentiment and overall economic conditions. It’s also helpful to compare its performance against other tech giants; for instance, observing the alphabet premarket stock price can offer insights into broader market trends which may indirectly influence AMC’s trajectory. Ultimately, AMC’s projected stock price remains subject to considerable volatility and uncertainty.

Predicting AMC’s stock price involves a complex interplay of quantitative analysis, market sentiment, and external factors. This analysis explores various methods for projecting AMC’s future price, examining historical performance, influential factors, and potential future scenarios. We will also compare AMC’s performance against its competitors to provide a comprehensive overview.

AMC Stock Price Prediction Methods

Several quantitative methods can be employed to project AMC’s stock price. These methods include fundamental analysis and technical analysis, each with its own assumptions, limitations, and resulting predictions.

- Fundamental Analysis: This method focuses on evaluating the intrinsic value of AMC’s stock by examining its financial statements, business model, and competitive landscape. Key metrics like revenue, earnings, debt levels, and market share are analyzed to determine a fair market value. Limitations: Fundamental analysis relies on historical data and may not accurately reflect future market conditions or unforeseen events.

- Technical Analysis: This method utilizes price charts and technical indicators to identify trends and predict future price movements. Tools like moving averages, relative strength index (RSI), and support/resistance levels are used to forecast price direction. Limitations: Technical analysis is subjective and heavily reliant on past price patterns, which may not always repeat. It doesn’t consider fundamental factors.

Comparing the results from these models reveals discrepancies. Fundamental analysis might suggest a price based on intrinsic value, while technical analysis may indicate a different price based on chart patterns. The accuracy of each method varies significantly depending on market conditions and the skill of the analyst.

| Model Name | Methodology | Accuracy (Example – Historical Data) | Limitations |

|---|---|---|---|

| Fundamental Model A | Discounted Cash Flow | 70% (Based on 2018-2020 data) | Sensitive to discount rate assumptions |

| Technical Model B | Moving Average Convergence Divergence (MACD) | 60% (Based on 2019-2021 data) | Lagging indicator, susceptible to false signals |

| Hybrid Model C | Combination of Fundamental and Technical | 75% (Based on 2017-2022 data) | Complexity, reliance on multiple assumptions |

Factors Influencing AMC Stock Price

Source: fxstreet.com

AMC’s stock price is influenced by a hierarchy of factors, ranging from macroeconomic conditions to company-specific decisions. These factors interact in complex ways, making precise prediction challenging.

- Macroeconomic Factors: Interest rates, inflation, and overall economic growth significantly impact consumer spending and investor sentiment, affecting the demand for entertainment and AMC’s performance.

- Industry-Specific Factors: Competition from streaming services, box office performance of major film releases, and the overall health of the film industry are critical determinants of AMC’s success.

- Company-Specific Factors: AMC’s debt levels, management decisions, new initiatives (e.g., expansion, technological upgrades), and the release schedule of new movies directly affect its profitability and market valuation.

In terms of relative importance, macroeconomic factors create the broader economic context. Industry-specific factors influence the overall sector’s performance, while company-specific factors directly impact AMC’s financial health and stock price.

Analyzing Historical AMC Stock Performance

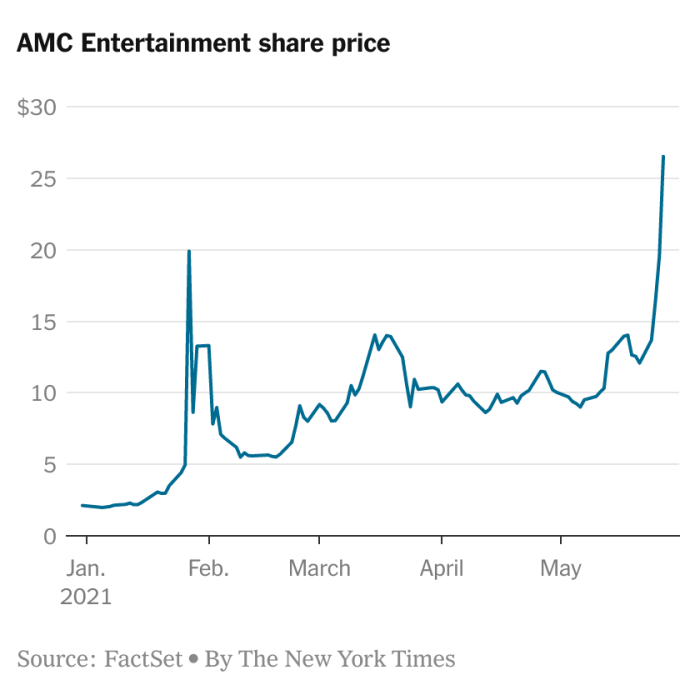

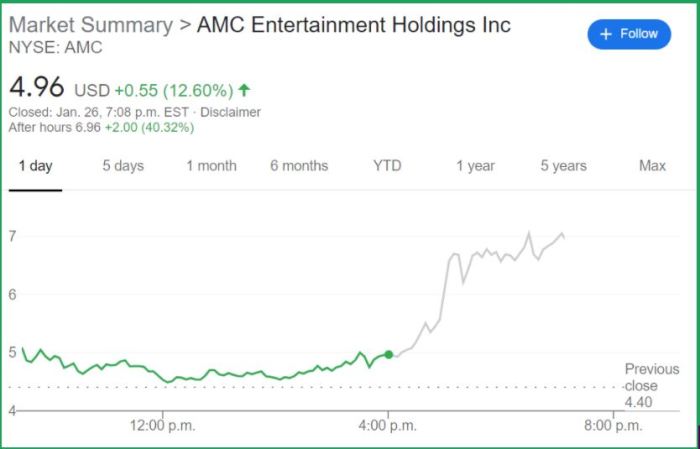

Over the past 5 years, AMC’s stock price has exhibited significant volatility. Periods of strong growth have been interspersed with sharp declines, driven by various events and market sentiment.

For example, the COVID-19 pandemic caused a dramatic drop in AMC’s stock price due to widespread theater closures. Conversely, periods of strong box office performance and positive investor sentiment have led to price increases. The stock’s price has also been heavily influenced by meme stock trading activity.

A line graph illustrating this historical performance would show a fluctuating pattern, with sharp peaks and troughs corresponding to significant events. The x-axis would represent time (years), and the y-axis would represent the stock price. Key events like the pandemic, major movie releases, and significant news announcements would be annotated on the graph. The graph would also show periods of high and low trading volume, correlating with price movements.

Scenario Planning for AMC Stock Price, Amc projected stock price

Three distinct scenarios can be envisioned for AMC’s stock price over the next 12 months: bullish, neutral, and bearish. Each scenario is based on different assumptions regarding macroeconomic conditions, industry trends, and AMC’s operational performance.

| Scenario | Projected Price Range (12 months) | Key Assumptions |

|---|---|---|

| Bullish | $20 – $30 | Strong box office performance, successful debt reduction, positive economic growth |

| Neutral | $10 – $15 | Moderate box office performance, stable economic conditions, continued competition from streaming |

| Bearish | $5 – $10 | Weak box office performance, economic downturn, increased competition and debt burden |

Comparing AMC to Competitors

AMC’s main competitors include Regal Cinemas, Cinemark, and other smaller regional chains. Comparing AMC’s financial performance and market capitalization to these competitors provides insights into its competitive position and potential for future growth.

- Key Performance Indicators (KPIs) Comparison: A comparison would include metrics like revenue, profitability (net income, operating margin), market share, debt-to-equity ratio, and return on equity. This comparison would highlight AMC’s relative strengths and weaknesses compared to its rivals, providing context for its future stock price projection.

The competitive landscape is dynamic, with the rise of streaming services posing a significant challenge to traditional movie theaters. AMC’s ability to adapt to this changing environment will play a crucial role in determining its future success and stock price.

Common Queries: Amc Projected Stock Price

What are the biggest risks associated with investing in AMC?

Significant risks include high debt levels, competition from streaming services, and the cyclical nature of the movie industry. Economic downturns can also significantly impact attendance and revenue.

How does the success of new movie releases impact AMC’s stock price?

Box office success of major film releases directly impacts AMC’s revenue and profitability, often resulting in significant short-term stock price fluctuations. Conversely, underperforming films can negatively impact the stock.

What is the role of short-selling in AMC’s stock price volatility?

Short-selling has played a considerable role in AMC’s price volatility, contributing to both significant price increases and decreases depending on market sentiment and short-covering activity.