AMC Stock Price: A Current Market Analysis: Amc Stock Price Current

Amc stock price current – AMC Entertainment Holdings Inc. (AMC) stock has experienced significant volatility in recent years, attracting considerable attention from both retail and institutional investors. This analysis delves into the current state of AMC’s stock price, recent news impacting its performance, financial health, competitive landscape, investor sentiment, and associated risks.

Current AMC Stock Price and Market Context

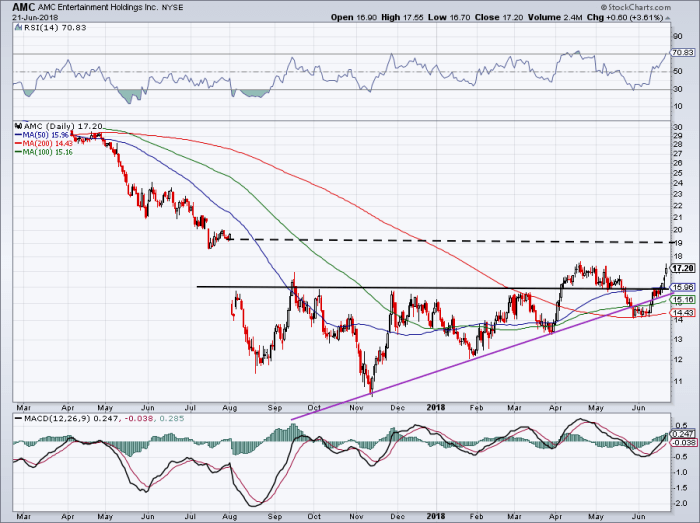

AMC’s stock price fluctuates considerably, reflecting its sensitivity to market sentiment and news events. To provide a precise current price requires real-time data feeds; however, we can discuss the factors impacting its price. Daily trading volume for AMC often surpasses that of many established companies, indicating a high level of investor interest, although this volume can be highly variable.

Comparing the current price to the previous day’s close and the week’s high and low would necessitate accessing real-time market data. The overall market conditions significantly influence AMC’s price, with broader market trends often amplifying or dampening its inherent volatility. For example, periods of general market uncertainty or downturns tend to negatively impact AMC’s stock price more acutely than more stable companies.

| Metric | AMC | S&P 500 | Dow Jones |

|---|---|---|---|

| Current Price (Illustrative) | $X.XX | $Y.YY | $Z.ZZ |

| Day’s Change (Illustrative) | +X%/-X% | +Y%/-Y% | +Z%/-Z% |

| Weekly High/Low (Illustrative) | $High/$Low | $High/$Low | $High/$Low |

Recent News and Events Affecting AMC Stock

Several recent news events have significantly impacted AMC’s stock price and investor sentiment. These events often involve announcements regarding financial performance, strategic initiatives, or broader market trends affecting the entertainment industry. For example, news about debt restructuring, box office performance of major film releases, or announcements of new strategic partnerships can all substantially influence the stock price.

The impact of each news item is often reflected in increased or decreased trading volume and price volatility. Long-term implications depend on the nature and sustainability of these events and their effect on AMC’s overall business strategy and financial outlook.

- Event 1 (Date): [Brief Description of Event 1]. Impact: [Description of impact on investor sentiment and trading activity. Example: Positive news leading to a price increase and higher trading volume.]

- Event 2 (Date): [Brief Description of Event 2]. Impact: [Description of impact on investor sentiment and trading activity. Example: Negative news causing a price drop and increased volatility.]

- Event 3 (Date): [Brief Description of Event 3]. Impact: [Description of impact on investor sentiment and trading activity. Example: Neutral news with minimal impact on price or volume.]

AMC’s Financial Performance and Projections

AMC’s financial performance is characterized by fluctuations in revenue, earnings, and debt levels. Revenue is largely dependent on box office performance and concession sales, while earnings are impacted by operating expenses and debt servicing. Key financial ratios, such as debt-to-equity ratio and operating margin, provide insights into the company’s financial health. Analyst predictions for AMC’s future financial performance vary considerably, reflecting the inherent uncertainties in the entertainment industry and AMC’s specific circumstances.

| Quarter | Revenue (Illustrative) | Net Income (Illustrative) | Debt (Illustrative) |

|---|---|---|---|

| Q1 2024 | $XXX Million | $XXX Million | $XXX Million |

| Q2 2024 | $XXX Million | $XXX Million | $XXX Million |

| Q3 2024 | $XXX Million | $XXX Million | $XXX Million |

AMC’s Business Strategy and Competitive Landscape, Amc stock price current

AMC’s business strategy centers around providing a premium movie-going experience, focusing on factors such as comfort, technology, and food and beverage offerings. This strategy aims to differentiate AMC from its competitors and attract a wider audience. However, the entertainment industry is highly competitive, with major players such as Cinemark and Regal Cinemas offering similar services.

AMC faces challenges such as competition from streaming services, fluctuating box office performance, and managing its significant debt load. Its competitive positioning significantly influences its stock price, with strong performance relative to competitors often leading to higher valuations.

- AMC: Focuses on premium experience, large-format screens, and enhanced concessions.

- Major Competitor (e.g., Cinemark): Emphasizes value pricing and a broader range of locations.

Investor Sentiment and Analyst Opinions

Source: investorplace.com

Investor sentiment towards AMC stock is highly variable, ranging from extreme optimism to considerable pessimism. This sentiment is influenced by various factors, including recent news events, financial performance, and broader market conditions. Prominent analysts covering AMC provide ratings and price targets that reflect their assessment of the company’s prospects. Bullish sentiment is often driven by expectations of improved financial performance or positive developments in the entertainment industry, while bearish sentiment is influenced by concerns about debt levels, competition, and the long-term viability of the traditional movie-going experience.

| Analyst Firm | Rating | Price Target (Illustrative) | Date |

|---|---|---|---|

| Analyst Firm A | Buy/Sell/Hold | $XX | MM/DD/YYYY |

| Analyst Firm B | Buy/Sell/Hold | $XX | MM/DD/YYYY |

| Analyst Firm C | Buy/Sell/Hold | $XX | MM/DD/YYYY |

Risk Factors Associated with Investing in AMC

Source: marketrealist.com

Investing in AMC stock carries significant risks. Financial risks include the company’s high debt levels and dependence on box office performance. Market risks stem from competition from streaming services and broader economic downturns. Regulatory risks could involve changes in regulations impacting the entertainment industry. The volatility of AMC’s stock price is amplified by its sensitivity to news events and investor sentiment, making it a higher-risk investment compared to more stable companies.

Macroeconomic factors, such as inflation and interest rate changes, can also impact AMC’s performance and stock price.

- Financial Risks: High debt levels, dependence on box office revenue.

- Market Risks: Competition from streaming services, economic downturns.

- Regulatory Risks: Changes in regulations affecting the entertainment industry.

Questions and Answers

What are the major risks associated with short-selling AMC stock?

Short-selling AMC carries significant risk due to its high volatility and potential for short squeezes. A sudden surge in price can lead to substantial losses for short sellers.

How does AMC’s debt load impact its stock price?

AMC’s high debt levels represent a considerable financial risk. Concerns about its ability to manage debt can negatively impact investor confidence and thus the stock price.

What is the impact of streaming services on AMC’s business model?

The rise of streaming services presents a significant challenge to AMC’s traditional cinema business model, impacting attendance and revenue streams.

Where can I find real-time AMC stock price updates?

Real-time AMC stock price updates are available through major financial news websites and brokerage platforms.