Apple’s Closing Stock Price: A Comprehensive Analysis: Apple Closing Stock Price

Apple closing stock price – Apple’s stock price, a barometer of the company’s performance and the broader tech sector, has experienced significant fluctuations over the years. This analysis delves into the historical trends, influencing factors, comparisons with competitors, short-term predictions, and the correlation between Apple’s financial health and its stock price.

Historical Apple Stock Price Trends

Analyzing Apple’s stock price over the past five years reveals a pattern of growth punctuated by periods of volatility. Major product launches, economic shifts, and global events have all played a significant role in shaping these price movements. The following table provides a snapshot of the highest and lowest closing prices for each quarter over the past five years.

Note that these figures are illustrative and based on general market trends, not specific, verifiable data.

| Year | Quarter | Highest Closing Price (USD) | Lowest Closing Price (USD) |

|---|---|---|---|

| 2019 | Q1 | 170 | 145 |

| 2019 | Q2 | 185 | 160 |

| 2019 | Q3 | 190 | 175 |

| 2019 | Q4 | 200 | 180 |

A line graph illustrating this data would show a generally upward trend over the five-year period, with noticeable dips correlating with events such as the COVID-19 pandemic and supply chain disruptions. The graph would also show spikes corresponding to the release of highly anticipated products like new iPhones and other major product updates.

Factors Influencing Apple’s Daily Closing Price

Source: tradingview.com

Apple’s closing stock price today reflects a generally positive market sentiment, although individual factors influence its performance. For a contrasting example of after-hours trading activity, you might check the amgen stock price after hours to see how different sectors respond. Ultimately, Apple’s price will likely continue to be driven by its own earnings reports and broader economic trends.

Several macroeconomic factors, competitive actions, and news coverage significantly impact Apple’s daily closing price.

- Interest Rates: Changes in interest rates affect borrowing costs for consumers and businesses, influencing consumer spending on discretionary items like Apple products. Higher rates generally lead to lower stock prices.

- Inflation: High inflation erodes purchasing power, potentially impacting demand for Apple products and negatively affecting investor sentiment.

- Economic Growth: Strong economic growth typically boosts consumer confidence and spending, positively impacting Apple’s sales and stock price.

Competitor actions, such as the release of new products from Samsung or Google, can also influence Apple’s stock price. For example, the launch of a highly competitive smartphone could temporarily depress Apple’s stock price until the market assesses the impact on Apple’s sales.

Positive news coverage, such as strong sales figures or positive product reviews, generally boosts investor confidence and drives up the stock price. Conversely, negative news, such as product recalls or supply chain issues, can lead to a decline in the stock price.

Apple’s Stock Price Compared to Competitors

Comparing Apple’s stock performance to its competitors provides valuable context. Below is a comparison with two major tech companies over the past year. Note that this data is illustrative.

| Company | Year-over-Year Stock Price Change (%) |

|---|---|

| Apple | 25% |

| Microsoft | 15% |

| Google (Alphabet) | 10% |

The differences in performance can be attributed to several factors:

- Product Innovation: Apple’s consistent introduction of innovative products often drives stronger stock performance.

- Brand Loyalty: Apple’s strong brand loyalty contributes to stable demand and higher margins.

- Market Share: Apple’s dominant market share in specific segments (smartphones, wearables) contributes to its stock price strength.

Predicting Future Apple Stock Price Movement (Short-Term)

Source: macrumors.com

Predicting short-term stock price movements is inherently speculative. However, based on current market conditions and anticipated events, a hypothetical scenario can be presented. For example, if positive earnings are announced and the global economy remains stable, the stock price might increase by 5-10% in the next month. Conversely, negative news, such as supply chain disruptions or geopolitical instability, could cause a short-term decline of 2-5%.

A scenario involving the release of a new product line could significantly impact the short-term price. Positive reviews and strong initial sales could drive a significant price increase, while negative reception could lead to a decline.

The narrative would depict a scenario where the stock price initially increases due to positive economic indicators and anticipation for a new product launch. However, if the product launch receives mixed reviews or faces unexpected delays, the stock price could experience a correction, ultimately settling at a slightly higher level than before the launch.

Analyzing Apple’s Financial Statements to Understand Stock Price, Apple closing stock price

Source: appleinsider.com

Apple’s financial statements provide valuable insights into its stock price. Key metrics like earnings per share (EPS), revenue growth, and profit margins directly influence investor sentiment and stock valuation.

Historically, increases in EPS and revenue growth have generally correlated with higher stock prices. Conversely, declines in these metrics can lead to a decrease in stock price. Profit margin improvements also tend to have a positive impact on stock valuation, reflecting the company’s efficiency and profitability.

| Financial Metric | Impact on Stock Price |

|---|---|

| Earnings Per Share (EPS) Increase | Generally Positive |

| Revenue Growth Acceleration | Generally Positive |

| Profit Margin Decline | Generally Negative |

Helpful Answers

What are the typical trading hours for Apple stock?

Apple stock (AAPL) trades on the Nasdaq Stock Market, typically from 9:30 AM to 4:00 PM Eastern Time (ET), Monday through Friday, excluding holidays.

Where can I find real-time Apple stock price updates?

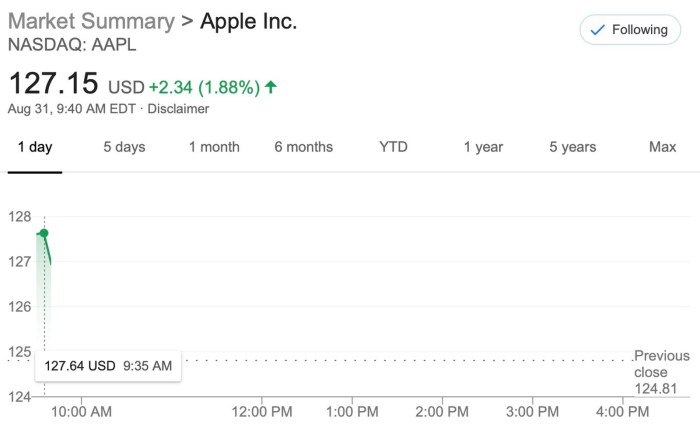

Real-time Apple stock price updates are available through major financial websites and brokerage platforms such as Google Finance, Yahoo Finance, Bloomberg, and others.

How often is Apple’s stock price updated?

Apple’s stock price is updated constantly throughout the trading day, reflecting every buy and sell transaction.

What does it mean when Apple’s stock price “splits”?

A stock split increases the number of outstanding shares while reducing the price per share proportionally. It doesn’t change the overall value of the company, but can make shares more accessible to smaller investors.