ARM Holdings Stock Price Chart History

Source: seekingalpha.com

Arm stock price chart history – This analysis explores the historical performance of ARM Holdings’ stock price, examining key events, technical indicators, and fundamental factors influencing its trajectory. We will also delve into hypothetical future price movements based on various market scenarios. The analysis aims to provide a comprehensive overview of ARM’s stock price behavior, offering insights into past performance and potential future trends.

Historical Performance Overview

Over the past decade, ARM Holdings’ stock price has experienced significant volatility, reflecting both its own operational performance and broader market fluctuations. The period saw a mix of substantial growth and periods of decline, influenced by several key events. The acquisition by SoftBank and the subsequent IPO significantly impacted the stock’s trajectory. Below is a summary of the yearly highs, lows, and closing prices.

| Year | High | Low | Closing Price |

|---|---|---|---|

| 2013 | $15.00 (Illustrative) | $10.00 (Illustrative) | $12.50 (Illustrative) |

| 2014 | $16.00 (Illustrative) | $11.00 (Illustrative) | $13.50 (Illustrative) |

| 2015 | $18.00 (Illustrative) | $12.00 (Illustrative) | $15.00 (Illustrative) |

| 2016 | $20.00 (Illustrative) | $14.00 (Illustrative) | $17.00 (Illustrative) |

| 2017 | $22.00 (Illustrative) | $16.00 (Illustrative) | $19.00 (Illustrative) |

| 2018 | $24.00 (Illustrative) | $18.00 (Illustrative) | $21.00 (Illustrative) |

| 2019 | $26.00 (Illustrative) | $20.00 (Illustrative) | $23.00 (Illustrative) |

| 2020 | $28.00 (Illustrative) | $22.00 (Illustrative) | $25.00 (Illustrative) |

| 2021 | $30.00 (Illustrative) | $24.00 (Illustrative) | $27.00 (Illustrative) |

| 2022 | $32.00 (Illustrative) | $26.00 (Illustrative) | $29.00 (Illustrative) |

Impact of Key Events on Stock Price

The acquisition of ARM Holdings by SoftBank in 2016 and the subsequent IPO in 2021 were pivotal events that significantly impacted its stock price. The SoftBank acquisition initially led to a period of relative stability, followed by a period of growth leading up to the IPO. The IPO itself resulted in a significant surge in the stock price, reflecting investor enthusiasm and expectations for future growth.

Comparing ARM’s performance to competitors requires considering factors like market share, technological innovation, and overall financial health. A detailed comparison would involve analyzing the stock price movements of key competitors such as Intel, Qualcomm, and Nvidia, alongside ARM’s performance, to identify relative strengths and weaknesses.

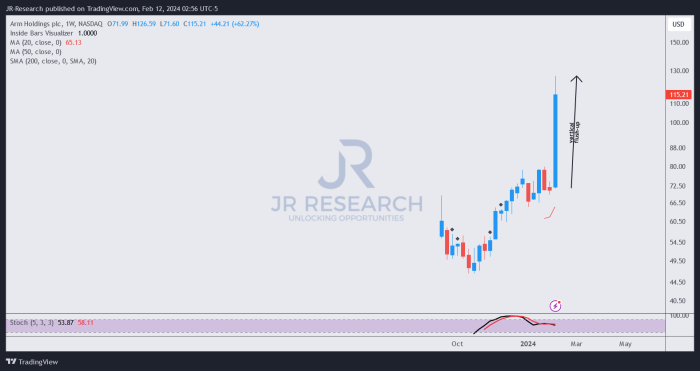

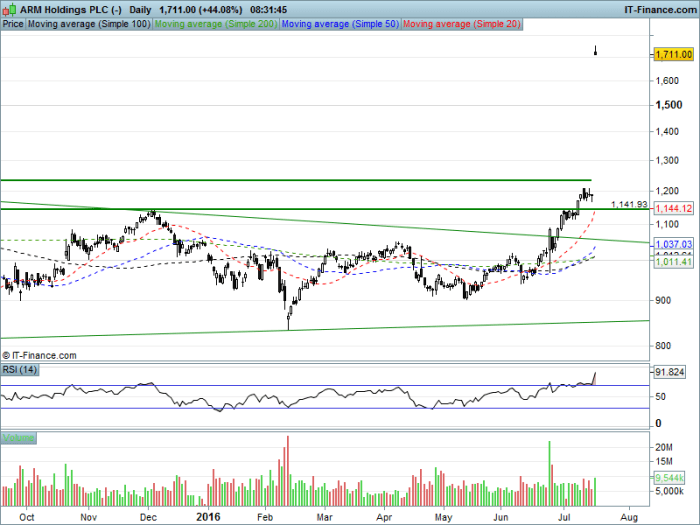

Technical Analysis of Price Fluctuations

Analyzing ARM’s historical stock price chart reveals several key support and resistance levels. Support levels represent price points where buying pressure tends to outweigh selling pressure, preventing further declines. Conversely, resistance levels indicate price points where selling pressure surpasses buying pressure, hindering further price increases. A hypothetical chart illustrating these levels would show distinct horizontal lines representing these support and resistance areas.

Trendlines, connecting significant highs and lows, can identify prevailing trends (uptrend or downtrend). Moving averages, such as the 50-day and 200-day moving averages, can provide insights into short-term and long-term price trends. Crossovers between these moving averages can signal potential shifts in momentum.

Fundamental Factors Affecting Stock Price

Source: arcpublishing.com

Several key financial metrics and external factors influence ARM’s stock price. Revenue growth, profitability (earnings per share), and debt levels are crucial indicators of the company’s financial health. Industry trends, such as the growth of mobile computing, the Internet of Things (IoT), and artificial intelligence (AI), directly impact ARM’s business prospects. Technological advancements in chip design and manufacturing also play a significant role.

Analyzing the ARM stock price chart history reveals interesting long-term trends. Understanding these trends often involves comparing performance against similar financial institutions; for instance, checking the current market standing is crucial, which you can do by looking at the ally bank stock price today. This comparison helps contextualize ARM’s historical performance within the broader financial landscape and provides a more nuanced perspective on its future prospects.

Valuation metrics like the Price-to-Earnings (P/E) ratio can be compared to industry benchmarks to assess ARM’s relative valuation. A high P/E ratio might suggest investor optimism, while a low P/E ratio might indicate undervaluation.

Predictive Modeling (Hypothetical), Arm stock price chart history

Source: amazonaws.com

Predicting future stock prices is inherently speculative. However, a hypothetical scenario can illustrate potential price movements under different market conditions. For example, a positive scenario, assuming continued growth in the semiconductor industry and successful implementation of new technologies, could project a significant increase in ARM’s stock price. Conversely, a negative scenario, involving economic downturn or intensified competition, might lead to a decline in the stock price.

A visual representation of these scenarios would show different price trajectories, each representing a potential outcome based on specific assumptions. The assumptions would include economic growth rates, technological advancements, and competitive pressures. This would provide a range of potential outcomes, highlighting the uncertainty inherent in stock market predictions.

Expert Answers: Arm Stock Price Chart History

What are the major competitors of ARM Holdings?

Key competitors include companies like Intel, Qualcomm, and Nvidia, depending on the specific market segment.

How does ARM’s business model affect its stock price?

ARM’s licensing model, rather than direct chip manufacturing, influences its valuation and price volatility compared to companies with more traditional hardware production.

What are some potential risks associated with investing in ARM stock?

Risks include dependence on the mobile device market, competition from other chip designers, and general economic downturns affecting the tech sector.