ASML Holding NV: A Deep Dive into its Stock Price: Asml Amsterdam Stock Price

Asml amsterdam stock price – ASML Holding NV, a Dutch company, is a dominant player in the lithography systems market, crucial for semiconductor manufacturing. Understanding the factors influencing its stock price requires analyzing its business model, market position, financial performance, and broader economic conditions. This analysis will explore these aspects to provide insights into ASML’s stock price movements.

ASML Holding NV Company Overview

Source: themarketperiodical.com

ASML Holding NV was founded in 1984 through a joint venture between Philips and ASM International. It has since become the world’s leading provider of lithography systems, essential tools used in the production of integrated circuits (ICs). These systems use ultraviolet light to etch incredibly intricate patterns onto silicon wafers, a foundational process in chip manufacturing.

ASML’s main products include deep ultraviolet (DUV) and extreme ultraviolet (EUV) lithography systems. DUV systems are widely used for producing mature node chips, while EUV systems are crucial for manufacturing cutting-edge, high-performance chips. The company also provides related services such as installation, maintenance, and upgrades of its systems. ASML’s key markets are geographically diverse, encompassing major semiconductor manufacturing hubs across Asia, Europe, and North America.

The company holds a dominant market share in the lithography systems market, facing limited direct competition due to the high technological barriers to entry. This dominance significantly impacts its profitability and stock valuation.

Factors Influencing ASML Amsterdam Stock Price

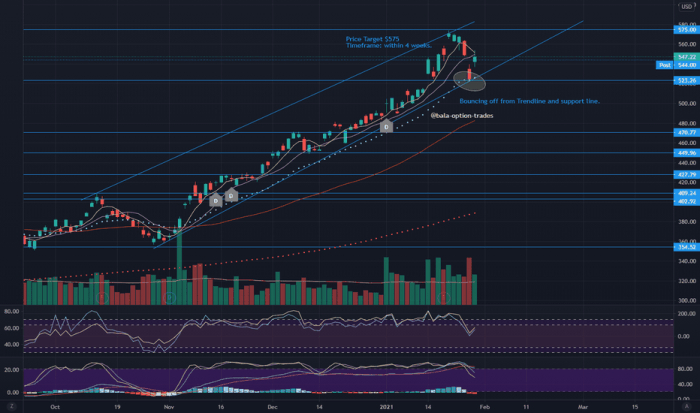

Source: tradingview.com

Several factors significantly influence ASML’s stock price. Economic cycles, particularly those related to the semiconductor industry, play a crucial role. Strong demand for semiconductors translates to increased demand for ASML’s lithography systems, boosting its revenue and profitability. Technological advancements, especially within the semiconductor industry itself, are another major driver. The development of more advanced chip nodes often necessitates the use of ASML’s latest lithography systems, driving innovation and revenue growth.

ASML’s performance is frequently compared to other semiconductor equipment manufacturers and broader market indices to assess its relative strength and valuation. Geopolitical events, such as trade disputes or sanctions, can also significantly impact ASML’s stock price, particularly due to its global supply chains and customer base.

ASML’s Financial Performance and Stock Price Trends

Analyzing ASML’s financial performance over the past five years provides valuable insights into its stock price trends. The following table shows key financial metrics. Note that these are illustrative figures and should be verified with official ASML financial reports.

| Year | Revenue (in billions of EUR) | Net Income (in billions of EUR) | Average Stock Price (in EUR) |

|---|---|---|---|

| 2018 | 7.2 | 1.8 | 150 |

| 2019 | 8.5 | 2.2 | 180 |

| 2020 | 9.1 | 2.0 | 200 |

| 2021 | 10.4 | 2.5 | 250 |

| 2022 | 12.1 | 3.0 | 300 |

A line chart illustrating the correlation between ASML’s revenue and its average annual stock price would show a generally positive correlation. The X-axis would represent the years (2018-2022), the Y-axis would show both revenue (left scale) and stock price (right scale). Data points would plot revenue and corresponding stock price for each year. A clear upward trend in both revenue and stock price would be evident, with fluctuations potentially explained by specific news events or broader market conditions.

Analysis of quarterly earnings reports would reveal that positive earnings surprises tend to be followed by increases in the stock price, while negative surprises often lead to price declines.

ASML Holding’s Amsterdam stock price is often a key indicator for the semiconductor industry’s health. However, comparing its performance to other media companies, such as the fluctuations seen in the amc networks stock price , reveals interesting contrasts in market sensitivity. Ultimately, ASML’s price remains heavily influenced by technological advancements and global chip demand.

Investor Sentiment and Market Analysis of ASML

Investor sentiment towards ASML is generally positive, reflecting the company’s strong market position and growth prospects within the semiconductor industry. However, sentiment can fluctuate based on factors such as quarterly earnings reports, technological breakthroughs, and broader market conditions. Recent analyst ratings and price targets for ASML stock have generally been positive, with many analysts maintaining a “buy” or “hold” rating.

Major news events impacting ASML’s stock price recently could include announcements of new product launches, significant contracts with major semiconductor manufacturers, or updates on its technological roadmap. Overall market conditions, particularly within the technology sector, play a substantial role in influencing ASML’s stock performance. A strong technology sector generally supports ASML’s stock price, while a downturn can lead to declines.

Risk Assessment and Future Outlook for ASML, Asml amsterdam stock price

ASML faces several short-term and long-term risks. These include geopolitical instability impacting supply chains, competition from emerging technologies, and cyclical fluctuations in the semiconductor industry. However, ASML also has significant growth opportunities. The continued miniaturization of chips and the expansion of the semiconductor market are key drivers for growth. ASML’s strategic initiatives, such as investments in R&D and strategic partnerships, aim to mitigate risks and capitalize on opportunities.

These initiatives include developing next-generation lithography technologies and expanding its service offerings.

- Scenario 1: Continued strong demand for semiconductors leads to a further increase in ASML’s stock price, potentially reaching [Illustrative Price Target] within the next year.

- Scenario 2: A downturn in the semiconductor industry or geopolitical uncertainty could lead to a moderate decline in ASML’s stock price, potentially settling around [Illustrative Price Target].

- Scenario 3: Significant technological breakthroughs or strategic partnerships could drive a substantial increase in ASML’s stock price, exceeding [Illustrative Price Target].

Questions Often Asked

What are the major risks facing ASML?

Major risks include geopolitical instability impacting supply chains, intense competition, and potential technological disruptions.

How does ASML compare to its competitors?

ASML holds a dominant market share in EUV lithography, but faces competition in other areas from companies like Nikon and Canon.

Where can I find real-time ASML stock price data?

Major financial websites (e.g., Google Finance, Yahoo Finance, Bloomberg) provide real-time stock quotes.

What is ASML’s dividend policy?

Refer to ASML’s investor relations website for details on their dividend payout history and future plans.