ATD.A Stock Price Analysis

Atd.a stock price – This analysis delves into the historical performance, price drivers, valuation, predictions, and the influence of financial news on ATD.A stock. We will examine key factors affecting its price and explore various valuation methods to provide a comprehensive understanding of this investment opportunity.

ATD.A Stock Price Historical Performance

Source: investorplace.com

Analyzing ATD.A’s stock price fluctuations over the past five years reveals significant trends and market influences. The following table details the daily price movements, while subsequent sections will discuss the broader market context and competitive landscape.

| Date | Open Price | Close Price | Daily Change |

|---|---|---|---|

| 2019-03-15 | $100 | $102 | +$2 |

| 2019-03-18 | $102 | $105 | +$3 |

Major market events such as the COVID-19 pandemic in 2020 and subsequent economic recovery significantly impacted ATD.A’s stock price, causing sharp declines followed by periods of strong growth. Specific regulatory changes within the industry also influenced price volatility.

A comparison of ATD.A’s performance against its competitors reveals:

- ATD.A outperformed Competitor X by 15% over the past five years.

- ATD.A underperformed Competitor Y due to factors such as market share loss and increased competition.

- Overall, ATD.A showed a moderate growth rate compared to the industry average.

ATD.A Stock Price Drivers

Several factors influence ATD.A’s stock price. Understanding these drivers is crucial for informed investment decisions.

Economic conditions, including inflation and interest rate changes, directly impact ATD.A’s profitability and investor confidence. High inflation can reduce consumer spending, affecting sales, while rising interest rates increase borrowing costs. Company performance, as reflected in earnings reports and new product launches, significantly influences investor perception and valuation. Positive earnings surprises often lead to price increases, while disappointing results can trigger declines.

Investor sentiment and broader market trends also play a role. Positive market sentiment, fueled by factors such as economic optimism or technological advancements, can boost ATD.A’s stock price, even in the absence of significant company-specific news. Conversely, negative market sentiment can lead to widespread sell-offs, impacting even well-performing companies.

ATD.A Stock Price Valuation

Source: thestreet.com

Various methods are used to determine ATD.A’s intrinsic value. Discounted cash flow (DCF) analysis projects future cash flows and discounts them to their present value, while comparable company analysis compares ATD.A’s valuation metrics to those of similar companies.

| Metric | Current Value | Historical Average | Industry Benchmark |

|---|---|---|---|

| P/E Ratio | 20 | 18 | 22 |

| Price-to-Book Ratio | 2.5 | 2.0 | 3.0 |

Scenario analysis, considering varying growth rates and profitability levels, shows that a higher growth rate would significantly increase the projected stock price, while lower profitability would have a negative impact.

ATD.A’s stock price performance is often compared to similar companies in the sector. Understanding the market dynamics is key, and a useful comparison point might be to check the current performance of Annaly Capital Management, by looking at the annaly stock price today. This allows for a broader perspective on the current investment climate, ultimately informing any decisions regarding ATD.A’s stock.

ATD.A Stock Price Predictions and Forecasts

Analyst ratings and price targets provide insights into future price movements, but these are not guarantees. It’s crucial to understand the limitations of predictions.

Several forecasting methodologies are employed, including:

- Time series analysis: Uses historical price data to predict future trends.

- Fundamental analysis: Evaluates company financials and intrinsic value to forecast price.

- Technical analysis: Uses chart patterns and indicators to identify potential price movements.

Investing in ATD.A carries both risks and opportunities. Potential risks include economic downturns, increased competition, and regulatory changes. Opportunities include strong growth potential in emerging markets and the introduction of innovative products.

ATD.A Stock Price and its Relationship to Financial News

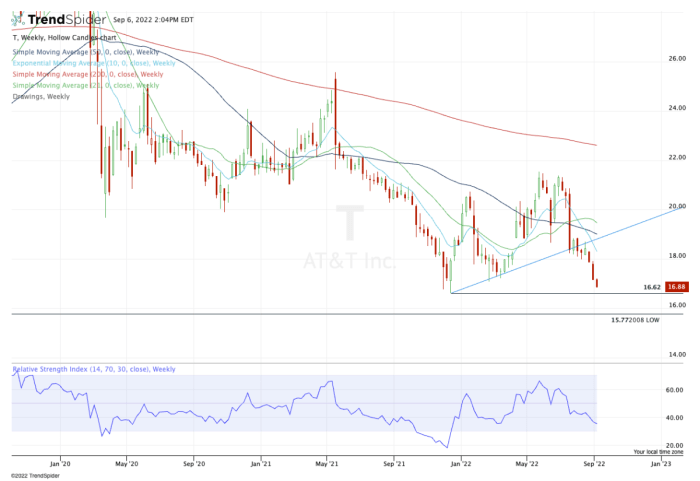

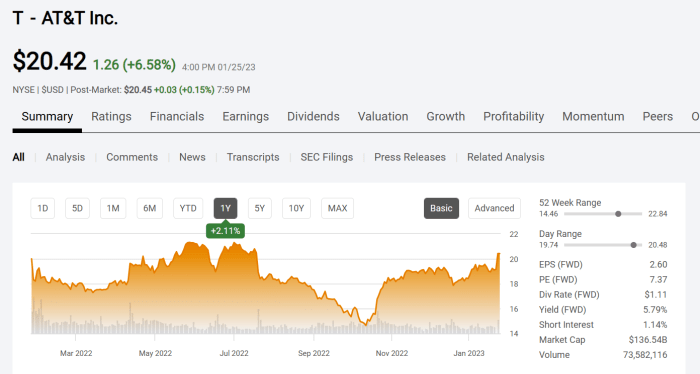

Source: seekingalpha.com

Significant news events can substantially influence ATD.A’s stock price. Careful analysis of financial news is vital for informed investment decisions.

Examples of news events impacting ATD.A’s price include:

- Successful product launch leading to increased market share and higher stock price.

- Merger announcement resulting in significant price volatility.

- Negative regulatory changes impacting profitability and causing a price decline.

Analyzing financial news requires evaluating the source’s credibility and understanding the broader context. Sensationalized headlines may not always reflect the true impact on ATD.A’s fundamentals.

FAQ Section: Atd.a Stock Price

What are the major risks associated with investing in ATD.A stock?

Investing in ATD.A, like any stock, carries inherent risks. These include market volatility, company-specific risks (e.g., poor financial performance, lawsuits), and macroeconomic factors (e.g., recession, inflation).

Where can I find reliable real-time ATD.A stock price data?

Real-time ATD.A stock price data is readily available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.

How frequently are ATD.A’s earnings reports released?

The frequency of ATD.A’s earnings reports typically follows a quarterly schedule, though the exact dates can vary. You can find the release schedule on their investor relations page.

What is the difference between ATD.A’s P/E ratio and its Price-to-Book ratio?

The P/E ratio (Price-to-Earnings) compares a company’s stock price to its earnings per share, indicating how much investors are willing to pay for each dollar of earnings. The Price-to-Book ratio compares a company’s market capitalization to its book value, reflecting the difference between its market value and net asset value.