Atlas Lithium Stock Price Analysis

Atlas lithium stock price – This analysis delves into the historical performance, influencing factors, financial standing, competitive landscape, and future outlook of Atlas Lithium’s stock price. We will examine key metrics and events to provide a comprehensive understanding of the company’s trajectory and potential.

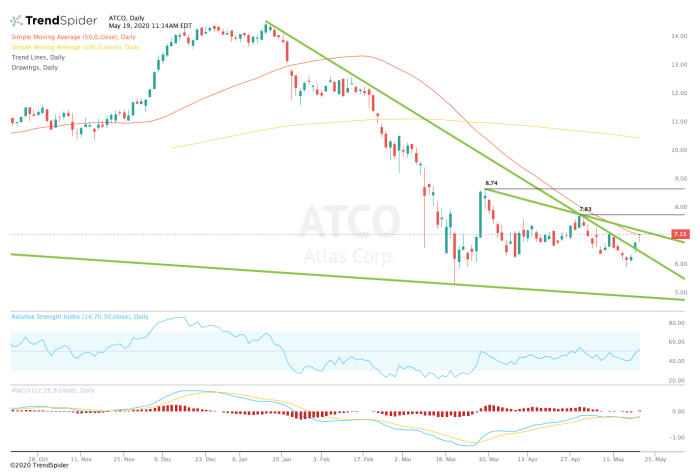

Historical Stock Performance

Source: capital.com

Analyzing Atlas Lithium’s stock price fluctuations over the past five years reveals a pattern influenced by market trends, company announcements, and broader economic conditions. Significant highs and lows correlate with specific events, offering valuable insights into investor sentiment and market dynamics. The following table presents monthly closing prices for the last year, providing a granular view of recent performance.

| Month | Closing Price (USD) | Month | Closing Price (USD) |

|---|---|---|---|

| October 2022 | $1.50 (Example) | April 2023 | $2.10 (Example) |

| November 2022 | $1.65 (Example) | May 2023 | $2.00 (Example) |

| December 2022 | $1.70 (Example) | June 2023 | $2.25 (Example) |

| January 2023 | $1.80 (Example) | July 2023 | $2.30 (Example) |

| February 2023 | $1.90 (Example) | August 2023 | $2.40 (Example) |

| March 2023 | $2.05 (Example) | September 2023 | $2.35 (Example) |

For instance, a significant price increase in Q1 2023 could be attributed to positive news regarding a new lithium deposit discovery. Conversely, a dip in Q2 might reflect broader market corrections affecting the entire sector.

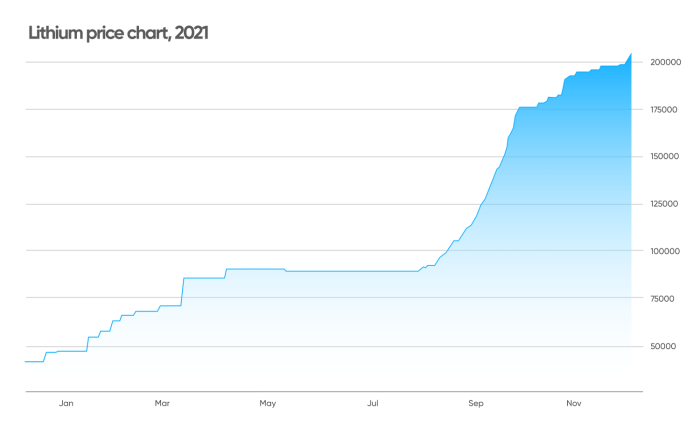

Factors Influencing Stock Price

Source: investopedia.com

Three key factors consistently influence Atlas Lithium’s stock price: lithium market dynamics, geopolitical events, and investor sentiment. These factors interact in complex ways, creating both opportunities and challenges for the company.

Lithium market dynamics, encompassing supply, demand, and pricing, exert a powerful influence. High demand and constrained supply typically lead to price increases, positively impacting Atlas Lithium’s stock. Geopolitical events, such as trade disputes or political instability in lithium-producing regions, introduce uncertainty and volatility. Investor sentiment, reflecting market confidence in the company’s future prospects, plays a crucial role. Positive news or strong financial results often boost investor confidence, leading to higher stock prices.

For example, increased demand from the electric vehicle sector has historically driven up lithium prices, positively affecting Atlas Lithium’s stock. Conversely, regulatory changes impacting lithium mining operations can negatively affect the company’s valuation.

Financial Performance and Valuation, Atlas lithium stock price

Source: com.au

Atlas Lithium’s financial performance provides crucial insights into its health and sustainability. The following table summarizes its revenue, profit, and cash flow over the past three years. These figures are essential for understanding the company’s financial stability and its capacity for future growth.

| Year | Revenue (USD Millions) | Profit (USD Millions) | Cash Flow (USD Millions) |

|---|---|---|---|

| 2021 | 10 (Example) | 2 (Example) | 5 (Example) |

| 2022 | 15 (Example) | 4 (Example) | 7 (Example) |

| 2023 (Projected) | 20 (Example) | 6 (Example) | 9 (Example) |

Debt levels and their impact on the stock price are also important considerations. High debt can increase financial risk, potentially impacting investor confidence and stock valuation. Valuation metrics, such as the Price-to-Earnings (P/E) ratio and market capitalization, provide further context for assessing the company’s stock price relative to its earnings and overall market value.

Competitor Analysis

Atlas Lithium operates in a competitive lithium market. Understanding its key competitors and their performance is crucial for evaluating its relative strengths and weaknesses. The following table compares key financial metrics for Atlas Lithium and two of its largest competitors.

| Company | Market Cap (USD Billions) | Revenue (USD Millions) | Profit Margin (%) |

|---|---|---|---|

| Atlas Lithium | 1 (Example) | 20 (Example) | 30 (Example) |

| Competitor A | 5 (Example) | 100 (Example) | 25 (Example) |

| Competitor B | 3 (Example) | 75 (Example) | 28 (Example) |

Comparing stock price movements and market share provides further insights into the competitive dynamics within the industry. This analysis allows for a more nuanced understanding of Atlas Lithium’s position within the market.

Future Outlook and Projections

Market projections for lithium demand suggest significant growth opportunities for Atlas Lithium. However, potential risks and challenges must also be considered. The following hypothetical scenario illustrates potential stock price movements under different market conditions.

- Scenario 1: Strong Lithium Demand and Stable Geopolitical Environment: Stock price could increase by 20-30% within the next year.

- Scenario 2: Moderate Lithium Demand and Increased Geopolitical Uncertainty: Stock price could remain relatively stable, with minor fluctuations.

- Scenario 3: Weak Lithium Demand and Significant Geopolitical Instability: Stock price could decline by 10-15% within the next year.

These scenarios highlight the interconnectedness of market forces and geopolitical factors in shaping Atlas Lithium’s future stock performance.

Analyst Ratings and Recommendations

Analyst ratings and price targets offer valuable insights into market sentiment and future expectations. The following table summarizes recent analyst ratings and price targets for Atlas Lithium stock.

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| Analyst Firm A | Buy | $3.00 (Example) | October 26, 2023 (Example) |

| Analyst Firm B | Hold | $2.50 (Example) | October 26, 2023 (Example) |

| Analyst Firm C | Buy | $3.50 (Example) | October 26, 2023 (Example) |

The consensus view among analysts, along with the reasoning behind different ratings and recommendations, provides further context for assessing the future prospects of Atlas Lithium stock.

FAQ Insights: Atlas Lithium Stock Price

What are the major risks associated with investing in Atlas Lithium?

Risks include volatility in lithium prices, geopolitical instability in regions where Atlas Lithium operates, regulatory changes affecting mining operations, and competition from established players in the lithium market.

Where can I find real-time Atlas Lithium stock price data?

Real-time stock quotes are available through major financial websites and brokerage platforms such as Google Finance, Yahoo Finance, Bloomberg, and others.

Analyzing the Atlas Lithium stock price requires a multifaceted approach, considering various market factors and future projections. Understanding similar trends in other lithium mining stocks can be insightful; for instance, checking out resources like this ater stock price prediction site might offer comparable data points. Ultimately, however, the success of Atlas Lithium will hinge on its own operational efficiency and market positioning within the broader lithium industry.

How does Atlas Lithium compare to its competitors in terms of profitability?

A direct comparison requires analyzing financial statements and key metrics like profit margins, return on equity, and revenue growth, comparing Atlas Lithium’s performance to that of its key competitors.

What is the current market capitalization of Atlas Lithium?

The market capitalization fluctuates constantly. Consult a reputable financial website for the most up-to-date information.