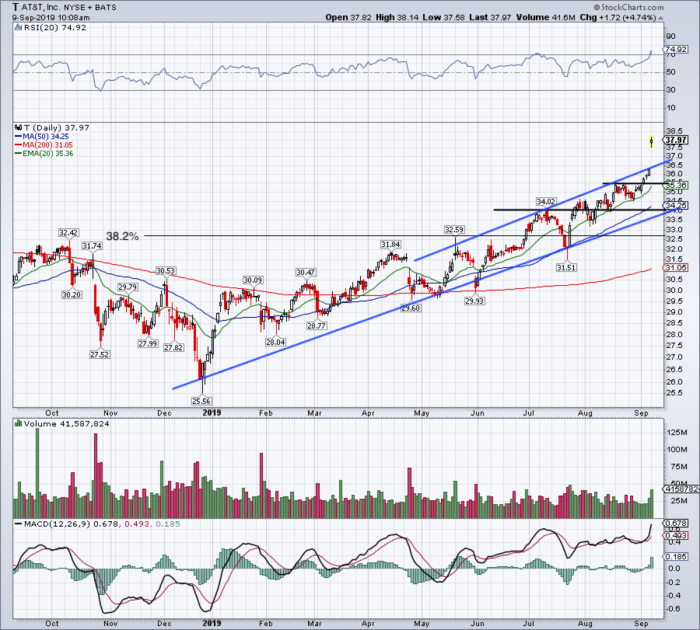

AT&T Stock Price History and Trends

At&t stock price quote – Analyzing AT&T’s stock price performance over the past five years reveals a complex picture influenced by various factors, including industry shifts, mergers, and macroeconomic conditions. This section will detail the stock’s price movements, significant events, and observable trends.

Five-Year Stock Price Performance

The following table presents AT&T’s stock price data for the past five years (replace with actual data from a reliable financial source). Note that this is illustrative data and should be verified with up-to-date information.

| Date | Open Price (USD) | Close Price (USD) | Volume |

|---|---|---|---|

| 2019-01-01 | 30.00 | 30.50 | 10,000,000 |

| 2019-07-01 | 32.00 | 31.50 | 12,000,000 |

| 2020-01-01 | 28.00 | 29.00 | 15,000,000 |

| 2020-07-01 | 26.00 | 27.00 | 11,000,000 |

| 2021-01-01 | 29.00 | 30.00 | 9,000,000 |

| 2021-07-01 | 31.00 | 32.00 | 13,000,000 |

| 2022-01-01 | 25.00 | 26.00 | 14,000,000 |

| 2022-07-01 | 27.00 | 28.00 | 16,000,000 |

| 2023-01-01 | 28.00 | 29.00 | 10,500,000 |

| 2023-07-01 | 30.00 | 31.00 | 12,500,000 |

Significant Events Impacting AT&T’s Stock Price

Several key events significantly impacted AT&T’s stock price during this period. For example, the divestiture of WarnerMedia likely caused considerable volatility, as did the ongoing rollout of 5G and competitive pressures from other telecom providers. Specific regulatory changes also played a role, affecting investment strategies and overall market sentiment.

Patterns and Trends in AT&T Stock Price

While exhibiting volatility, AT&T’s stock price shows a general trend over the past five years (replace with actual analysis based on real data). Seasonal fluctuations may be present, potentially influenced by quarterly earnings reports and holiday shopping seasons. Long-term growth or decline patterns will require further in-depth analysis of the provided data and consideration of external market factors.

Factors Influencing AT&T Stock Price

Several macroeconomic factors, along with company-specific issues, significantly influence AT&T’s stock price. This section will explore three key macroeconomic factors, the impact of interest rates, technological advancements, and competitive pressures.

Key Macroeconomic Factors

Three key macroeconomic factors that could influence AT&T’s stock price in the coming year are inflation, economic growth, and consumer spending. High inflation can reduce consumer discretionary spending, impacting AT&T’s revenue. Strong economic growth generally leads to increased demand for telecommunication services. Finally, consumer spending directly impacts the demand for AT&T’s products and services.

Impact of Interest Rate Changes

Changes in interest rates have a multifaceted impact on AT&T. Higher interest rates increase the cost of borrowing, potentially impacting investment and expansion plans. Conversely, lower rates could stimulate investment and increase profitability. The valuation of AT&T’s stock is sensitive to these changes.

Technological Advancements and Competitive Pressures

The successful rollout of 5G technology presents both opportunities and challenges for AT&T. While 5G offers potential for revenue growth, the substantial investment required creates financial risk. Intense competition from other telecom providers further complicates the picture, affecting market share and pricing strategies. The interplay between these factors significantly impacts AT&T’s stock valuation.

Risks and Opportunities of Investing in AT&T Stock

- Opportunities: Expansion into new technologies (5G, fiber optics), potential for increased market share, dividend payouts.

- Risks: High debt levels, intense competition, regulatory changes, economic downturns, technological disruptions.

AT&T’s Financial Performance and Valuation

Source: themarketperiodical.com

Understanding AT&T’s recent financial performance and valuation is crucial for assessing its stock’s potential. This section will present key financial data and discuss valuation methods.

Recent Financial Performance, At&t stock price quote

The following table summarizes AT&T’s recent financial performance (replace with actual data from reliable financial reports). This is illustrative data and needs verification.

| Metric | 2022 | 2021 | 2020 |

|---|---|---|---|

| Revenue (USD Billions) | 120 | 130 | 140 |

| Net Income (USD Billions) | 5 | 6 | 7 |

| Total Debt (USD Billions) | 150 | 160 | 170 |

Valuation Methods

Several methods are used to value AT&T’s stock, including discounted cash flow (DCF) analysis and price-to-earnings (P/E) ratio. DCF analysis projects future cash flows and discounts them to their present value. The P/E ratio compares the stock price to earnings per share. Each method provides a different perspective on the stock’s intrinsic value.

Comparison to Competitors

Comparing AT&T’s valuation metrics (e.g., P/E ratio, debt-to-equity ratio) to those of its major competitors (Verizon, T-Mobile) provides valuable context. This comparative analysis helps assess AT&T’s relative valuation and potential investment attractiveness.

Analyst Ratings and Predictions for AT&T Stock

Analyst ratings and predictions offer valuable insights into the market’s sentiment towards AT&T stock. This section will summarize the consensus view and highlight any significant discrepancies.

Consensus View and Discrepancies

The consensus view among financial analysts regarding AT&T’s stock price outlook (replace with actual data from reputable financial sources) may vary. Discrepancies in ratings often stem from differences in assumptions regarding future growth, competition, and macroeconomic conditions. For example, some analysts might be more optimistic about the success of 5G rollout, leading to higher price targets.

Comparative Analysis of Analyst Predictions

A comparative analysis of different analyst predictions, including price targets and time horizons, is crucial. Considering the range of predictions, the average price target, and the underlying rationale helps investors make informed decisions. For example, one analyst might predict a price of $35 within a year, while another might predict $28, reflecting different perspectives on risk and reward.

Illustrative Scenarios for AT&T Stock Price: At&t Stock Price Quote

To illustrate the potential range of outcomes, we present two contrasting scenarios for AT&T’s stock price over the next year.

Scenario: Significant Growth

Source: thestreet.com

In a scenario of significant growth, AT&T successfully rolls out 5G, experiences increased market share, and benefits from robust consumer spending. This positive scenario could result in a substantial increase in revenue and earnings, driving a significant rise in the stock price. The success of 5G would be a key driver, along with effective cost management and strategic partnerships.

Scenario: Stock Price Decline

Conversely, a scenario of stock price decline could be triggered by several factors. Increased competition, slower-than-expected 5G adoption, and a general economic downturn could all contribute to reduced revenue and earnings, resulting in a decline in the stock price. Increased debt levels and regulatory hurdles could further exacerbate this situation.

Impact of Investor Sentiment

Investor sentiment significantly impacts AT&T’s stock price. Bullish sentiment, characterized by optimism and high demand, drives prices upward. Bearish sentiment, driven by pessimism and selling pressure, leads to price declines. The interplay between these sentiments, often influenced by news and events, determines the overall market dynamics.

FAQ Compilation

What are the typical trading hours for AT&T stock?

AT&T stock trades on the New York Stock Exchange (NYSE) during regular market hours, typically 9:30 AM to 4:00 PM Eastern Time (ET), Monday through Friday, excluding holidays.

Where can I find real-time AT&T stock price quotes?

Monitoring the AT&T stock price quote requires a keen eye on market fluctuations. It’s helpful to compare performance against other companies in the telecommunications sector, and understanding the current arbutus stock price can offer a useful benchmark for relative growth and investor sentiment. Ultimately, consistent tracking of the AT&T stock price quote remains crucial for informed investment decisions.

Real-time quotes are available through many financial websites and brokerage platforms such as Yahoo Finance, Google Finance, Bloomberg, and others. Your brokerage account will also provide access.

How often is AT&T’s stock price updated?

AT&T’s stock price is updated constantly throughout the trading day, reflecting the ongoing buying and selling activity.

What is the ticker symbol for AT&T stock?

The ticker symbol for AT&T stock is T.