Autonomix’s Business Model and Financial Health

Autonomix stock price target – This section delves into Autonomix’s core business operations, financial performance, and market positioning to provide a comprehensive understanding of the company and its potential for future growth. We will analyze its financial statements, compare it to competitors, and assess the impact of market conditions on its stock price.

Autonomix’s Business Operations and Revenue Streams

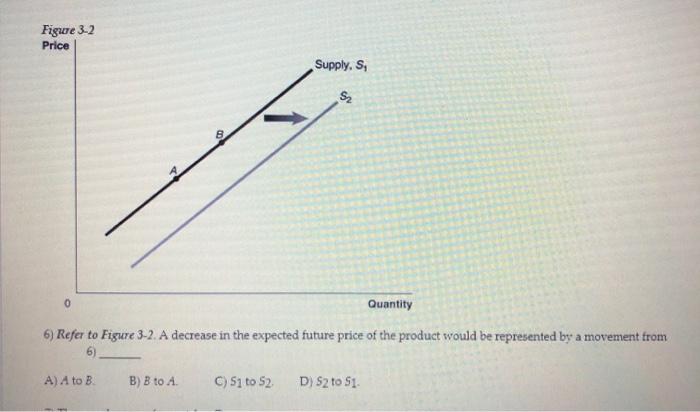

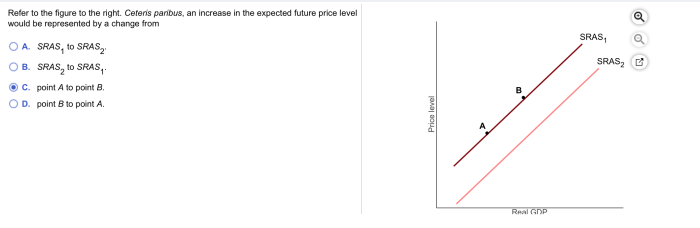

Source: cheggcdn.com

Autonomix operates in the [Insert Industry Sector Here] sector, focusing on [Insert Specific Niche or Business Activity]. Its primary revenue streams are derived from [List Key Revenue Sources, e.g., software licensing, subscription fees, hardware sales]. The company’s business model relies on [Explain the core business model, e.g., a SaaS model, a direct sales model, etc.], targeting [Describe target customer segments].

Competitive Advantages and Disadvantages

Autonomix’s competitive advantages include [List key advantages, e.g., proprietary technology, strong brand recognition, efficient operational processes]. However, the company faces challenges such as [List key disadvantages, e.g., intense competition, dependence on key suppliers, regulatory hurdles].

Comparison to Key Competitors, Autonomix stock price target

Compared to its main competitors, [List Key Competitors], Autonomix differentiates itself through [Explain key differentiators]. While competitors [Competitor A] focus on [Competitor A’s focus], and [Competitor B] emphasizes [Competitor B’s focus], Autonomix’s strategy centers on [Autonomix’s strategic focus]. This comparison highlights both Autonomix’s strengths and areas where it needs improvement to maintain a competitive edge.

Potential Risks and Opportunities

Significant risks facing Autonomix include [List potential risks, e.g., economic downturns, technological disruptions, changes in regulations]. Conversely, opportunities for growth include [List potential opportunities, e.g., expansion into new markets, development of innovative products, strategic partnerships].

Analyzing Autonomix’s Financial Performance

Source: cheggcdn.com

A thorough analysis of Autonomix’s financial statements – income statement, balance sheet, and cash flow statement – is crucial for assessing its financial health and predicting future performance. Key financial ratios and trends will be examined to gain a comprehensive perspective.

Overview of Recent Financial Statements

Autonomix’s recent financial performance reveals [Summarize key trends observed in revenue, expenses, profits, assets, liabilities, and cash flow]. For example, revenue growth has been [Describe revenue growth trend, e.g., consistent, fluctuating, declining], while profitability has [Describe profitability trend, e.g., improved, remained stable, decreased]. Cash flow from operations has been [Describe cash flow trend, e.g., positive and strong, weak, inconsistent].

Key Financial Ratios and Metrics

Analysis of key financial ratios, such as [List key ratios, e.g., gross profit margin, operating profit margin, return on equity, debt-to-equity ratio], provides insights into Autonomix’s financial health and efficiency. These ratios indicate [Explain the implications of the key ratios calculated, e.g., strong profitability, high leverage, efficient use of assets].

Comparison to Industry Averages

| Metric | Autonomix | Industry Average | Difference |

|---|---|---|---|

| Revenue Growth (YoY) | [Insert Data] | [Insert Data] | [Insert Data] |

| Profit Margin | [Insert Data] | [Insert Data] | [Insert Data] |

| Debt-to-Equity Ratio | [Insert Data] | [Insert Data] | [Insert Data] |

| Return on Equity (ROE) | [Insert Data] | [Insert Data] | [Insert Data] |

Market Conditions and Industry Trends

Understanding the broader market context and industry trends is vital for evaluating Autonomix’s future prospects. This section examines macroeconomic factors and growth prospects within the industry.

Market Drivers and Their Impact

- Increased Demand for [Relevant Product/Service]: This trend is driving growth in the [Industry Sector] sector, creating opportunities for Autonomix to expand its market share.

- Technological Advancements: New technologies are [Explain the impact of technological advancements on the industry, e.g., creating new opportunities, disrupting existing business models].

- Economic Conditions: [Describe the impact of macroeconomic factors, e.g., A strong economy could boost demand, while a recession could negatively impact sales].

- Regulatory Changes: New regulations could [Explain the impact of regulatory changes, e.g., create new challenges, open up new markets].

Analyst Ratings and Price Targets

This section summarizes recent analyst ratings and price targets for Autonomix stock, providing insights into market sentiment and expectations for future performance. We’ll examine the rationale behind different price targets to gain a more nuanced perspective.

Summary of Analyst Ratings and Price Targets

| Analyst Firm | Rating | Price Target | Rationale |

|---|---|---|---|

| [Analyst Firm 1] | [Rating] | [Price Target] | [Rationale] |

| [Analyst Firm 2] | [Rating] | [Price Target] | [Rationale] |

| [Analyst Firm 3] | [Rating] | [Price Target] | [Rationale] |

Potential Catalysts for Stock Price Movement

Several factors could significantly influence Autonomix’s stock price in the short and long term. This section identifies potential positive and negative catalysts and assesses their likelihood and impact.

Positive and Negative Catalysts

- Successful Product Launch: A successful new product launch could significantly boost revenue and market share, leading to a price increase. (Probability: [Estimate], Potential Impact: [Estimate])

- Acquisition or Merger: A strategic acquisition or merger could expand Autonomix’s market reach and product offerings, potentially increasing the stock price. (Probability: [Estimate], Potential Impact: [Estimate])

- Negative Earnings Surprise: Disappointing earnings results could negatively impact investor sentiment and lead to a price decline. (Probability: [Estimate], Potential Impact: [Estimate])

- Increased Competition: Intense competition from new entrants could erode Autonomix’s market share and negatively affect its stock price. (Probability: [Estimate], Potential Impact: [Estimate])

Stock Price Valuation

This section employs different valuation methods to estimate Autonomix’s intrinsic value and provide a range of potential stock prices. The assumptions and limitations of each method are discussed.

Valuation Methods and Results

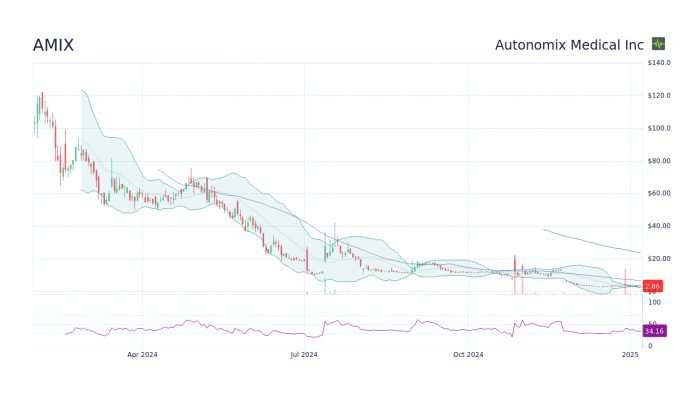

Source: googleapis.com

Using discounted cash flow (DCF) analysis, a [Insert estimated value] intrinsic value is derived, based on [Explain assumptions, e.g., projected future cash flows, discount rate]. Comparable company analysis, comparing Autonomix to similar publicly traded companies, suggests a valuation range of [Insert range]. The discrepancies between these methods stem from differing assumptions regarding [Explain the reasons for discrepancies, e.g., future growth rates, risk profiles].

Hypothetical Scenarios

In a scenario where Autonomix successfully launches a groundbreaking new product and experiences significant market share gains, the stock price could potentially increase by [Percentage] due to increased revenue and profitability. Conversely, a scenario involving a major regulatory setback or a significant economic downturn could lead to a [Percentage] decrease in the stock price due to reduced demand and profitability.

FAQ Corner: Autonomix Stock Price Target

What are the major risks associated with investing in Autonomix?

Risks include competition, economic downturns affecting the industry, and execution risks related to Autonomix’s business strategy.

How does Autonomix compare to its main competitors?

A detailed competitive analysis, comparing market share, revenue growth, and profitability, is necessary to answer this. This analysis would be included in a full report.

What is the historical performance of Autonomix stock?

Reviewing historical stock charts and financial statements will reveal past performance, but past performance is not necessarily indicative of future results.

Predicting the autonomix stock price target involves considering various market factors. One relevant parallel is the recent excitement surrounding the arm stock price ipo , which highlights the current investor appetite for tech IPOs. Understanding the performance of similar tech launches can offer valuable insights when assessing the potential trajectory of the autonomix stock price target.

Where can I find more detailed financial information about Autonomix?

Autonomix’s investor relations website and SEC filings (if publicly traded) are the best sources for comprehensive financial data.