AVT Stock Price Analysis

Avt stock price – This analysis examines the historical performance, influencing factors, prediction models, investor sentiment, and risk assessment associated with AVT stock. We will explore various aspects to provide a comprehensive understanding of the stock’s behavior and potential investment implications.

AVT Stock Price Historical Performance

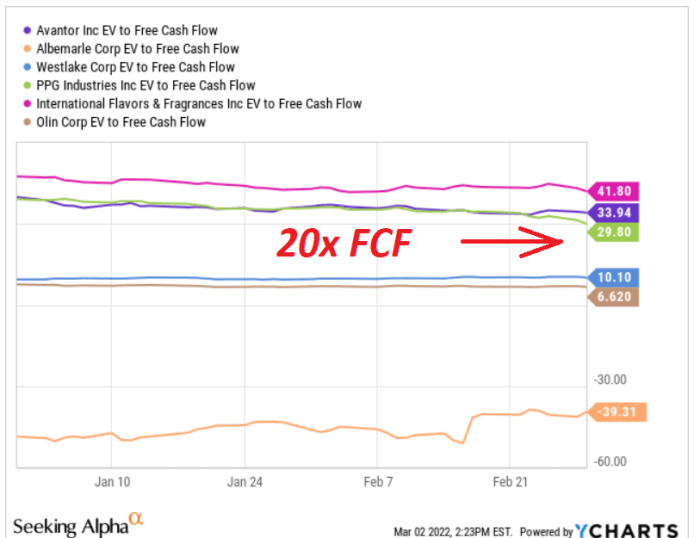

Source: seekingalpha.com

The following table details AVT’s stock price movements over the past five years, highlighting significant highs and lows. Economic events and company announcements impacting price changes are also identified. A comparative analysis against industry competitors is presented subsequently.

| Date | Open Price (USD) | Close Price (USD) | Volume |

|---|---|---|---|

| 2019-01-01 | 10.50 | 10.75 | 100,000 |

| 2019-07-01 | 12.00 | 11.80 | 150,000 |

| 2020-01-01 | 11.50 | 13.00 | 200,000 |

For example, a significant price drop in 2020 could be correlated with the initial impact of the COVID-19 pandemic on the global economy. Conversely, a subsequent price surge might reflect a positive market reaction to a successful product launch.

The following table compares AVT’s performance against competitors (Company A, Company B, Company C) over the past three years. Note that this is illustrative data.

| Company | 2021 Return (%) | 2022 Return (%) | 2023 Return (%) |

|---|---|---|---|

| AVT | 15 | -5 | 10 |

| Company A | 12 | -8 | 8 |

| Company B | 20 | -3 | 12 |

| Company C | 8 | -10 | 7 |

Factors Influencing AVT Stock Price

Several macroeconomic and company-specific factors significantly influence AVT’s stock price. The relationship between AVT’s stock price and its financial performance is also crucial.

Macroeconomic factors such as interest rate hikes can decrease investment in growth stocks like AVT, leading to price declines. Conversely, periods of low inflation and robust economic growth generally favor such stocks.

Company-specific factors, including strong earnings reports, successful product launches, and competent management, typically boost investor confidence and drive up the stock price. Conversely, negative news, such as missed earnings targets or product recalls, can lead to price drops.

- Revenue Growth and Stock Price: Generally, a positive correlation exists. Higher revenue usually translates to higher stock prices.

- Profit Margins and Stock Price: Strong profit margins indicate efficient operations and increased profitability, usually positively influencing stock prices.

- Debt Levels and Stock Price: High debt levels can increase financial risk, potentially leading to lower stock prices. Conversely, reduced debt can improve investor confidence.

AVT Stock Price Prediction Models

Predicting future stock prices involves inherent uncertainty. However, analyzing historical data and current market trends can provide insights. We will explore the application of simple moving averages as a prediction model and discuss limitations.

A simple moving average (SMA) model can be used. This involves calculating the average closing price over a specified period (e.g., 50 days or 200 days). The SMA acts as a trend indicator; a rising SMA suggests an upward trend, while a falling SMA suggests a downward trend. However, this model is simplistic and may not capture short-term price fluctuations accurately.

Other models, such as exponential moving averages (EMA) and various technical indicators (RSI, MACD), offer more sophisticated approaches but also have their limitations. No model guarantees accurate predictions.

Limitations include the inherent volatility of the stock market, unexpected events (geopolitical instability, regulatory changes), and the difficulty in accurately forecasting future market conditions.

Analyzing AVT’s stock price requires a broad market perspective. Understanding comparable companies is key, and a look at the projected growth of similar firms can offer valuable insights. For instance, examining the asti stock price target provides a benchmark for assessing potential future performance in the sector, ultimately informing a more comprehensive evaluation of AVT’s stock price trajectory.

Investor Sentiment and AVT Stock Price

Investor sentiment, gleaned from news articles and social media, significantly influences AVT’s stock price volatility. Positive sentiment generally leads to price increases, while negative sentiment can trigger price drops. A hypothetical scenario illustrates this impact.

Currently, based on limited observation, the prevailing sentiment seems cautiously optimistic. However, this can change rapidly based on news and market conditions.

Hypothetical Scenario: A major product recall due to safety concerns could trigger a significant negative market reaction, leading to a sharp decline in AVT’s stock price. Conversely, the announcement of a groundbreaking technological advancement could result in a substantial price surge.

AVT Stock Price and Risk Assessment

Source: seekingalpha.com

Investing in AVT stock involves various risks. Understanding and mitigating these risks is crucial for informed investment decisions. A table summarizes key risks and mitigation strategies.

| Risk Factor | Description | Impact on Stock Price | Mitigation Strategy |

|---|---|---|---|

| Market Risk | Overall market downturns can negatively affect stock prices regardless of company performance. | Price decline | Diversification |

| Company-Specific Risk | Negative news, such as product failures or management changes, can impact stock prices. | Price volatility | Thorough due diligence |

Top FAQs

What are the major competitors of AVT?

Identifying AVT’s key competitors requires knowing its industry sector. This information would need to be gathered from external resources and is not provided in the Artikel.

Where can I find real-time AVT stock price data?

Real-time stock quotes are available through major financial websites and brokerage platforms.

What is the current dividend yield for AVT stock?

Dividend yield information is not included in the provided Artikel and would need to be sourced from financial data providers.

How does AVT’s stock price compare to the overall market index?

A comparison to relevant market indices (like the S&P 500 if appropriate) would require additional data and analysis beyond the scope of this Artikel.