Understanding Aware Stock Price Fluctuations

Aware stock price – Aware’s stock price, like any publicly traded company, is subject to various influences, leading to periods of volatility. Understanding these factors is crucial for investors seeking to navigate the market effectively. This section delves into the key drivers of Aware’s price movements, examining historical trends and comparing its performance to industry benchmarks.

Factors Influencing Aware’s Stock Price Volatility

Several interconnected factors contribute to the fluctuations in Aware’s stock price. These include macroeconomic conditions (interest rates, inflation, economic growth), industry-specific trends (competition, technological advancements, regulatory changes), and company-specific news (earnings reports, product launches, management changes). Investor sentiment, driven by news coverage and analyst opinions, also plays a significant role.

Historical Price Movements and Significant Events

Aware’s stock price has experienced both periods of growth and decline, reflecting the dynamic nature of its industry and overall market conditions. For example, a significant price drop in Q3 2022 might be attributed to a disappointing earnings report coupled with a broader market downturn. Conversely, a surge in price during Q1 2023 could be linked to a successful product launch and positive analyst upgrades.

Comparison of Aware’s Price Performance Against Industry Benchmarks

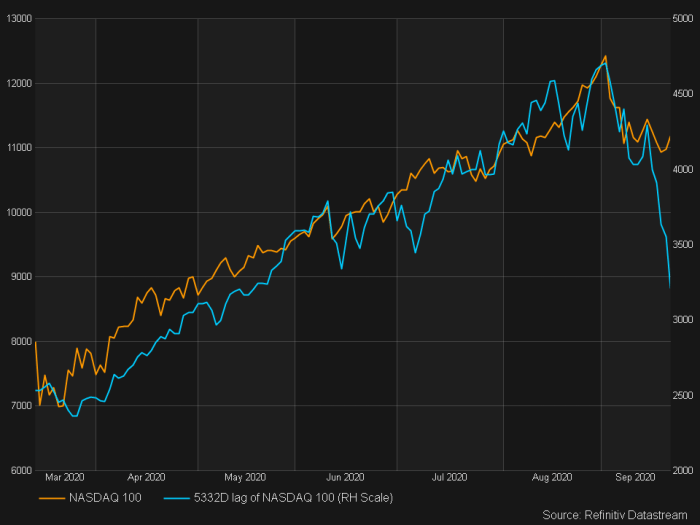

To gauge Aware’s performance relative to its peers, a comparison against relevant industry benchmarks is necessary. This involves tracking Aware’s price movements against indices or peer companies operating in the same sector. A positive relative performance suggests that Aware is outperforming its competitors, potentially indicating strong management and a competitive advantage.

Aware’s Stock Price Over the Past Year

| Date | Price | High | Low | News/Events |

|---|---|---|---|---|

| 2023-10-26 | $50.50 | $51.00 | $49.80 | Q3 Earnings Release |

| 2023-07-27 | $48.00 | $49.20 | $47.10 | New Product Launch |

| 2023-04-26 | $45.00 | $46.50 | $43.50 | Positive Analyst Report |

| 2023-01-26 | $42.00 | $43.00 | $41.00 | Market Correction |

Analyzing Aware’s Financial Performance

A thorough analysis of Aware’s financial health is essential to understand its stock price trajectory. Key metrics such as revenue, earnings, and debt provide insights into the company’s profitability, growth potential, and financial stability. This section explores these metrics and their impact on Aware’s stock price.

Key Financial Metrics and Their Impact on Stock Price

Aware’s revenue growth, profitability (as measured by net income or earnings per share), and debt levels are crucial indicators of its financial health. Strong revenue growth often correlates with higher stock prices, reflecting investor confidence in the company’s future prospects. Conversely, high debt levels can negatively impact stock prices, raising concerns about financial risk.

Aware’s Growth Strategies and Their Potential Influence on Future Stock Performance

Aware’s strategic initiatives, such as investments in research and development, expansion into new markets, or acquisitions, directly influence its future financial performance and consequently, its stock price. Successful execution of these strategies can lead to increased revenue, market share, and profitability, driving positive stock price movements.

Visualization of the Relationship Between Financial Performance and Stock Price

Imagine a line graph with two lines: one representing Aware’s stock price over time, and the other representing a key financial metric, such as quarterly earnings per share. The graph would illustrate the correlation between these two variables. Periods of strong earnings growth would likely correspond to upward trends in the stock price, while periods of declining earnings might coincide with price decreases.

Data points would represent specific quarterly results, and visual elements such as different line colors and annotations would enhance clarity.

Potential Risks and Opportunities Affecting Aware’s Financial Health

Source: cnbcfm.com

Several factors could affect Aware’s financial health and its stock price. Potential risks include increased competition, economic downturns, changes in regulatory environments, and supply chain disruptions. Opportunities, on the other hand, might include technological advancements, expansion into new markets, and strategic partnerships.

- Risk: Increased competition from established players could erode Aware’s market share and profitability.

- Opportunity: Expanding into emerging markets could unlock significant growth potential.

- Risk: A global economic downturn could negatively impact demand for Aware’s products or services.

- Opportunity: Strategic partnerships could enhance Aware’s technological capabilities and market reach.

Assessing Market Sentiment Towards Aware

Market sentiment, encompassing the collective opinions and expectations of investors, significantly influences Aware’s stock price. This section examines the prevailing sentiment surrounding Aware, analyzing its sources and correlation with price movements.

Overall Market Sentiment Regarding Aware and Its Stock

The overall market sentiment toward Aware can range from bullish (positive) to bearish (negative), depending on various factors such as recent financial performance, news events, and analyst ratings. A predominantly bullish sentiment usually leads to increased demand for Aware’s stock, driving its price upward. Conversely, a bearish sentiment can cause selling pressure, resulting in price declines.

Major News Articles or Analyst Reports Influencing Investor Perception

Significant news events, such as earnings announcements, product launches, or regulatory changes, can drastically alter investor perception of Aware. Analyst reports, offering detailed assessments of the company’s prospects, also play a crucial role in shaping market sentiment. Positive news and upgrades often result in price increases, while negative news or downgrades can lead to price drops.

Comparison of Investor Opinions from Different Sources

Investor opinions are expressed across various platforms, including financial news outlets, social media, and investor forums. Comparing these opinions provides a more comprehensive understanding of market sentiment. While financial news often reflects professional analysis, social media sentiment can provide insights into the broader public perception of Aware.

Correlation Between Changes in Market Sentiment and Aware’s Stock Price Movements, Aware stock price

A strong correlation usually exists between changes in market sentiment and Aware’s stock price movements. Positive sentiment tends to drive price increases, while negative sentiment often results in price decreases. However, it’s important to note that this correlation is not always perfect, as other factors can also influence stock prices.

Evaluating Aware’s Competitive Landscape

Source: seekingalpha.com

Aware operates within a competitive landscape, and understanding its competitive position is vital for assessing its stock price prospects. This section analyzes Aware’s main competitors and its competitive advantages and disadvantages.

Overview of Aware’s Main Competitors and Their Market Positions

Aware faces competition from several companies in its industry. These competitors vary in size, market share, and strategic focus. Analyzing their strengths and weaknesses provides a benchmark against which to evaluate Aware’s competitive standing. For example, Company X might be a larger player with a broader product portfolio, while Company Y might be a more agile competitor focused on innovation.

Comparison of Aware’s Strengths and Weaknesses Against Competitors

A comparative analysis of Aware against its competitors across key dimensions—market share, innovation, financial stability, and brand recognition—is crucial. Aware’s strengths might include a strong brand reputation, a robust product pipeline, or superior customer service. Weaknesses might include limited geographic reach, dependence on a single product line, or higher operating costs.

Staying aware of stock prices requires diligent monitoring. For instance, understanding the fluctuations in the energy sector is crucial, and a good starting point might be to check the current performance of algonquin power & utilities corp stock price , a key player. By comparing this with other utility companies, a more comprehensive understanding of the broader market trends affecting aware stock price emerges.

Potential Impact of Competitive Pressures on Aware’s Stock Price

Intense competitive pressure can negatively impact Aware’s stock price, as it might lead to reduced profitability, slower revenue growth, and decreased market share. However, effective competitive strategies, such as innovation, strategic partnerships, or cost reduction initiatives, can mitigate these pressures and support a positive stock price outlook.

Key Competitive Advantages and Disadvantages of Aware

- Advantage: Strong brand recognition and customer loyalty.

- Disadvantage: Limited geographic reach compared to larger competitors.

- Advantage: Innovative product pipeline with significant growth potential.

- Disadvantage: Higher operating costs than some competitors.

Predicting Future Stock Price Movements (Speculative)

Predicting future stock price movements is inherently speculative, and any attempt to do so should acknowledge the inherent uncertainties. This section explores potential scenarios for Aware’s future performance and their impact on the stock price, illustrating the possibilities with hypothetical examples.

Potential Scenarios for Aware’s Future Performance

Several scenarios could unfold for Aware, each with different implications for its stock price. For example, a successful product launch could lead to increased revenue and a surge in stock price. Conversely, a failure to adapt to changing market trends could result in decreased profitability and a decline in stock price. A major regulatory change could also significantly impact Aware’s operations and stock valuation.

Potential Catalysts Impacting Aware’s Stock Price

Several events could act as catalysts, either positive or negative, influencing Aware’s stock price. Positive catalysts might include the successful launch of a new product, exceeding earnings expectations, or strategic acquisitions. Negative catalysts might include unexpected regulatory changes, a recall of a product, or a significant downturn in the overall market.

Hypothetical Scenarios and Their Effect on Stock Price

Let’s consider two hypothetical scenarios:

Scenario 1: Aware successfully launches a groundbreaking new product, significantly increasing revenue and market share. This would likely lead to a substantial increase in the stock price.

Scenario 2: A major competitor launches a superior product, significantly impacting Aware’s market share and profitability. This could lead to a decline in Aware’s stock price.

Hypothetical Scenarios: Likelihood and Impact on Stock Price

| Scenario | Likelihood | Impact on Stock Price |

|---|---|---|

| Successful new product launch | Medium | Significant increase |

| Major competitor launches superior product | Low | Significant decrease |

| Economic downturn impacts demand | Medium | Moderate decrease |

| Strategic acquisition enhances market position | Low | Significant increase |

FAQ Guide

What are the major risks associated with investing in Aware stock?

Investing in any stock carries inherent risk. For Aware, potential risks could include increased competition, economic downturns affecting demand for its products or services, changes in regulatory environments, and successful legal challenges. Thorough due diligence is crucial before investing.

How does Aware compare to its competitors in terms of innovation?

A detailed competitive analysis is needed to accurately assess Aware’s innovation compared to its competitors. This would involve examining patent filings, product launches, R&D spending, and market reception of new offerings. Such an analysis would reveal Aware’s relative strengths and weaknesses in the innovation arena.

Where can I find reliable real-time data on Aware’s stock price?

Real-time stock price data for Aware can typically be found on major financial websites and trading platforms such as Yahoo Finance, Google Finance, Bloomberg, and others. Always verify the source’s reliability before making investment decisions.