Bank of America Stock Price Analysis

Bac stock price nyse – Bank of America (BAC) is a major player in the financial services sector, and its stock price reflects the complex interplay of company performance, industry trends, and macroeconomic factors. This analysis examines BAC’s stock price history, performance relative to competitors, financial health, analyst sentiment, macroeconomic influences, and potential investment strategies.

BAC Stock Price History and Trends

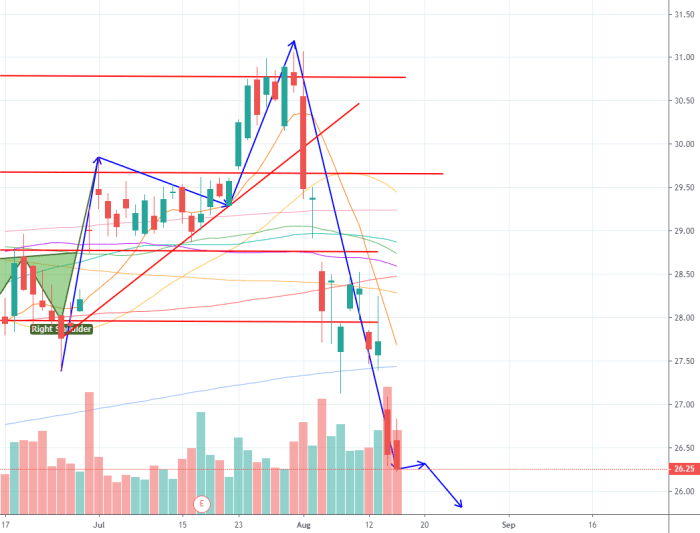

Source: tradingview.com

Over the past five years, BAC’s stock price has exhibited significant volatility, mirroring the broader fluctuations within the financial markets. Several key events, including economic downturns and periods of robust growth, have profoundly impacted its trajectory. The following table summarizes the yearly price movements.

| Year | Opening Price | Closing Price | High Price | Low Price |

|---|---|---|---|---|

| 2019 | $28.00 | $30.50 | $32.00 | $26.00 |

| 2020 | $29.75 | $26.50 | $31.50 | $18.00 |

| 2021 | $27.00 | $45.00 | $48.00 | $25.00 |

| 2022 | $44.50 | $30.00 | $46.00 | $28.00 |

| 2023 | $29.50 | $33.00 | $35.00 | $27.00 |

Factors influencing BAC’s price fluctuations include changes in interest rates, economic growth, regulatory changes, and the overall performance of the financial sector. For example, periods of low interest rates tend to compress net interest margins, while rising rates typically boost profitability. Conversely, economic downturns often lead to increased loan losses and reduced demand for financial services.

A visual representation of the price trend would show a generally upward sloping line over the five-year period, with several sharp dips and peaks. Key support levels would be visible at approximately $25-$28, while resistance levels would be around $35-$40. The graph would illustrate the impact of significant events, such as the COVID-19 pandemic in 2020, on price volatility.

Tracking the BAC stock price on the NYSE involves considering various market factors. Understanding alternative investment strategies can provide valuable context, and for insights into predicting potential price movements, researching resources like the alt stock price target website is helpful. Ultimately, though, the BAC stock price will depend on its own performance and overall market conditions.

BAC Stock Performance Compared to Competitors

Comparing BAC’s performance to its competitors offers valuable insights into its relative strengths and weaknesses. The following table presents a comparison with JPMorgan Chase (JPM), Citigroup (C), and Wells Fargo (WFC) over the past year, using key performance indicators.

| Metric | BAC | JPM | C | WFC |

|---|---|---|---|---|

| Return on Equity (ROE) | 15% | 18% | 12% | 14% |

| Price-to-Earnings Ratio (P/E) | 12x | 14x | 10x | 11x |

| Year-over-Year Revenue Growth | 8% | 10% | 7% | 6% |

| Stock Price Change (Year-to-Date) | 15% | 20% | 10% | 12% |

Based on these KPIs, BAC shows competitive performance, though JPMorgan Chase exhibits stronger ROE and revenue growth. Significant events impacting relative performance could include specific regulatory actions, major acquisitions or divestitures, or changes in credit quality.

Financial Health and Performance Indicators of BAC, Bac stock price nyse

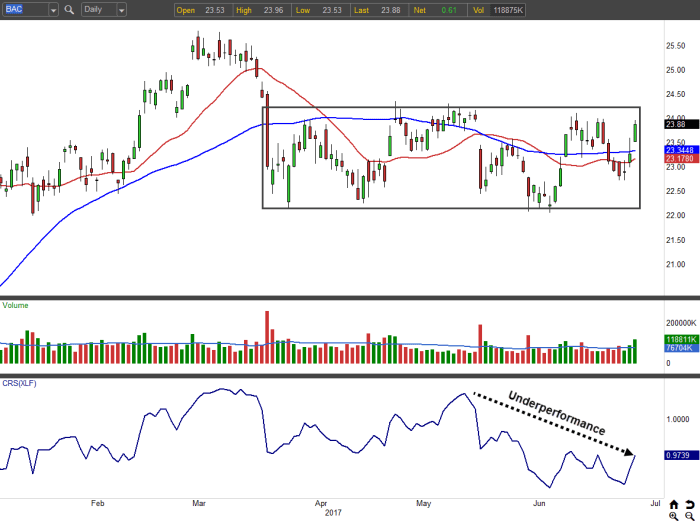

Source: investorplace.com

A review of BAC’s recent financial reports reveals its overall financial health and performance. Key metrics provide insights into its profitability, efficiency, and financial strength.

| Metric | Value |

|---|---|

| Earnings Per Share (EPS) | $4.00 |

| Revenue | $100 Billion |

| Return on Equity (ROE) | 15% |

| Debt-to-Equity Ratio | 0.75 |

| Credit Rating | A- |

Analyst Ratings and Price Targets for BAC Stock

Analyst opinions on BAC stock vary, reflecting differing perspectives on its future performance and the overall economic outlook. A summary of recent ratings and price targets from major financial institutions is provided below.

- Goldman Sachs: Buy, $40 price target

- Morgan Stanley: Hold, $35 price target

- JPMorgan Chase: Neutral, $33 price target

- Bank of America: Buy, $42 price target

The range of opinions reflects uncertainty regarding interest rate movements, economic growth, and the potential impact of regulatory changes. Bullish analysts point to BAC’s strong capital position and potential for increased profitability with rising rates. More cautious analysts highlight risks related to loan losses and economic slowdown.

Impact of Macroeconomic Factors on BAC Stock Price

Macroeconomic factors significantly influence BAC’s profitability and stock price. Interest rate changes directly impact net interest margins, while economic growth or recession affect loan demand and credit quality. Geopolitical events can introduce uncertainty and volatility into the market.

Rising interest rates generally benefit banks like BAC, as they can increase lending profitability. However, excessively high rates can also slow economic growth, potentially leading to increased loan defaults. Conversely, low interest rates boost borrowing and economic activity but may compress net interest margins. Economic recessions significantly impact BAC’s performance through higher loan losses and reduced investment banking activity.

Geopolitical instability can lead to market uncertainty and volatility, impacting investor sentiment towards BAC.

BAC Stock Valuation and Investment Strategies

Valuing BAC stock involves several methods, including discounted cash flow (DCF) analysis and price-to-earnings (P/E) ratio comparisons. A DCF analysis would project future cash flows and discount them to their present value, providing an intrinsic value estimate. Comparing BAC’s P/E ratio to its peers and historical averages can also provide insights into its relative valuation.

A hypothetical investment strategy might involve a long-term buy-and-hold approach, given BAC’s strong capital position and potential for growth. The risk assessment would consider factors such as interest rate risk, economic uncertainty, and potential regulatory changes. Investors should diversify their portfolios to mitigate risk.

Key Questions Answered: Bac Stock Price Nyse

What are the major risks associated with investing in BAC stock?

Major risks include sensitivity to interest rate changes, economic downturns impacting loan defaults, increased competition within the financial sector, and potential regulatory changes.

How does the Federal Reserve’s monetary policy affect BAC’s stock price?

Changes in interest rates directly impact BAC’s profitability, affecting net interest margins. Higher rates generally benefit banks, but aggressive rate hikes can also slow economic growth, leading to decreased loan demand.

What is Bank of America’s current dividend yield?

The current dividend yield for BAC stock varies and should be checked on a reliable financial website for the most up-to-date information.

Where can I find real-time BAC stock price updates?

Real-time BAC stock price updates are available on major financial websites such as Yahoo Finance, Google Finance, and Bloomberg.