Bally’s Corporation: A Deep Dive into Stock Performance

Ballys stock price – Bally’s Corporation, a prominent player in the gaming and entertainment industry, has experienced significant fluctuations in its stock price. This analysis delves into the key factors influencing Bally’s stock performance, providing insights into its financial health, competitive landscape, and future outlook.

Bally’s Corporation Overview

Source: googleapis.com

Bally’s Corporation boasts a rich history, tracing its roots back to a legacy in the gaming industry. Its core business segments currently encompass casino operations, online sports betting and iGaming, and free-to-play games. Bally’s holds a notable market position, particularly within the rapidly expanding online gaming sector. However, it faces stiff competition from established giants and newer entrants.

The company’s revenue streams are diverse, with significant contributions from both physical casinos and digital platforms. The relative contribution of each segment fluctuates depending on market conditions and regulatory changes. For example, successful online sports betting seasons can significantly boost revenue, while casino performance is tied to tourism and economic factors.

Factors Influencing Bally’s Stock Price

Source: companieslogo.com

Several macroeconomic, competitive, and regulatory factors significantly impact Bally’s stock valuation. These factors interact in complex ways, influencing investor sentiment and market expectations.

Three macroeconomic factors significantly impacting Bally’s stock price are interest rates, inflation, and consumer spending. Rising interest rates increase borrowing costs, potentially hindering expansion plans and impacting profitability. High inflation reduces consumer disposable income, affecting spending on entertainment and leisure activities like casino visits and online gaming. Conversely, strong consumer spending can positively impact revenue, particularly in the casino segment.

Competitor actions heavily influence Bally’s stock valuation. Companies like DraftKings and FanDuel are major competitors in the online gaming space, while established casino operators pose challenges in the physical casino market. Bally’s competitive advantages lie in its diverse business model and expanding digital footprint. However, disadvantages include its relatively smaller market share compared to established players and the intense competition for market share.

Bally’s stock price has seen some volatility recently, largely influenced by the overall market sentiment. It’s interesting to compare this to the performance of other companies, such as Alibaba, whose premarket stock price you can check here: baba premarket stock price. Observing Alibaba’s movement can offer a broader perspective on the current economic climate and potentially provide insight into future trends for Bally’s stock price as well.

Regulatory changes and legal considerations profoundly affect Bally’s stock price. The legal landscape surrounding online gaming varies across jurisdictions, creating both opportunities and risks. The following table summarizes the impact of key regulations and potential mitigation strategies.

| Regulation | Impact on Bally’s Stock Price | Potential Mitigation Strategies |

|---|---|---|

| Changes in online gambling licensing | Positive impact if licenses are granted in new markets; negative if licenses are revoked or restricted. | Proactive engagement with regulators, strong compliance programs. |

| Taxation of online gaming revenue | Increased tax burdens can reduce profitability and negatively impact stock price. | Strategic tax planning, lobbying for favorable tax policies. |

| Advertising restrictions for gambling | Restrictions can limit customer acquisition and marketing effectiveness. | Diversification of marketing channels, focus on responsible gambling initiatives. |

Financial Performance and Stock Valuation, Ballys stock price

Source: dogsofthedow.com

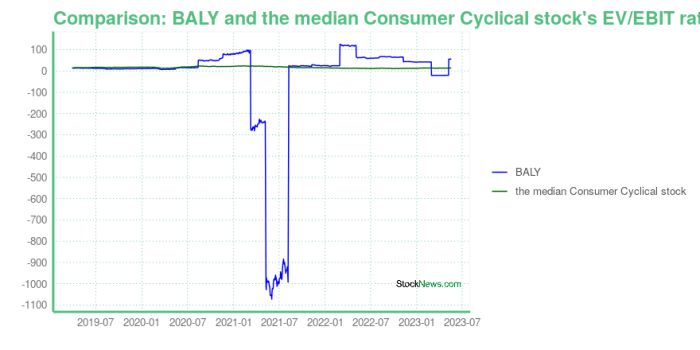

Bally’s recent financial performance should be analyzed using publicly available financial statements. Revenue, earnings, and cash flow figures would be examined to understand the company’s financial health. A comparison to previous periods and industry benchmarks would provide valuable context.

A strong correlation exists between Bally’s financial performance and its stock price movements. A visual representation, such as a line graph plotting stock price against quarterly or annual earnings per share (EPS), would effectively illustrate this relationship. The graph would show upward trends in stock price coinciding with periods of strong financial performance and downward trends during periods of weaker performance.

This visual would clearly demonstrate the market’s reaction to Bally’s financial results.

Bally’s valuation metrics, including its Price-to-Earnings (P/E) ratio and market capitalization, should be compared to those of its competitors to gauge its relative valuation. This comparative analysis would help investors assess whether Bally’s stock is overvalued, undervalued, or fairly priced relative to its peers.

Investment Strategies and Outlook

Several investment strategies are possible for Bally’s stock, catering to different risk tolerances. Conservative investors might adopt a buy-and-hold strategy, while more aggressive investors could consider options trading or leveraging.

Potential scenarios for Bally’s future performance include continued expansion into new markets, successful integration of acquisitions, and increased market share in online gaming. These positive scenarios could lead to significant stock price appreciation. Conversely, challenges such as increased competition, regulatory hurdles, or economic downturns could negatively impact the stock price.

- Potential Risks: Increased competition, regulatory uncertainty, economic downturn, failure to execute expansion plans, integration challenges with acquisitions.

- Potential Opportunities: Expansion into new regulated markets, successful product innovation, strategic partnerships, increased market share in online gaming.

Analyst Opinions and Market Sentiment

Financial analysts’ consensus view on Bally’s stock can be gleaned from analyst reports and financial news sources. This consensus will incorporate their assessment of the company’s financial performance, growth prospects, and risk profile. Market sentiment, often reflected in social media and news coverage, will influence trading activity and stock price fluctuations. Positive sentiment tends to drive higher prices, while negative sentiment can lead to price declines.

A hypothetical news headline that could significantly impact Bally’s stock price is: “Bally’s Secures Major Online Gaming License in California.” This would be positive because it signifies access to a large and lucrative market, potentially leading to substantial revenue growth and a significant increase in the stock price.

Questions Often Asked: Ballys Stock Price

What are the major risks associated with investing in Bally’s stock?

Major risks include increased competition, regulatory changes impacting the gaming industry, economic downturns affecting consumer spending on entertainment, and potential operational challenges.

How does Bally’s compare to its competitors in terms of profitability?

A direct comparison requires analyzing key financial metrics like revenue, profit margins, and return on equity against competitors like DraftKings or Penn National Gaming. This analysis should be conducted using the most recent financial reports.

What is the historical volatility of Bally’s stock price?

Historical volatility can be determined by analyzing past stock price data. Resources like financial news websites or dedicated stock analysis platforms provide tools to calculate and visualize this data.

Where can I find real-time Bally’s stock price information?

Real-time stock quotes are readily available on major financial websites and brokerage platforms. Many financial news sources also provide live updates.