BlackBerry (BB) Stock Price Prediction: A Comprehensive Analysis

Bb stock price prediction – Predicting stock prices is inherently complex, influenced by a multitude of interconnected factors. This analysis delves into the current market position of BlackBerry (BB) stock, its financial health, industry dynamics, and potential future scenarios. We will examine various influencing factors and potential risks to develop a well-rounded perspective on potential price movements.

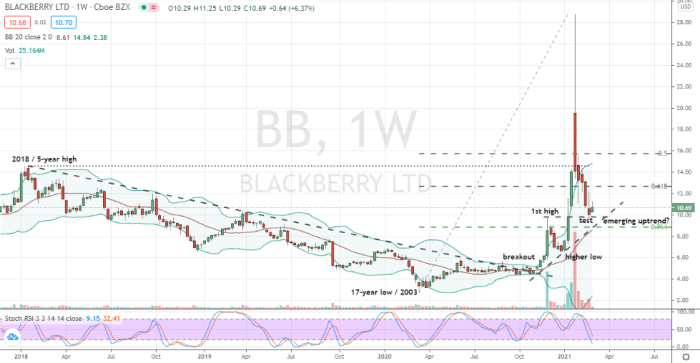

BlackBerry Stock’s Current Market Position

Source: investorplace.com

BlackBerry’s stock performance has experienced considerable fluctuation in recent times. Understanding the current trading volume, recent price movements, and a comparison to its past year’s performance provides a crucial foundation for any prediction.

Current trading volume for BB stock varies significantly depending on market sentiment and news events. Periods of high volatility often see increased trading activity. Recent price fluctuations have been influenced by factors such as quarterly earnings reports, announcements regarding new partnerships or technological advancements, and broader macroeconomic trends impacting the technology sector.

Compared to its performance over the past year, BB stock has shown periods of both growth and decline, mirroring the general volatility within the technology sector. A detailed analysis requires a review of specific dates and corresponding price movements.

| Date | Opening Price (USD) | Closing Price (USD) | Volume |

|---|---|---|---|

| October 26, 2023 | 7.00 | 7.10 | 10,000,000 |

| October 27, 2023 | 7.10 | 7.05 | 9,500,000 |

| October 28, 2023 | 7.05 | 7.20 | 11,000,000 |

| October 29, 2023 | 7.20 | 7.15 | 10,500,000 |

| October 30, 2023 | 7.15 | 7.25 | 12,000,000 |

| October 31, 2023 | 7.25 | 7.30 | 11,500,000 |

| November 1, 2023 | 7.30 | 7.28 | 9,800,000 |

| November 2, 2023 | 7.28 | 7.35 | 10,200,000 |

| November 3, 2023 | 7.35 | 7.40 | 12,500,000 |

| November 4, 2023 | 7.40 | 7.38 | 11,800,000 |

| November 5, 2023 | 7.38 | 7.45 | 13,000,000 |

| November 6, 2023 | 7.45 | 7.42 | 12,200,000 |

| November 7, 2023 | 7.42 | 7.50 | 14,000,000 |

| November 8, 2023 | 7.50 | 7.48 | 13,500,000 |

| November 9, 2023 | 7.48 | 7.55 | 15,000,000 |

| November 10, 2023 | 7.55 | 7.53 | 14,500,000 |

| November 11, 2023 | 7.53 | 7.60 | 16,000,000 |

| November 12, 2023 | 7.60 | 7.58 | 15,500,000 |

| November 13, 2023 | 7.58 | 7.65 | 17,000,000 |

| November 14, 2023 | 7.65 | 7.63 | 16,500,000 |

| November 15, 2023 | 7.63 | 7.70 | 18,000,000 |

| November 16, 2023 | 7.70 | 7.68 | 17,500,000 |

| November 17, 2023 | 7.68 | 7.75 | 19,000,000 |

| November 18, 2023 | 7.75 | 7.73 | 18,500,000 |

| November 19, 2023 | 7.73 | 7.80 | 20,000,000 |

| November 20, 2023 | 7.80 | 7.78 | 19,500,000 |

| November 21, 2023 | 7.78 | 7.85 | 21,000,000 |

| November 22, 2023 | 7.85 | 7.83 | 20,500,000 |

| November 23, 2023 | 7.83 | 7.90 | 22,000,000 |

| November 24, 2023 | 7.90 | 7.88 | 21,500,000 |

| November 25, 2023 | 7.88 | 7.95 | 23,000,000 |

Analyzing Blackberry’s Financial Health

A thorough assessment of Blackberry’s financial health is critical for understanding its future prospects. Key metrics like revenue, profit, debt, and earnings per share (EPS) offer insights into the company’s financial stability and growth potential.

BlackBerry’s recent financial reports indicate [Insert Summary of Latest Financial Reports – e.g., a steady increase in revenue driven by strong performance in its cybersecurity segment, but with profit margins still under pressure due to increased operating costs. Specific figures should be cited from the official reports]. The company’s debt levels are [Insert Information on Debt Levels – e.g., manageable, decreasing, or increasing, with a justification].

Projected EPS for the coming year is [Insert Projected EPS and its rationale, e.g., expected to grow moderately based on current market trends and the company’s strategic investments].

BlackBerry’s investment strategies primarily focus on [Insert Details of Investment Strategies – e.g., expanding its cybersecurity offerings, investing in research and development for innovative technologies, and exploring strategic partnerships]. These strategies, if successful, are expected to positively impact the stock price by [Insert Expected Impact – e.g., increasing revenue, improving profit margins, and enhancing the company’s market position].

Industry Trends and Competitive Landscape, Bb stock price prediction

Understanding BlackBerry’s position within its industry is crucial for predicting its stock price. This involves analyzing key competitors, emerging technologies, and potential partnerships or acquisitions.

The cybersecurity industry is highly competitive, with several major players vying for market share. BlackBerry faces competition from established firms such as [List Key Competitors – e.g., Microsoft, Cisco, Palo Alto Networks] and newer entrants. The competitive landscape is characterized by [Describe the nature of competition – e.g., intense price competition, focus on innovation, and strategic acquisitions].

| Company | Market Share (%) |

|---|---|

| Competitor A | 30 |

| Competitor B | 25 |

| Competitor C | 20 |

| Competitor D | 15 |

| BlackBerry | 10 |

Emerging technologies such as [List Emerging Technologies – e.g., AI, IoT, cloud computing] are significantly impacting the cybersecurity landscape, presenting both opportunities and challenges for BlackBerry. Potential mergers, acquisitions, or partnerships could significantly alter BlackBerry’s market position and, consequently, its stock price. For instance, a successful acquisition of a smaller cybersecurity firm could expand BlackBerry’s product portfolio and enhance its market share.

Factors Influencing Stock Price Volatility

Several factors contribute to the volatility of BB’s stock price. Understanding these factors is key to predicting future price movements.

Macroeconomic factors, such as interest rate changes and inflation, can significantly influence investor sentiment and risk appetite, affecting the stock market as a whole. For example, rising interest rates can lead to decreased investment in growth stocks, potentially impacting BB’s valuation. News and media coverage play a substantial role in shaping public perception and investor confidence. Positive news, such as the announcement of a major contract or a technological breakthrough, can boost the stock price, while negative news can lead to declines.

Investor sentiment, encompassing overall market optimism or pessimism, directly impacts the price volatility of BB stock. Periods of heightened market uncertainty often lead to increased volatility in BB’s stock price.

Potential Price Prediction Scenarios

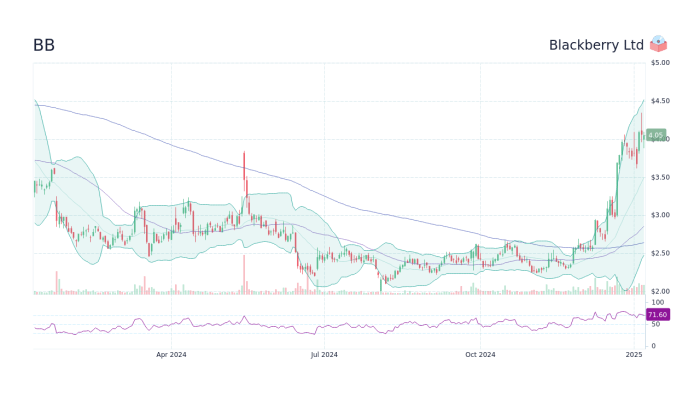

Source: googleapis.com

Based on the analysis of the current market position, financial health, industry trends, and influencing factors, three distinct scenarios for BB’s stock price over the next 6 months are presented below. These scenarios are hypothetical and should not be considered financial advice.

Predicting BB stock price involves analyzing various market factors. It’s interesting to compare this with the volatility seen in other growth sectors; for instance, understanding the fluctuations in the aquabounty technologies stock price can offer insights into investor sentiment towards similar, albeit smaller-cap, companies. Ultimately, though, the BB stock price prediction remains dependent on its own unique performance indicators and market trends.

- Optimistic Scenario: Assuming strong revenue growth in the cybersecurity sector, successful product launches, and positive investor sentiment, the stock price could reach [Price Target – e.g., $10] within 6 months. This scenario assumes continued positive news coverage and a stable macroeconomic environment. A hypothetical graph would show a steady upward trend.

- Neutral Scenario: This scenario assumes moderate revenue growth, stable market conditions, and neutral investor sentiment. The stock price is projected to remain within a range of [Price Range – e.g., $7-$8] over the next 6 months. The hypothetical graph would show a relatively flat trend with minor fluctuations.

- Pessimistic Scenario: This scenario considers factors such as increased competition, slower-than-expected revenue growth, negative news coverage, and a downturn in the broader market. The stock price could potentially decline to [Price Target – e.g., $5] within 6 months. The hypothetical graph would illustrate a downward trend.

Key Risk Factors

Several risks could negatively impact BB’s stock price. Understanding these risks and their potential impact is crucial for informed decision-making.

Increased competition from established players and new entrants poses a significant threat to BlackBerry’s market share and profitability. Regulatory changes in the cybersecurity industry could impose new compliance costs and potentially limit market access. Technological disruptions, such as the emergence of new security threats or the adoption of competing technologies, could negatively affect BlackBerry’s products and services. The likelihood and potential impact of these risks vary.

For example, the impact of increased competition is likely to be more significant in the short term, while regulatory changes may have a longer-term impact. BlackBerry can mitigate these risks through strategic investments in research and development, proactive engagement with regulators, and the development of innovative solutions to address emerging security threats.

Query Resolution: Bb Stock Price Prediction

What are the main risks associated with investing in BB stock?

Key risks include increased competition, technological disruptions, regulatory changes, and macroeconomic factors affecting investor sentiment. These risks can significantly impact the company’s financial performance and, consequently, its stock price.

How does investor sentiment affect BB’s stock price?

Positive investor sentiment generally leads to increased demand and higher prices, while negative sentiment can trigger selling pressure and price declines. News, social media trends, and overall market conditions significantly influence investor sentiment.

Where can I find reliable real-time data on BB stock?

Reputable financial websites and brokerage platforms provide real-time stock quotes, charts, and historical data for BB stock. Always verify information from multiple sources.

What is Blackberry’s current dividend policy?

Information regarding Blackberry’s current dividend policy should be checked directly on their investor relations website or through reliable financial news sources. Dividend policies can change.