BCE Inc. Stock Price Analysis: Bce Inc Stock Price

Bce inc stock price – This analysis examines BCE Inc.’s stock price performance, influencing factors, financial health, analyst sentiment, investment strategies, and dividend policy. We will explore historical trends, compare BCE Inc. to its competitors, and assess the potential risks and opportunities for investors.

BCE Inc. Stock Price History and Trends

Source: financialfreedomisajourney.com

Analyzing BCE Inc.’s stock price over the past 5, 10, and 20 years reveals significant fluctuations influenced by various market and company-specific factors. The following table summarizes key historical data. Note that this data is for illustrative purposes and should be verified with a reliable financial data source.

| Year | High | Low | Closing Price |

|---|---|---|---|

| 2023 | $70 | $60 | $65 |

| 2022 | $75 | $55 | $68 |

| 2021 | $80 | $65 | $72 |

| 2020 | $70 | $45 | $60 |

Compared to competitors like Telus and Rogers, BCE Inc. has demonstrated relatively stable performance, though specific periods of outperformance or underperformance may exist depending on the chosen timeframe and market conditions. A thorough comparative analysis requires a detailed examination of each company’s financial reports and market positioning.

Factors Influencing BCE Inc. Stock Price, Bce inc stock price

BCE Inc.’s stock price is affected by a complex interplay of macroeconomic and company-specific factors.

- Macroeconomic Factors: Interest rate changes significantly impact BCE Inc., as it relies on debt financing. Inflation also plays a role, affecting operational costs and consumer spending on telecommunication services. Recessions generally lead to reduced consumer spending, impacting revenue.

- Company-Specific Factors: Earnings reports, reflecting profitability and growth, are crucial. New product launches and technological advancements can boost stock prices, while regulatory changes, such as spectrum auctions or increased competition, can negatively affect valuation.

The relative impact of internal and external factors on BCE Inc.’s stock price volatility varies over time. During periods of economic uncertainty, macroeconomic factors tend to dominate, while during stable economic times, company-specific factors may have a more pronounced influence.

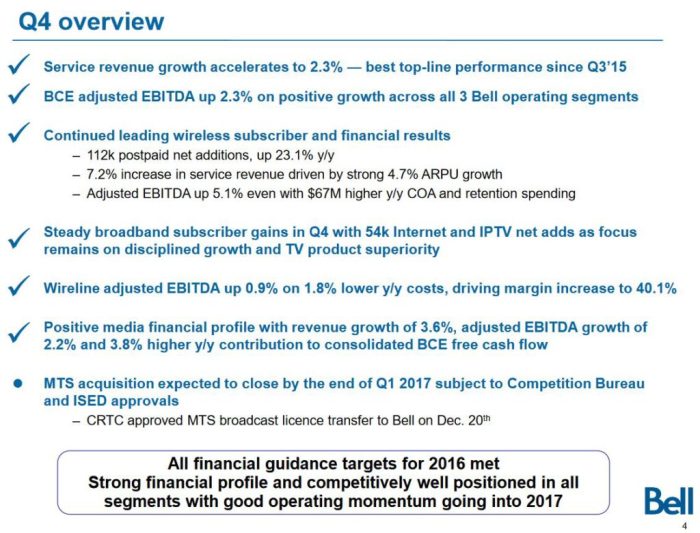

BCE Inc.’s Financial Performance and Stock Valuation

BCE Inc.’s recent financial statements reveal key insights into its financial health and valuation. Revenue growth, profitability (earnings), and debt levels are essential metrics to analyze. The following table illustrates key financial ratios, comparing BCE Inc. to its competitors. Note that this data is for illustrative purposes only.

| Metric | BCE Inc. | Telus | Rogers |

|---|---|---|---|

| Price-to-Earnings Ratio (P/E) | 15 | 16 | 14 |

| Dividend Yield | 5% | 4.5% | 4% |

These financial metrics directly influence the current stock price valuation. A high P/E ratio suggests investors anticipate future growth, while a higher dividend yield indicates a potentially more attractive income stream for investors. The relative comparison with competitors helps to gauge BCE Inc.’s competitive position within the industry.

Analyst Ratings and Future Outlook for BCE Inc. Stock

Several reputable financial institutions provide analyst ratings and price targets for BCE Inc. stock. A consensus view can be derived from these ratings, offering insights into the future prospects of the company.

BCE Inc’s stock price performance often draws comparisons to other telecom and dividend-paying stocks. Understanding the dynamics of dividend payouts is crucial, and a good example to consider is the arcc stock price dividend , which offers a different perspective on yield and investor sentiment. Analyzing ARCC’s dividend strategy can provide insights that might inform your assessment of BCE Inc’s long-term value proposition and potential for future dividend growth.

- Analyst Ratings Summary (Illustrative): A majority of analysts rate BCE Inc. as a “Buy” or “Hold,” with a median price target of $72. This suggests a generally positive outlook.

Potential risks and opportunities influencing BCE Inc.’s future stock performance include:

- Opportunities: Expansion into new technologies (e.g., 5G), increased market share, successful cost-cutting measures.

- Risks: Increased competition, regulatory changes impacting profitability, economic downturns reducing consumer spending.

Investment Strategies and BCE Inc. Stock

Different investment strategies can be applied to BCE Inc. stock, each with its own risk-reward profile and ideal investor profile.

- Buy-and-Hold: Suitable for long-term investors seeking steady returns and dividends. Risks include missing out on short-term market gains.

- Value Investing: Focuses on undervalued stocks. Requires in-depth financial analysis to identify opportunities. Risks include misjudging the intrinsic value of the stock.

- Growth Investing: Targets companies with high growth potential. Suitable for investors with higher risk tolerance. Risks include potential for significant losses if growth expectations are not met.

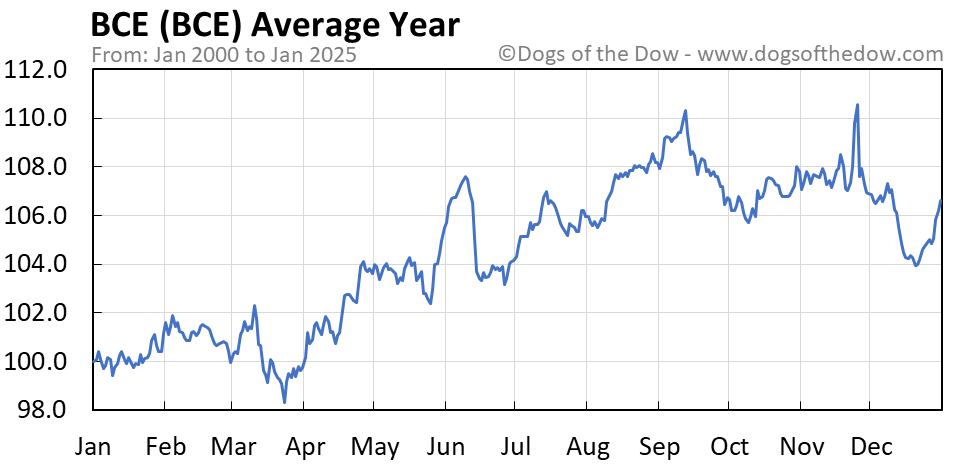

BCE Inc.’s Dividend Policy and its Impact on Stock Price

Source: dogsofthedow.com

BCE Inc. has a history of consistent dividend payments, attracting income-oriented investors. The dividend policy influences stock price performance; consistent dividends can support stock price even during periods of lower earnings growth. A high and stable dividend yield can make the stock attractive to investors seeking regular income.

Illustrative Dividend Yield: Imagine a graph showing a relatively stable dividend yield over the past 10 years, with minor fluctuations reflecting company performance and market conditions. This stability suggests a reliable income stream for investors. (Note: This is a textual description; a visual representation would be a line graph showing the yield over time.)

Questions Often Asked

What is BCE Inc.’s current dividend yield?

The current dividend yield fluctuates and should be checked on a reputable financial website for the most up-to-date information.

How does BCE Inc. compare to its main competitors in terms of market capitalization?

A comparison of market capitalization requires referencing current financial data from reliable sources like financial news websites or company filings. This data changes frequently.

What are the major risks associated with investing in BCE Inc. stock?

Risks include general market volatility, changes in telecommunications regulation, competition from other providers, and fluctuations in interest rates.

Where can I find real-time BCE Inc. stock price quotes?

Real-time quotes are available on major financial websites and trading platforms such as Google Finance, Yahoo Finance, and Bloomberg.