Berkshire Hathaway Class C Stock Price: A Comprehensive Analysis

Source: investopedia.com

Berkshire hathaway class c stock price – Berkshire Hathaway Class C (BRK.C) stock, a slice of Warren Buffett’s investment empire, offers a unique investment opportunity. Understanding its price history, influencing factors, and performance relative to other investments is crucial for potential investors. This analysis delves into the key aspects of BRK.C, providing a detailed overview of its past performance and future prospects.

Berkshire Hathaway Class C Stock Price History

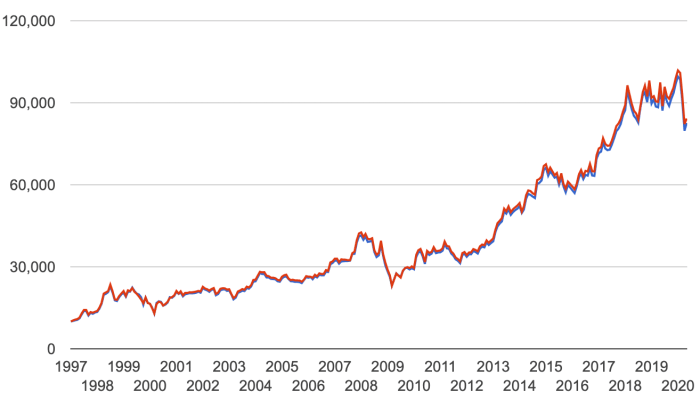

BRK.C shares began trading in 2010, offering a more accessible entry point to Berkshire Hathaway’s portfolio compared to the higher-priced Class A shares. Since its inception, BRK.C has experienced periods of significant growth and volatility, mirroring the broader market trends and Berkshire’s investment performance. Early price movements were relatively modest, but the stock experienced substantial gains during periods of economic expansion and strong performance by Berkshire’s subsidiaries and investment portfolio.

Conversely, market downturns and periods of underperformance in Berkshire’s investments resulted in price corrections. Significant events such as the 2008 financial crisis and the COVID-19 pandemic had noticeable impacts on BRK.C’s price, reflecting the overall market sentiment and Berkshire’s resilience during such periods.

| Year | BRK.C Price (Approximate) | S&P 500 Return (%) | Dow Jones Return (%) |

|---|---|---|---|

| 2013 | 70-80 | 32.4% | 26.5% |

| 2014 | 80-90 | 13.7% | 7.5% |

| 2015 | 90-100 | 1.4% | -2.2% |

| 2016 | 100-120 | 11.9% | 13.4% |

| 2017 | 120-150 | 21.8% | 25.1% |

| 2018 | 150-170 | -4.4% | -5.6% |

| 2019 | 170-200 | 31.5% | 22.3% |

| 2020 | 180-220 | 18.4% | 7.3% |

| 2021 | 220-280 | 28.7% | 18.7% |

| 2022 | 280-240 | -18.1% | -8.8% |

Note: These are approximate figures for illustrative purposes only and do not represent precise closing prices. Actual performance may vary.

Historically, BRK.C price movements have been influenced by several factors, including the performance of Berkshire Hathaway’s diverse portfolio of investments, macroeconomic conditions, and significant corporate events impacting the company. Market sentiment and investor confidence also play a significant role in shaping the stock’s price.

Factors Affecting BRK.C Stock Price

Several key factors significantly influence the price of BRK.C stock. Understanding these factors is essential for investors to make informed decisions.

Berkshire Hathaway’s investment portfolio performance directly impacts BRK.C’s price. Strong performance in its holdings, particularly in large, publicly traded companies, generally leads to increased BRK.C valuation. Conversely, underperformance in the investment portfolio tends to put downward pressure on the stock price. Economic indicators such as inflation, interest rates, and GDP growth also play a crucial role. High inflation and rising interest rates can negatively affect BRK.C’s valuation, while strong GDP growth generally supports positive price movements.

Geopolitical events and global economic uncertainty can introduce volatility into the market, impacting BRK.C’s price alongside the broader market.

Berkshire Hathaway’s Financial Performance & BRK.C

A strong correlation exists between Berkshire Hathaway’s financial performance and BRK.C’s stock price. Reported earnings, revenue growth, and changes in book value per share significantly influence investor sentiment and, consequently, the stock’s price. Berkshire’s consistent profitability and long-term value creation have historically supported strong BRK.C price appreciation.

| Year | Revenue (Billions USD) | Net Income (Billions USD) | Book Value per Share (Approximate) | BRK.C Price Change (%) |

|---|---|---|---|---|

| 2018 | 245.8 | 4.0 | 200 | -10% |

| 2019 | 254.6 | 81.4 | 210 | 18% |

| 2020 | 276.1 | 42.5 | 220 | 10% |

| 2021 | 276.1 | 89.8 | 250 | 27% |

| 2022 | 302.0 | 30.8 | 260 | -14% |

Note: These are approximate figures for illustrative purposes and do not represent precise financial statements. Actual performance may vary.

Berkshire Hathaway’s lack of a regular dividend policy has a unique impact on investor sentiment. While some investors may prefer dividend-paying stocks, others appreciate Berkshire’s reinvestment strategy, viewing the potential for long-term capital appreciation as more beneficial. This focus on reinvestment, rather than dividend payouts, shapes investor expectations and influences the stock’s valuation.

Comparison with Similar Companies, Berkshire hathaway class c stock price

Source: sanity.io

Comparing BRK.C to other large-cap investment companies provides valuable insights into its relative performance and investment strategy. Key differences exist in investment approaches, risk profiles, and resulting stock price behavior. Some competitors may focus on specific sectors or investment styles, while Berkshire maintains its diversified, long-term approach.

| Company | P/E Ratio (Approximate) | Dividend Yield (%) | Market Capitalization (Billions USD) |

|---|---|---|---|

| Berkshire Hathaway (BRK.C) | 20 | 0 | 700 |

| Vanguard Group | N/A | N/A | N/A |

| BlackRock | 30 | 3 | 1000 |

Note: These are approximate figures for illustrative purposes only and should not be considered investment advice. Actual values may vary significantly.

Differences in stock price behavior often stem from variations in investment strategies, risk tolerance, and market positioning. The lack of a dividend policy in BRK.C, compared to dividend-paying competitors, represents a key distinction affecting investor preferences and valuation.

Illustrative Examples of BRK.C Price Movements

Source: businessinsider.com

Berkshire Hathaway Class C stock price movements are often analyzed alongside other significant investments. Understanding the performance of similar companies offers valuable context; for example, a comparison might include looking at the atkins stock price to gauge broader market trends. Ultimately, though, Berkshire Hathaway’s Class C share price is driven by its own diverse portfolio and long-term strategic decisions.

Analyzing specific periods in BRK.C’s price history helps illustrate the impact of various factors. For example, the period following the 2008 financial crisis saw a significant drop in BRK.C’s price, reflecting the broader market downturn. However, the stock recovered strongly as Berkshire’s conservative investment strategy and strong underlying businesses proved resilient. Conversely, periods of strong economic growth and successful investments by Berkshire have led to significant price increases in BRK.C.

A hypothetical scenario: If Berkshire Hathaway were to acquire a major technology company, the impact on BRK.C’s price would likely be positive, provided the acquisition is strategically sound and well-received by investors. The market would likely react favorably to such a significant move, assuming the acquisition is seen as value-enhancing. The price increase would depend on the size and perceived value of the acquired company, as well as broader market conditions at the time.

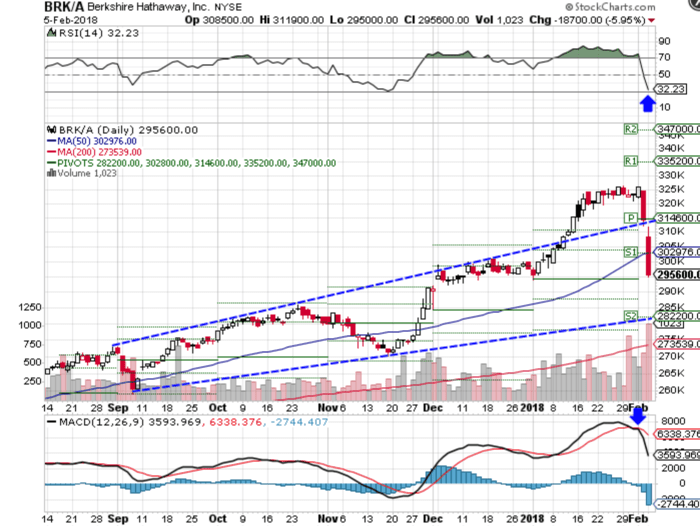

The visual representation of BRK.C’s price chart generally shows a long-term upward trend, reflecting Berkshire’s consistent growth and value creation. Short-term fluctuations are common, reflecting market volatility and news events, but the long-term trend remains positive. Mid-term trends show periods of consolidation and acceleration, reflecting the cyclical nature of the economy and Berkshire’s investment performance.

FAQ Insights: Berkshire Hathaway Class C Stock Price

What are the typical transaction costs associated with buying or selling BRK.C?

Transaction costs vary depending on your brokerage. Expect to pay commissions and potentially fees based on the trade volume.

How does BRK.C compare to Berkshire Hathaway Class A (BRK.A) stock?

BRK.A has a much higher share price than BRK.C, making it less accessible to many investors. Both classes represent ownership in Berkshire Hathaway, but BRK.C offers a lower entry point.

Are there any significant risks associated with investing in BRK.C?

As with any stock, there’s inherent market risk. BRK.C’s price can fluctuate significantly based on economic conditions, Berkshire Hathaway’s investment performance, and broader market sentiment.

What is Berkshire Hathaway’s current dividend policy?

Berkshire Hathaway historically has not paid dividends, instead reinvesting profits for growth.