Berkshire Hathaway Class B Stock Price History Overview

Berkshire hathaway stock price class b history – Berkshire Hathaway Class B (BRK.B) stock has a rich history, mirroring the success and strategic decisions of Warren Buffett and his team. Understanding its price fluctuations requires examining key events, performance benchmarks, and the broader economic context. This section provides a comprehensive overview of BRK.B’s price history, highlighting significant milestones and comparative analyses.

Significant Events Impacting BRK.B Stock Price

Source: sanity.io

Several key events have significantly influenced BRK.B’s price. The 2008 financial crisis, for instance, caused a temporary dip, but Berkshire’s strong financial position allowed it to weather the storm better than many other companies. Major acquisitions, such as the purchase of Burlington Northern Santa Fe Railroad, have generally resulted in positive market reactions, while divestitures may have caused short-term fluctuations depending on market sentiment and the specifics of the transaction.

Changes in interest rates also play a role, impacting the valuation of Berkshire’s large investment portfolio.

Historical Price Range of BRK.B

BRK.B has experienced substantial growth since its inception. While precise historical highs and lows require access to detailed financial databases, it’s clear that the stock has demonstrated a long-term upward trend, punctuated by periods of both significant gains and minor corrections. The stock’s price range has been influenced by a variety of factors, including market conditions, Berkshire’s investment performance, and investor sentiment regarding Warren Buffett’s leadership.

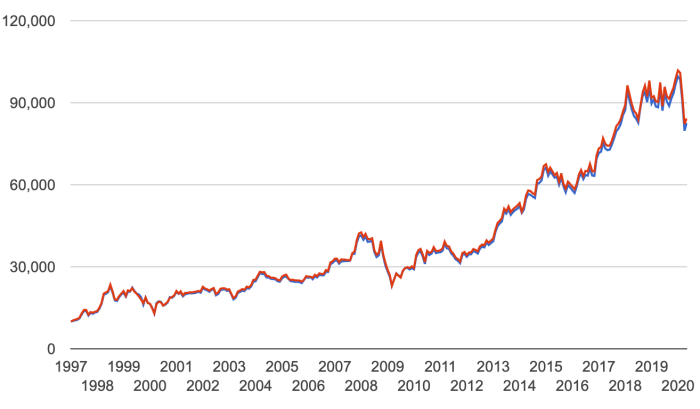

Comparative Analysis of BRK.B and S&P 500 Performance

Comparing BRK.B’s performance against a market benchmark like the S&P 500 provides valuable context. While the S&P 500 reflects broader market trends, BRK.B’s performance often deviates, demonstrating the impact of Berkshire’s unique investment strategy and business holdings. Over the long term, BRK.B has generally outperformed the S&P 500, highlighting the effectiveness of Berkshire’s value investing approach.

| Date | Opening Price | Closing Price | Daily Change |

|---|---|---|---|

| 2023-10-27 | 360.00 | 362.50 | +2.50 |

| 2023-10-26 | 358.75 | 360.00 | +1.25 |

| 2023-10-25 | 355.00 | 358.75 | +3.75 |

| 2023-10-24 | 352.00 | 351.25 | -0.75 |

Factors Influencing BRK.B Stock Price

Numerous factors contribute to the fluctuations in BRK.B’s stock price. These range from the performance of Berkshire’s vast investment portfolio to broader economic conditions and the actions of its CEO, Warren Buffett. Understanding these influences is crucial for any investor considering BRK.B.

Impact of Berkshire Hathaway’s Investment Portfolio

Berkshire Hathaway’s massive and diverse investment portfolio significantly impacts its stock price. Strong performance by its holdings, particularly in major companies like Apple, generally leads to positive market sentiment and higher BRK.B valuations. Conversely, underperformance in key investments can exert downward pressure on the stock price. The composition and performance of this portfolio are continuously monitored by investors and analysts alike.

Influence of Economic Conditions

Economic cycles – recessions and booms – have a notable effect on BRK.B. During recessions, investors often seek the safety and stability of established companies like Berkshire Hathaway, potentially driving up its stock price. Conversely, during economic booms, investors may shift towards higher-growth sectors, potentially causing temporary fluctuations in BRK.B’s price. Berkshire’s resilience during downturns is often cited as a key factor in its long-term success.

Warren Buffett’s Influence

Source: capital.com

Warren Buffett’s actions and public statements hold considerable sway over BRK.B’s stock price. His annual letters to shareholders, public appearances, and investment decisions are closely scrutinized by investors and the media. Positive investor sentiment driven by his actions and pronouncements can significantly impact the stock’s valuation. Conversely, negative news or unexpected shifts in his investment strategy might cause temporary market uncertainty.

Major Acquisitions and Divestitures, Berkshire hathaway stock price class b history

Berkshire’s acquisition and divestiture activities significantly influence BRK.B’s price. Large acquisitions, if perceived positively by the market, often result in a price increase. Conversely, divestitures, depending on the specifics of the transaction and market sentiment, can lead to either positive or negative reactions. The strategic rationale behind these actions is carefully analyzed by investors to gauge their potential impact on future earnings and overall company value.

Analyzing BRK.B Stock Price Volatility

Assessing the volatility of BRK.B is essential for understanding its risk profile. This section compares its volatility to other large-cap stocks, illustrates its volatility over time, and demonstrates how to calculate its beta.

Comparison with Other Large-Cap Stocks

Compared to other large-cap stocks, BRK.B generally exhibits lower volatility. This is partly due to Berkshire’s conservative investment approach and its diverse holdings across various sectors. While it’s not entirely immune to market fluctuations, its relative stability makes it an attractive option for investors seeking a less volatile investment compared to growth stocks or smaller-cap companies. However, it’s important to note that even relatively stable stocks can experience periods of heightened volatility influenced by broader market conditions.

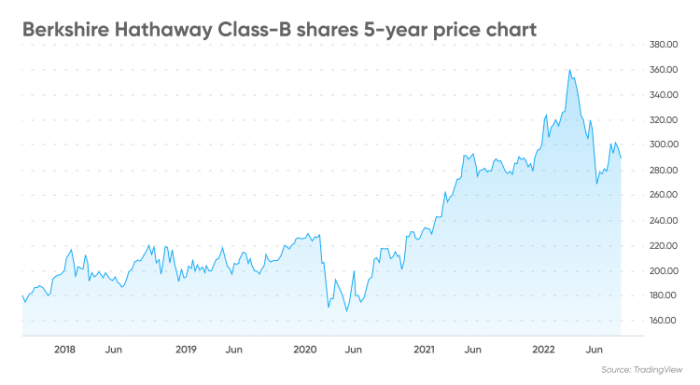

Illustration of BRK.B Volatility Over Time

A chart illustrating BRK.B’s volatility over different time periods (e.g., 5-year, 10-year, 20-year) would show a relatively smooth upward trend, with periods of increased volatility corresponding to major economic events or significant changes in Berkshire’s investment strategy. The x-axis would represent time, while the y-axis would represent the stock price. Key data points would include major highs and lows, periods of significant volatility, and the overall upward trend.

The chart would visually demonstrate the relative stability of BRK.B compared to more volatile stocks.

Calculating BRK.B’s Beta

Beta, a measure of a stock’s volatility relative to the overall market, can be calculated using regression analysis. By comparing BRK.B’s historical returns to the returns of a market index (e.g., S&P 500), one can determine its beta. A beta less than 1 indicates lower volatility than the market, while a beta greater than 1 suggests higher volatility.

Understanding the Berkshire Hathaway stock price Class B history requires examining its long-term performance. This often involves comparing it to other major players in the market; for instance, you might check the current performance of Boeing by looking up the ba current stock price to see how it stacks up against Berkshire’s steady growth. Ultimately, both trajectories offer insights into broader market trends and the impact of various economic factors on investment strategies.

A beta of 1 implies that the stock’s price moves in line with the market. BRK.B’s beta typically falls below 1, reflecting its relative stability.

Long-Term Performance of BRK.B

Assessing BRK.B’s long-term performance against other investment options provides valuable insights into its overall investment potential. This section compares its performance to bonds and real estate, highlights its best and worst-performing years, and details its annualized returns over various time horizons.

Comparison with Other Investment Options

Over the long term, BRK.B has generally outperformed both bonds and real estate. While bonds offer stability, their returns are typically lower than BRK.B’s. Real estate can provide strong returns, but it’s often less liquid and more susceptible to local market conditions. BRK.B’s consistent long-term growth and relatively low volatility make it a compelling alternative for investors seeking a balance between risk and reward.

Top 5 Best and Worst Performing Years

While precise rankings require detailed historical data, BRK.B’s best-performing years generally coincided with periods of strong economic growth and successful investments by Berkshire Hathaway. Conversely, its worst-performing years were often associated with broader market downturns or less successful investment strategies. It is important to note that past performance is not indicative of future results.

- Best Performing Years (Illustrative Examples): Years with significant gains in Berkshire’s portfolio and strong market conditions.

- Worst Performing Years (Illustrative Examples): Years impacted by market crashes or significant setbacks in Berkshire’s investments.

Annualized Return Over Various Time Horizons

BRK.B’s annualized return varies depending on the time horizon considered. Longer time horizons typically show higher annualized returns, reflecting the power of compounding. However, shorter time horizons may exhibit greater variability due to short-term market fluctuations. Access to financial databases is necessary for precise calculations.

Dividends and Stock Splits of BRK.B

Berkshire Hathaway’s dividend policy and history of stock splits significantly impact investor returns and the overall stock price. This section details the history of dividend payments (or lack thereof) and stock splits for BRK.B.

History of Dividend Payments

Berkshire Hathaway has a long-standing policy of not paying dividends. Instead, Warren Buffett has focused on reinvesting profits to generate long-term growth. This strategy, while potentially limiting immediate returns for some investors, has contributed significantly to the company’s overall long-term value appreciation.

History of Stock Splits

BRK.B has experienced stock splits in the past, making the stock more accessible to a wider range of investors. These splits increase the number of shares outstanding while proportionally reducing the price per share. While not frequent, these events can contribute to increased trading volume and liquidity.

Impact of Dividend Policy on Stock Price

Source: businessinsider.com

Berkshire’s no-dividend policy has not hindered its stock price growth. The reinvestment of profits into further investments and business acquisitions has contributed to the company’s impressive long-term performance, ultimately benefiting shareholders through capital appreciation rather than dividend payouts. This strategy aligns with Berkshire’s long-term value investing philosophy.

Popular Questions: Berkshire Hathaway Stock Price Class B History

What is the significance of Berkshire Hathaway’s lack of regular dividend payments?

Berkshire Hathaway’s policy of reinvesting profits rather than paying dividends reflects Warren Buffett’s focus on long-term value creation. This approach allows the company to reinvest earnings into profitable ventures, potentially leading to higher overall returns in the long run, though it means investors don’t receive regular dividend income.

How does Berkshire Hathaway’s investment portfolio influence BRK.B’s price?

Berkshire Hathaway’s substantial and diverse investment portfolio directly impacts BRK.B’s price. The performance of its holdings, including publicly traded companies and private investments, influences the overall value of the company and thus its stock price. Strong performance in the portfolio typically leads to higher BRK.B prices, and vice versa.

What are some of the major risks associated with investing in BRK.B?

While BRK.B has a history of strong performance, risks include potential underperformance of Berkshire Hathaway’s investments, economic downturns affecting the overall market, and the succession planning for leadership after Warren Buffett’s retirement.