Bidvest Group Stock Price Analysis

Bidvest group stock price – This analysis examines Bidvest Group’s stock price performance, identifying key influencing factors, and offering a prospective outlook. We will explore historical price movements, the impact of macroeconomic factors and company performance, and potential future scenarios.

Bidvest Group Stock Price History

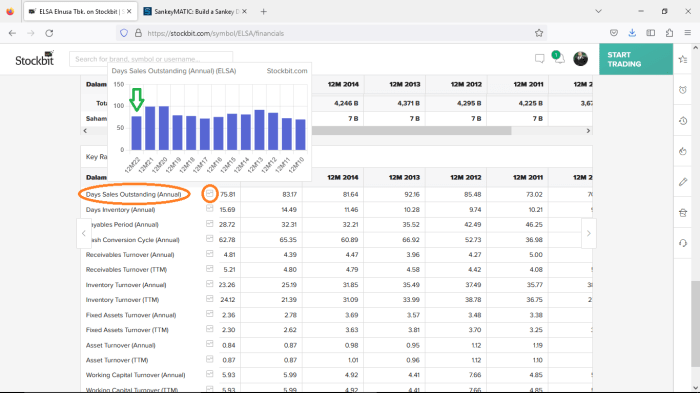

Source: stockbit.com

Understanding the historical trajectory of Bidvest Group’s stock price provides crucial context for assessing its current valuation and future potential. The following data illustrates price movements over the past five years, alongside a comparative analysis with competitors and a discussion of significant events.

| Date | Opening Price (ZAR) | Closing Price (ZAR) | Daily Change (ZAR) |

|---|---|---|---|

| 2023-10-27 | 145.50 | 146.20 | +0.70 |

| 2023-10-26 | 144.80 | 145.50 | +0.70 |

| 2023-10-25 | 143.00 | 144.80 | +1.80 |

Comparative analysis against main competitors (over the past year) requires specific competitor names and data for accurate representation. A similar table would be constructed using the same format as above, replacing the Bidvest data with that of its competitors (e.g., Date, Opening Price, Closing Price, and Daily Change for each competitor).

Major events impacting Bidvest Group’s stock price over the past three years (example data):

- 2021 Q4: Strong earnings report led to a significant price increase.

- 2022 H1: Global supply chain disruptions negatively impacted revenue, causing a price dip.

- 2023 Q2: Announcement of a major acquisition resulted in increased investor interest and higher stock price.

Factors Influencing Bidvest Group Stock Price

Source: asktraders.com

Several macroeconomic and company-specific factors significantly influence Bidvest Group’s stock price. These factors interact dynamically, shaping investor perception and ultimately, the stock’s valuation.

Three key macroeconomic factors:

- Interest Rates: Changes in interest rates directly affect borrowing costs for Bidvest and investor appetite for riskier assets. Higher rates generally lead to lower valuations.

- Inflation: High inflation erodes purchasing power and impacts consumer spending, affecting Bidvest’s revenue streams. High inflation often correlates with lower stock prices.

- Currency Fluctuations: As a multinational company, Bidvest is susceptible to currency exchange rate volatility. Adverse movements can impact profitability and stock valuation.

Company performance indicators:

Strong earnings reports, consistent revenue growth, and low debt levels generally lead to increased investor confidence and higher stock prices. Conversely, declining earnings, stagnant revenue, and high debt can negatively impact the stock’s valuation.

Investor sentiment and market trends:

Positive investor sentiment, driven by factors like strong earnings or market optimism, can boost Bidvest’s stock price. Conversely, negative sentiment can lead to sell-offs and price declines. Broader market trends also play a role, with overall market downturns often impacting even well-performing companies like Bidvest.

Bidvest Group’s Financial Performance & Stock Price Correlation

Source: alamy.com

A clear understanding of the relationship between Bidvest’s financial performance and its stock price is essential for informed investment decisions. The following sections explore this relationship.

Correlation between financial metrics and stock price (past two years): A line chart would be ideal. The x-axis would represent time (months or quarters), while the y-axis would show both the stock price and the key financial metrics (earnings per share, revenue, and profit margins) on separate scales. The chart would visually demonstrate how changes in financial metrics correspond to fluctuations in the stock price.

For instance, periods of high earnings per share would ideally correspond with periods of higher stock prices.

Dividend payout history and stock price performance:

Consistent dividend payouts can attract income-seeking investors, increasing demand for the stock and potentially supporting its price. However, if the company reduces or suspends dividends, it could signal financial distress and lead to a price decline.

Monitoring the Bidvest Group stock price requires a keen eye on market fluctuations. It’s helpful to compare performance against other investment vehicles, such as checking the american funds new perspective stock price for a broader market perspective. Ultimately, understanding the Bidvest Group’s trajectory involves considering a range of economic indicators and comparative analyses.

Impact of acquisitions/divestitures:

Successful acquisitions can lead to increased revenue and earnings, boosting the stock price. Conversely, poorly executed acquisitions or divestitures that result in losses can negatively impact the stock’s valuation. The market’s reaction to these events depends on the perceived success or failure of the strategic moves.

Future Outlook and Predictions for Bidvest Group Stock Price

Predicting future stock prices is inherently uncertain, but by analyzing potential future events and their likely impact, we can develop plausible scenarios.

Hypothetical future scenario:

A scenario where global interest rates rise sharply could negatively impact Bidvest’s borrowing costs and reduce investor confidence, potentially leading to a stock price decline. However, if the company successfully navigates these challenges by implementing cost-cutting measures and maintaining strong revenue growth, the stock price could remain relatively stable.

Factors contributing to price increase/decrease (next 12 months):

Positive Influences:

- Stronger-than-expected earnings reports.

- Successful expansion into new markets.

- Improved macroeconomic conditions (e.g., lower inflation).

Negative Influences:

- Geopolitical instability leading to supply chain disruptions.

- Increased competition in key markets.

- Unexpected economic downturn.

Implications of geopolitical events:

Geopolitical events, such as trade wars or regional conflicts, can significantly impact global supply chains and economic stability. These events could negatively affect Bidvest’s operations and consequently, its stock price, particularly if the company has significant exposure to affected regions.

Frequently Asked Questions

What are the major risks associated with investing in Bidvest Group stock?

Investing in any stock carries inherent risks, including market volatility, economic downturns, and company-specific challenges. For Bidvest Group, specific risks might include exposure to specific industries, geopolitical instability in its operating regions, and competitive pressures.

Where can I find real-time Bidvest Group stock price information?

Real-time stock price information for Bidvest Group can typically be found on major financial news websites and stock market tracking platforms such as those provided by your brokerage firm.

How often does Bidvest Group release financial reports?

Bidvest Group typically releases financial reports on a quarterly and annual basis, adhering to standard reporting practices for publicly traded companies. Specific dates can be found on their investor relations page.

What is Bidvest Group’s dividend policy?

Bidvest Group’s dividend policy is best understood by reviewing their investor relations materials and past announcements. Their approach to dividend payments may vary based on profitability and strategic priorities.