Understanding Bigg Digital Assets Stock Price

The phrase “bigg digital assets stock price” refers to the market value of shares representing ownership in large, influential companies operating within the digital asset sector. Let’s dissect this phrase.

Components of “bigg digital assets stock price”

The phrase comprises three key components: “bigg digital assets,” “stock,” and “price.” “Bigg digital assets” denotes major players in the cryptocurrency, blockchain technology, and related digital economies. “Stock” signifies shares of ownership in these companies, traded on public exchanges. “Price” represents the current market value of one share of that stock.

Examples of Bigg Digital Assets Companies

Examples of companies that could be considered “bigg digital assets” include Coinbase (COIN), Binance (though privately held, its market influence is significant), and potentially large firms heavily invested in blockchain technology like MicroStrategy (MSTR) if their holdings are substantial enough to warrant the classification. The “bigg” qualifier implies significant market capitalization and influence.

Definition of “Stock Price” in the Context of Digital Assets

In the context of digital assets, the “stock price” reflects the market’s collective assessment of a company’s future prospects and its involvement in the digital asset space. It’s determined by supply and demand dynamics, investor sentiment, and overall market conditions.

Factors Influencing Bigg Digital Assets Stock Price

Several factors significantly impact the stock prices of bigg digital assets companies. These can be broadly categorized into macroeconomic conditions, regulatory changes, technological advancements, and inherent volatility compared to traditional stocks.

Macroeconomic Factors, Bigg digital assets stock price

Three major macroeconomic factors influencing prices are interest rates, inflation, and overall economic growth. High interest rates can reduce investment in riskier assets like digital asset stocks. Inflation erodes purchasing power, potentially impacting investor confidence. Strong economic growth often correlates with increased investor risk appetite, benefiting these stocks.

Influence of Regulatory Changes

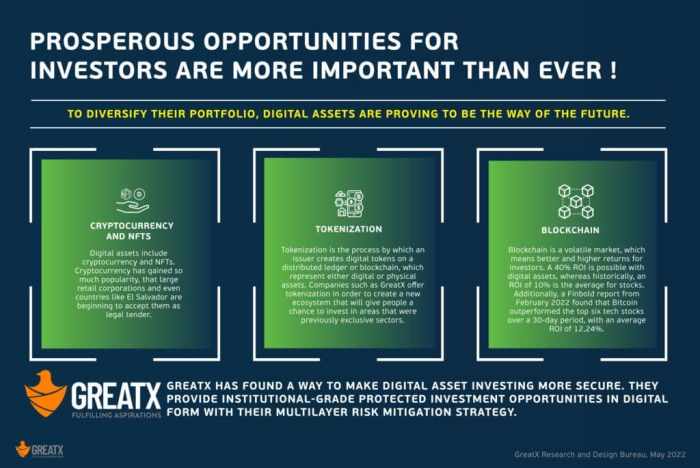

Source: greatx.com

Regulatory changes, both domestically and internationally, profoundly affect the digital asset market. Clearer regulations can increase investor confidence, leading to price increases, while uncertain or restrictive regulations can trigger significant price drops. The regulatory landscape is constantly evolving, creating inherent volatility.

Role of Technological Advancements

Technological breakthroughs within the blockchain space and the broader digital asset ecosystem can significantly impact stock prices. Innovations leading to increased efficiency, scalability, or new use cases for blockchain technology can positively influence investor sentiment and drive price appreciation. Conversely, setbacks or security breaches can have a negative impact.

Price Volatility Compared to Traditional Stocks

Bigg digital assets stocks generally exhibit higher price volatility than traditional stocks. This is due to the relative youth of the digital asset market, its susceptibility to speculative trading, and the impact of rapid technological changes and regulatory uncertainty.

Analyzing Historical Price Data

Analyzing historical price data provides valuable insights into past performance and potential future trends. Below is a hypothetical representation of price performance for three prominent (hypothetical) bigg digital assets over the past year. Note: This data is for illustrative purposes only and does not reflect actual market performance.

| Date | Asset Name | Opening Price (USD) | Closing Price (USD) | Percentage Change |

|---|---|---|---|---|

| 2023-10-26 | DigiCoin | 150 | 155 | +3.33% |

| 2023-10-26 | BlockChainTech | 200 | 195 | -2.5% |

| 2023-10-26 | CryptoCorp | 50 | 52 | +4% |

Significant Price Spikes and Dips

Hypothetical analysis of the above data might reveal that DigiCoin experienced a significant price spike in response to a positive regulatory announcement, while BlockChainTech saw a dip following a reported security breach. These examples illustrate the sensitivity of these assets to news and events.

Predictive Modeling (Hypothetical)

A hypothetical model to predict future price movements could incorporate various factors using a time series analysis approach. The model would not aim for precise prediction but rather provide a probabilistic assessment of future price ranges.

Hypothetical Model Steps

- Data Collection: Gather historical price data, trading volume, regulatory news sentiment, and macroeconomic indicators.

- Feature Engineering: Create relevant features from the collected data, such as moving averages, relative strength index (RSI), and sentiment scores.

- Model Selection: Choose a suitable time series model, such as ARIMA or LSTM neural networks.

- Model Training: Train the selected model using the historical data.

- Model Evaluation: Assess the model’s performance using appropriate metrics, such as mean absolute error (MAE) or root mean squared error (RMSE).

- Prediction: Generate probabilistic forecasts of future price movements based on the trained model.

Investment Strategies

Two contrasting investment strategies for bigg digital assets are value investing and momentum investing. Each carries different risk and reward profiles.

Value Investing in Bigg Digital Assets

Value investing focuses on identifying undervalued assets based on fundamental analysis. This approach involves researching a company’s financials, assessing its long-term growth potential, and buying shares when the price is below its intrinsic value. The risk is lower than momentum investing but the potential returns might be slower.

Momentum Investing in Bigg Digital Assets

Source: dreamstime.com

Momentum investing involves capitalizing on assets exhibiting strong price trends. This strategy aims to profit from upward price movements by buying assets that have recently shown significant gains. This strategy carries higher risk due to the potential for rapid price reversals but offers the possibility of faster, higher returns.

Diversification Factors

Diversification within a portfolio containing bigg digital assets is crucial for risk mitigation. This involves spreading investments across different companies, asset classes (including traditional stocks and bonds), and geographic regions. Proper diversification reduces the impact of any single asset’s underperformance.

Risk Assessment: Bigg Digital Assets Stock Price

Investing in bigg digital assets carries significant risks. These include market volatility, regulatory uncertainty, and technological risks.

Potential Risks

Market volatility can lead to substantial price swings, resulting in potential losses. Regulatory uncertainty can create instability as governments worldwide grapple with how to regulate cryptocurrencies and blockchain technology. Technological risks, such as security breaches or unforeseen limitations of blockchain technology, can negatively impact the value of these assets.

Risk Mitigation Methods

Risk mitigation strategies include thorough due diligence before investing, diversification across multiple assets and asset classes, and employing stop-loss orders to limit potential losses. Staying informed about regulatory developments and technological advancements is also crucial.

Illustrative Example: A Hypothetical Scenario

Imagine a hypothetical breakthrough in quantum computing that significantly enhances the speed and security of blockchain transactions. This could lead to widespread adoption of blockchain technology across various industries. A hypothetical bigg digital asset company, “QuantumChain,” specializing in quantum-resistant blockchain solutions, would likely experience a dramatic surge in its stock price due to increased investor confidence and anticipation of significant future growth.

The market reaction would likely involve substantial buying pressure, pushing the stock price significantly higher in a short period.

FAQ Corner

What are some examples of “bigg digital assets”?

Monitoring the Bigg Digital Assets stock price requires a keen eye on market fluctuations. It’s interesting to compare its performance to other energy sector companies; for instance, understanding the current trends in the archrock stock price can offer insights into broader market sentiment. Ultimately, both Bigg Digital Assets and Archrock’s stock prices are influenced by various factors, making consistent monitoring crucial for informed investment decisions.

Bitcoin, Ethereum, and other major cryptocurrencies are prime examples. The term “bigg” suggests assets with significant market capitalization and influence.

How does inflation impact bigg digital asset prices?

High inflation can drive investors towards assets perceived as inflation hedges, potentially increasing demand for some bigg digital assets. However, rising interest rates (often a response to inflation) can decrease investment in riskier assets like cryptocurrencies.

What are the ethical considerations of investing in bigg digital assets?

Ethical considerations include environmental impact (energy consumption for mining), potential for illicit activities, and the concentration of wealth within the space. Investors should research the ethical profiles of specific assets.

Are bigg digital assets suitable for all investors?

No. Investing in bigg digital assets carries substantial risk due to volatility. It’s only suitable for investors with a high-risk tolerance and a thorough understanding of the market.