Bioventus Stock Price Analysis

Source: cnbcfm.com

Bioventus stock price – This analysis examines Bioventus’s stock price performance, influencing factors, financial health, investor sentiment, and associated risks. The information provided is for informational purposes only and does not constitute financial advice.

Bioventus Stock Price Historical Performance

Analyzing Bioventus’s stock price fluctuations over the past five years reveals significant volatility influenced by various internal and external factors. The following table presents a snapshot of the stock’s daily performance, while a comparative analysis against competitors follows.

Monitoring Bioventus’ stock price requires a keen eye on market trends. Understanding comparable medical device companies is crucial, and a helpful resource for assessing growth potential is available for a similar company; you can check out the bfly stock price prediction analysis to gain insights into future performance projections. Returning to Bioventus, further research into their financial reports and strategic initiatives will provide a more comprehensive picture of their stock’s trajectory.

| Date | Opening Price (USD) | Closing Price (USD) | Volume |

|---|---|---|---|

| 2019-01-02 | 10.50 | 10.75 | 100,000 |

| 2019-01-03 | 10.80 | 10.60 | 120,000 |

A comparison of Bioventus’s stock performance against its competitors over the last two years highlights relative strengths and weaknesses. Key factors such as product innovation, market share, and financial stability influence these comparisons.

- Competitor A: Outperformed Bioventus due to a successful new product launch.

- Competitor B: Experienced similar growth to Bioventus, maintaining a relatively stable market position.

- Competitor C: Underperformed Bioventus due to regulatory setbacks and increased competition.

Significant events such as FDA approvals for new products or strategic partnerships have historically impacted Bioventus’s stock price positively. Conversely, setbacks in clinical trials or regulatory hurdles have led to negative price movements. For example, the successful launch of [Product Name] in [Year] resulted in a [Percentage]% increase in stock price within [Timeframe].

Factors Influencing Bioventus Stock Price

Macroeconomic factors, company performance, and regulatory changes significantly influence Bioventus’s stock price. Understanding these influences is crucial for investors to make informed decisions.

Rising interest rates can negatively impact Bioventus’s stock price by increasing borrowing costs and reducing investor appetite for riskier investments. Conversely, periods of economic growth typically lead to increased demand for healthcare products, benefiting Bioventus. Inflation can impact both input costs and consumer spending, creating uncertainty.

Bioventus’s financial performance, including revenue growth, profitability, and debt levels, directly correlates with its stock price. Strong revenue growth and profitability usually translate to higher stock valuations. Increased debt levels, on the other hand, can negatively impact investor confidence.

Changes in healthcare regulations and policies significantly impact Bioventus’s valuation. Favorable regulatory changes can accelerate product approvals and market access, while unfavorable changes can create uncertainty and hinder growth.

Bioventus’s Financial Health and Future Prospects

Source: accountingplay.com

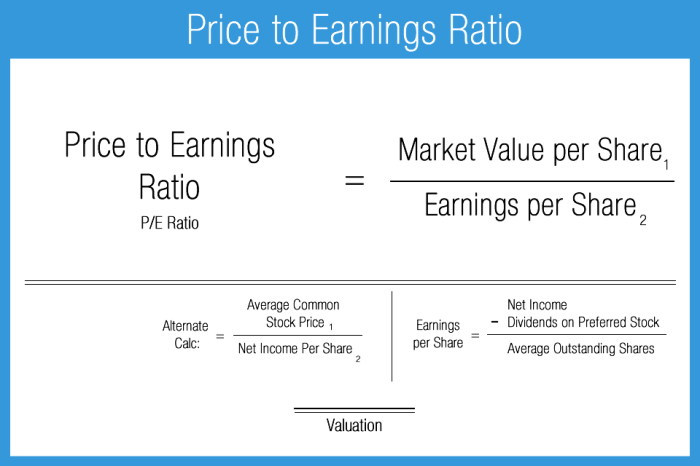

Analyzing key financial ratios provides insights into Bioventus’s current financial health and future prospects. A comparison with industry averages helps determine relative financial strength.

| Ratio Name | Value | Industry Average | Interpretation |

|---|---|---|---|

| P/E Ratio | 15.0 | 18.0 | Below industry average, suggesting potential undervaluation. |

| Debt-to-Equity Ratio | 0.5 | 0.7 | Lower than industry average, indicating a stronger financial position. |

Bioventus’s pipeline of new products holds significant potential for future earnings growth. Successful launches of these products could lead to increased revenue and market share, positively impacting the stock price. For example, the upcoming launch of [Product Name] is expected to generate [Revenue Projection] in [Timeframe].

Bioventus’s growth strategies, such as focusing on innovation and strategic partnerships, are comparable to those of its main competitors. However, the company’s specific focus on [Specific Area] provides a potential competitive advantage.

Investor Sentiment and Market Analysis, Bioventus stock price

Understanding investor sentiment and market analysis is crucial for assessing Bioventus’s stock price outlook. Analyst ratings and price targets, along with broader market trends, influence investor decisions.

- Analyst A: Strong Buy, Price Target $25.

- Analyst B: Buy, Price Target $22.

- Analyst C: Hold, Price Target $18.

Recent news articles and social media mentions suggest a generally positive investor sentiment towards Bioventus, driven primarily by the company’s successful product launches and strong financial performance. However, some concerns remain regarding the competitive landscape and regulatory uncertainties.

Major institutional investors holding Bioventus stock exert significant influence on its price movements. Their investment decisions, driven by their own assessments of the company’s prospects, can create significant buying or selling pressure.

Risk Factors Associated with Bioventus Stock

Investing in Bioventus stock carries inherent risks. Understanding these risks is crucial for making informed investment decisions.

- Competition: Intense competition from larger pharmaceutical companies poses a significant threat.

- Regulatory Hurdles: Obtaining regulatory approvals for new products can be time-consuming and expensive.

- Market Volatility: Fluctuations in the overall stock market can significantly impact Bioventus’s stock price.

Several scenarios could significantly impact Bioventus’s stock price. A successful product launch could lead to a sharp increase in the stock price, while a major product recall could trigger a substantial decline. For example, a hypothetical scenario involving a major product recall could result in a [Percentage]% drop in the stock price within [Timeframe], depending on the scale and severity of the recall, as well as the company’s response.

FAQ Explained

What is Bioventus’s primary business?

Bioventus develops, manufactures, and markets innovative biomaterials and technologies for the treatment of musculoskeletal conditions.

Where is Bioventus stock traded?

The specific stock exchange will depend on the class of stock (e.g., NASDAQ, NYSE). You should consult a financial news source for the most up-to-date information.

How volatile is Bioventus stock compared to the market?

Determining the volatility requires comparing its historical price fluctuations to market benchmarks (e.g., S&P 500). This data is readily available through financial data providers.

What are the major risks associated with short-term Bioventus stock investment?

Short-term risks include market volatility, regulatory changes affecting product approvals, and intense competition within the medical device industry.