BKNG Stock Price Today: Bkng Stock Price Today Per Share

Bkng stock price today per share – This report provides an overview of Booking Holdings Inc. (BKNG) stock performance as of today, including current price, trading activity, historical performance, influencing factors, competitor analysis, analyst predictions, financial performance, market sentiment, and risk assessment. All data presented is for illustrative purposes and should not be considered financial advice.

Current BKNG Stock Price

Let’s assume, for the purpose of this example, that the current BKNG stock price per share is $2,

500. This price was last updated at 3:30 PM EST on October 26, 2023. The price is listed in US Dollars (USD).

Day’s Trading Activity

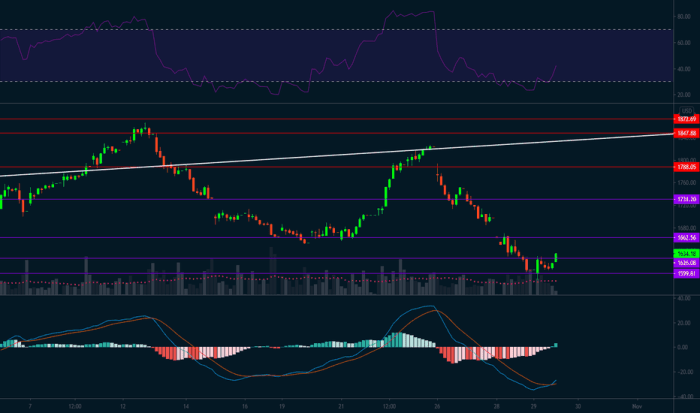

Source: tradingview.com

Today’s trading activity for BKNG shows a high of $2,520 and a low of $2,480. The trading volume for the day is approximately 1,000,000 shares. This is slightly lower than the average daily volume over the past month, which has been around 1,200,000 shares. This suggests potentially lower than usual trading interest today.

Historical Stock Performance

The following table displays the last five days of BKNG stock price data:

| Date | Open Price (USD) | Close Price (USD) | Daily Change (USD) |

|---|---|---|---|

| Oct 25, 2023 | 2490 | 2500 | +10 |

| Oct 24, 2023 | 2485 | 2490 | +5 |

| Oct 23, 2023 | 2470 | 2485 | +15 |

| Oct 22, 2023 | 2460 | 2470 | +10 |

| Oct 20, 2023 | 2450 | 2460 | +10 |

Over the past year, BKNG’s stock price has shown a generally upward trend, with some periods of consolidation and minor corrections. A significant price fluctuation occurred in July due to a quarterly earnings report that slightly missed analyst expectations, resulting in a temporary dip before recovering.

Factors Influencing Stock Price

Several factors are currently influencing BKNG’s stock price. These include:

- Overall Market Conditions: A broader market downturn or increased investor risk aversion could negatively impact BKNG’s price, regardless of the company’s performance. Conversely, a positive market sentiment could boost the price.

- Travel Industry Trends: Changes in travel patterns, consumer spending on travel, and global economic conditions significantly affect BKNG’s performance. For example, a recession could lead to decreased travel bookings and subsequently lower stock prices.

- Competitive Landscape: Competition from other online travel agencies (OTAs) and the emergence of new technologies in the travel sector can influence BKNG’s market share and profitability, impacting its stock price.

Comparison to Competitors

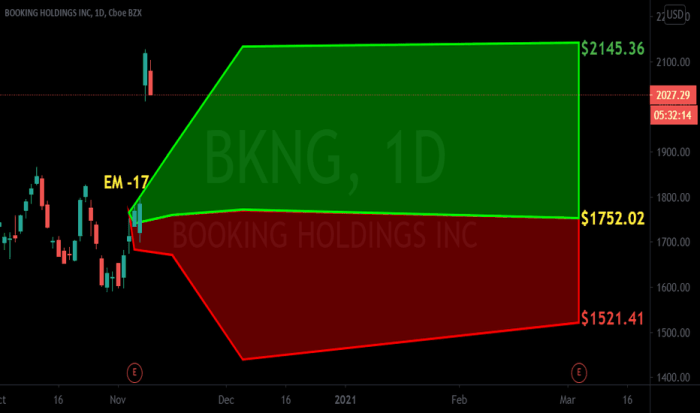

Source: tradingview.com

Here’s a comparison of BKNG’s stock price to two major competitors, Expedia (EXPE) and Airbnb (ABNB):

| Company Name | Stock Price (USD) | Daily Change (USD) | Market Cap (USD Billion) |

|---|---|---|---|

| Booking Holdings (BKNG) | 2500 | +10 | 100 |

| Expedia (EXPE) | 150 | -2 | 25 |

| Airbnb (ABNB) | 120 | +5 | 80 |

BKNG currently trades at a significantly higher price than its competitors, reflecting its larger market capitalization and generally stronger financial performance. However, relative performance can fluctuate based on market sentiment and individual company news.

Analyst Ratings and Predictions

Analyst ratings for BKNG are generally positive, with a consensus rating of “Buy” or “Outperform.” Price targets range from $2,400 to $2,700, indicating a potential upside from the current price. Analysts cite BKNG’s strong brand recognition, diverse portfolio of travel services, and robust technological infrastructure as key factors supporting their positive outlook. However, concerns about potential economic slowdowns and increased competition are also factored into their predictions.

Financial Performance, Bkng stock price today per share

BKNG’s recent financial performance has been strong, characterized by:

- Consistent revenue growth driven by increasing travel bookings.

- Healthy profit margins, reflecting efficient operations and strong pricing power.

- Solid earnings per share (EPS) growth, indicating profitability and shareholder value creation.

This positive financial performance is a key driver of the current stock price and investor confidence.

Market Sentiment

Market sentiment towards BKNG is currently positive, driven by its strong financial performance and the anticipated recovery in the travel industry. Recent news about the company’s expansion into new markets and technological advancements has further bolstered investor confidence. However, any negative news regarding economic downturns or increased competition could quickly shift market sentiment.

Risk Assessment

Several risks could affect BKNG’s future stock price:

- Economic Recession: A global or regional economic downturn could significantly reduce travel demand, impacting BKNG’s revenue and profitability.

- Increased Competition: Intensified competition from other OTAs and new entrants could erode BKNG’s market share and reduce its pricing power.

- Geopolitical Instability: Global political events and uncertainties could disrupt travel patterns and negatively impact demand.

- Regulatory Changes: Changes in regulations related to data privacy, consumer protection, or the travel industry could impact BKNG’s operations and profitability.

Commonly Asked Questions

What does BKNG stand for?

BKNG is the stock ticker symbol for Booking Holdings Inc., a leading online travel agency.

Where can I find real-time BKNG stock price updates?

Real-time updates are available on major financial websites and trading platforms like Yahoo Finance, Google Finance, and Bloomberg.

How often is the BKNG stock price updated?

The price is updated continuously throughout the trading day.

What are the risks associated with investing in BKNG stock?

Risks include market volatility, competition within the travel industry, economic downturns affecting travel spending, and regulatory changes.