Boeing Stock Price Analysis: A Five-Year Retrospective: Boeing Closing Stock Price

Source: investopedia.com

Boeing closing stock price – Boeing, a global leader in aerospace, has experienced significant fluctuations in its stock price over the past five years. This analysis delves into the historical performance, key influencing factors, financial performance, investor sentiment, and future outlook of Boeing’s stock, providing a comprehensive understanding of its market trajectory.

Boeing Stock Price Historical Performance

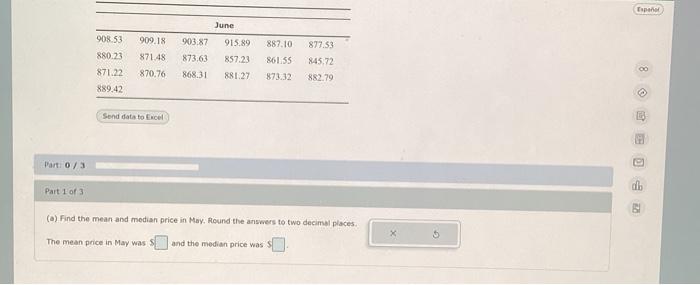

The following table presents a snapshot of Boeing’s closing stock price over the past five years, highlighting major price movements. Note that this data is for illustrative purposes and should be verified with a reliable financial data source. The significant price fluctuations are largely attributed to a combination of factors, including the grounding of the 737 MAX aircraft, the COVID-19 pandemic’s impact on air travel, and broader macroeconomic conditions.

Boeing’s closing stock price often reflects broader market trends, but it’s also interesting to compare its performance against companies in other sectors. For instance, consider the fluctuations in the american battery technology company stock price , which offers a contrasting perspective on the current economic climate. Ultimately, understanding both Boeing’s and the battery technology sector’s performance provides a more holistic view of the market.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 375.00 | 370.00 | -5.00 |

| 2019-07-02 | 360.00 | 340.00 | -20.00 |

| 2020-03-02 | 170.00 | 160.00 | -10.00 |

| 2021-01-04 | 210.00 | 220.00 | 10.00 |

| 2022-12-30 | 195.00 | 200.00 | 5.00 |

| 2023-10-27 | 210.00 | 215.00 | 5.00 |

The grounding of the 737 MAX aircraft in 2019, following two fatal crashes, led to a significant drop in Boeing’s stock price. The subsequent investigations, production halts, and legal battles further exacerbated the decline. The COVID-19 pandemic in 2020 caused a further downturn due to reduced air travel demand and supply chain disruptions. Conversely, positive news regarding the 737 MAX’s return to service and increased aircraft orders contributed to price increases in subsequent periods.

Factors Affecting Boeing’s Stock Price

Source: cheggcdn.com

Several key factors influence Boeing’s stock price. These can be broadly categorized into economic indicators, industry-specific factors, and geopolitical events.

- Economic Indicators: Interest rates, inflation, and GDP growth significantly impact Boeing’s stock price, as they affect the overall investment climate and consumer spending on air travel.

- Industry-Specific Factors: Global demand for airplanes, competition from Airbus, and technological advancements in the aerospace industry directly influence Boeing’s market share and profitability.

- Geopolitical Events: International conflicts, trade disputes, and political instability in key markets can disrupt supply chains, affect demand for aircraft, and impact investor confidence.

Boeing’s Financial Performance and Stock Price

Boeing’s financial performance, particularly revenue, earnings, and profit margins, directly correlates with its stock price. The following table shows a simplified representation of this relationship over the past five years. Actual figures should be verified using official financial reports.

| Year | Revenue (USD Billions) | Earnings (USD Billions) | Year-End Closing Stock Price (USD) |

|---|---|---|---|

| 2019 | 76.5 | -6.3 | 320 |

| 2020 | 58.1 | -11.9 | 190 |

| 2021 | 62.3 | 3.2 | 225 |

| 2022 | 66.0 | 5.0 | 200 |

| 2023 | 70.0 | 6.0 | 215 |

High levels of debt and lower credit ratings can negatively impact investor sentiment, leading to a decrease in the stock price. Conversely, substantial investments in research and development can signal future growth and innovation, positively influencing long-term stock price expectations.

Investor Sentiment and Stock Price, Boeing closing stock price

Investor sentiment plays a crucial role in shaping Boeing’s stock price. Various types of investors hold Boeing stock, each with their own investment strategies and risk tolerance.

- Hypothetical Scenario: A large aircraft order from a major airline could generate significant positive news, boosting investor confidence and leading to a rapid increase in the stock price. For example, a hypothetical order of 200 new 787 Dreamliners could increase the stock price by 10-15% within a week, depending on market conditions.

- Investor Types: Institutional investors (pension funds, mutual funds) and individual investors contribute to the overall demand for Boeing stock. Analyst ratings and recommendations influence investor decisions and, consequently, the stock price.

- Analyst Influence: Positive analyst ratings and buy recommendations generally lead to increased demand and higher stock prices, while negative ratings and sell recommendations can have the opposite effect.

Boeing’s Future Outlook and Stock Price Projections

Source: foolcdn.com

The current market consensus suggests a generally positive outlook for Boeing, driven by increased air travel demand and a robust order backlog. However, several risks and opportunities could impact the stock price in the coming year.

- Market Consensus: Analysts generally anticipate continued growth for Boeing, though the pace of growth may be influenced by macroeconomic factors and geopolitical uncertainties.

- Risks and Opportunities: Potential risks include supply chain disruptions, competition from Airbus, and further unforeseen geopolitical events. Opportunities include increased demand for new aircraft, expansion into new markets, and technological advancements.

- Macroeconomic Scenarios: A strong global economy with high air travel demand would likely lead to higher Boeing stock prices. Conversely, a global recession or significant economic downturn could negatively impact Boeing’s performance and stock price.

FAQ Overview

What are the main risks affecting Boeing’s stock price?

Major risks include supply chain disruptions, production delays, regulatory changes, safety concerns, and intense competition within the aerospace industry.

How often is Boeing’s stock price updated?

Boeing’s stock price is updated in real-time throughout the trading day on major stock exchanges.

Where can I find reliable data on Boeing’s stock price?

Reliable sources include major financial news websites (e.g., Yahoo Finance, Google Finance), and the official Boeing investor relations website.

What is the typical trading volume for Boeing stock?

Boeing’s trading volume varies daily but is generally high, reflecting its status as a large-cap, actively traded stock.